[For Immediate Release]

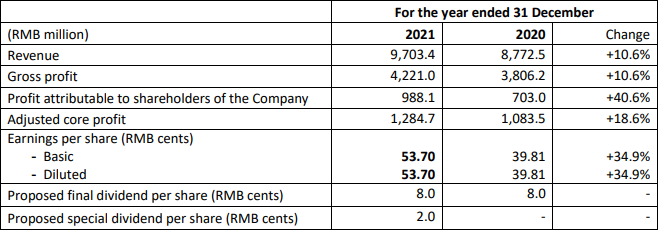

Financial Highlights

(24 March 2022 - Hong Kong) The United Laboratories International Holdings Limited ("TUL", the "Company" or the "Group"; Stock code: 3933), one of the leading pharmaceutical product manufacturers in the PRC, announced today its annual results for the year ended 31 December 2021 (the "Year").

In 2021, the Group's revenue increased by 10.6% to approximately RMB9,703.4 million. Gross profit increased by 10.6% to RMB4,221.0 million. Profit attributable to shareholders of the Company increased by 40.6% to RMB988.1 million. Taking the impairment loss under expected credit loss model and net of reversal into account, the adjusted core profit was RMB1,284.7 million, up 18.6% year on year. Basic earnings per share amounted to RMB53.70 cents. The board of directors recommends a final dividend of RMB8.0 cents per share and a special dividend of RMB2.0 cents per share for the year ended 31 December 2021, which, together with the interim dividend of RMB4.0 cents per share, will bring the total dividend for the Year to RMB14 cents per share.

During the Year, the Group's finished products recorded a total revenue of RMB4,035 million, up 8.4% year on year. The insulin series maintained steady growth, with revenue totaling RMB1,434 million, up 16.1% year on year. In particular, the recombinant human insulin injection (USLIN) and glargine insulin injection (USLEN) recorded sales revenue of RMB869 million and RMB553 million, with their sales volume recording a year-on-year increase of 4.6% and 37.5%, respectively. During the Year, the Group has successfully launched its insulin aspart injection and insulin aspart 30 injection and recorded a sales revenue of RMB12.2 million. As for other finished products, revenue from the sales of antibiotic products increased by 10.2% to RMB2,305 million. In addition, the Group rapidly expanded its veterinary drugs business during the Year and recorded a sales revenue of RMB387 million, representing a significant year-on-year increase of 76.3%.

The bidding for the Sixth Batch of National Centralized Procurement of Pharmaceuticals (specializing in Insulin) was kick-started during the Year, and all six groups of insulin products of the Group won the bid, including human insulin and insulin analogues in mealtime, basal and premixed groups. The Group will take this opportunity to expand the sales of insulin products vigorously, increase its market share and enhance its brand influence, aiming to benefit the vast number of diabetic patients and accelerate the process of replacing imported drugs with domestic drugs in the field of diabetes.

In intermediate products and bulk medicine, the Group recorded an external sales revenue of RMB1,700 million and RMB3,969 million, representing a year-on-year increase of 18.9% and 9.6% respectively. The average selling price of 6-APA continued to increase, and the external sales of bulk medicine such as amoxicillin witnessed a steady growth. The Group's export sales recorded a revenue of RMB2,096 million. The Group not only continued to hold a leading position in the domestic and export markets of intermediate products and bulk medicine, but also actively contributed to maintaining the stability of the international API supply chain during COVID-19.

The Group continued to devote itself to the research and development ("R&D") of drugs and pressed ahead with its product pipeline, with 23 new products under development, including 9 Class 1 new drugs. The Group focuses on the development of diabetes drugs, with projects covering insulin analogues such as insulin degludec injection, insulin degludec-insulin aspart mixed injection, and GLP-1 receptor agonists such as liraglutide injection and Semaglutide injection. In particular, insulin aspart 50 injection has been approved to conduct clinical trial in May 2021, and the notice of acceptance of clinical trial application for Semaglutide Injection has been issued in June 2021. Meanwhile, the Group also laid out an array of innovative drug products in the fields of internal secretion, autoimmune disease and ophthalmology.

During the Year, the Group achieved solid progress in the Quality and Efficacy Consistency Evaluation of Generic Drugs ("Consistency Evaluation"). In January 2021, the Group obtained the Drug Registration Certificate for its oral hypoglycemic drug Glipizide Tablets (specification: 5mg) and Tenofovir Dipivoxil Fumarate Tablets (specification: 300mg) for the treatment of chronic hepatitis B and HIV-1 infection in adults, which are both regarded as passing the Consistency Evaluation. The Amoxicillin Capsule (specification: 0.25g) produced by The United Laboratories Co., Ltd. (Hong Kong) passed the Consistency Evaluation in April 2021. The Memantine Hydrochloride Tablets (specification: 10mg), a drug to treat Alzheimer's disease also passed the Consistency Evaluation in May 2021. As of 31 December 2021, the Group had a total of six products that have passed the Consistency Evaluation, further enhancing its market competitiveness.

As part of the efforts to boost the R&D of biological drugs and realize a leapfrog growth, the Group established Zhuhai United Bio-Pharmaceutical Co., Ltd. (珠海聯邦生物醫藥有限公司) and The United Biotechnology (Hengqin) Co., Ltd. (聯邦生物科技(珠海橫琴)有限公司) during the Year. Backed by its existing technology platform and research team, the Group will increase its investment in biological fields and bring in more high-end R&D talents to further develop and expand the businesses of diabetes drugs, monoclonal antibody drugs, chronic disease management, and cooperate with research institutes in the Greater Bay Area. The Group will also forge ahead with drug molecular screening, process R&D, clinical trials, drug registration, product launch, commissioned production and other related businesses.

The Group stepped up its efforts to reduce finance costs by adjusting the ratio of onshore and offshore borrowings and continuously optimized its financial structure to improve its liquidity. During the Year, the Group's finance costs was RMB60.2 million, representing a significant year-on-year decrease of 66.8%. As at 31 December 2021, the Group's net cash and bank balances (after deducting borrowings and bills payables) amounted to RMB212.6 million, maintaining a solid financial position.

Looking ahead, Mr. Tsoi Hoi Shan, Chairman of the Group concluded that, "We will consistently uphold the mission of 'Making Life More Valuable', seize the opportunities of the development and reform of China's pharmaceutical and health industry, move forward in the direction guided by national policies, solidify the development of core business, and speed up our transformation with scientific research and innovation. The Group will continue to allocate more resources in the R&D of new drugs, improve scientific research strength, increase the size of talent team, expand business coverage, develop innovative products with great market potential, so as to provide impetus to the Group's long-term sustainable development. As a pharmaceutical enterprise with comprehensive competitiveness in R&D, production and quality control systems, sales and after-sales network, and talent team, we are confident that we can give full play to our advantages in the fierce market competition and continue to consolidate and enhance our industry position, so as to maximize the value for our shareholders, clients and stakeholders."

|

Company Information Listed on the Stock Exchange of Hong Kong in June 2007, TUL is one of the leading comprehensive pharmaceutical companies in China, principally engaged in the R&D, manufacturing and selling of finished products, bulk medicines and intermediate products. The Group has six production bases, and its sales teams for intermediate products, bulk medicines and finished products formed a broad sales network covering China and the rest of the world. Currently, TUL is one of the few pharmaceutical companies in China that owns both second and third generation insulin products. The Group is presently a component of the Hang Seng Composite Index Series. |

For further enquiries, please contact:

iPR Ogilvy Ltd.

Tina Law / Joann Fang / Kelvin Tang

Tel: (852) 2136 6181 / 3920 7619 / 3920 7655

Fax: (852) 3170 6606

Email: tul@iprogilvy.com

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |