Miramar Hotel and Investment Company, Limited

(Incorporated in Hong Kong with limited liability)

| Press Release | [For Immediate Release] |

[Hong Kong – 19 March 2024] Miramar Hotel and Investment Company, Limited (“Miramar” or ‘the Group”, HKSE stock code: 71) announced today the audited results for the year ended 31 December 2023.

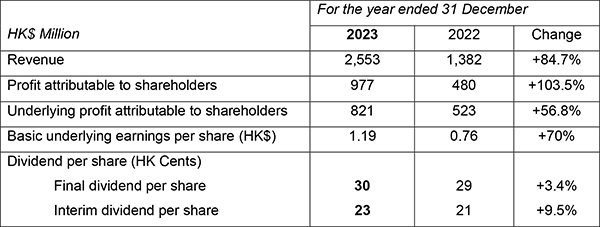

The Group's revenue for the year 2023 amounted to HK$2,552.6 million (2022: HK$1,382.2 million), an increase of 84.7% against last year. Profit attributable to shareholders for the year was HK$977.1 million (2022: HK$480.1 million) with a year-on-year increase of 103.5%. Mr. Lai Ho Man, Director of Group Finance, said, “The aforesaid outcome is mainly attributable to the increase in revenue from the Group's three business segments (including hotel and serviced apartments, food and beverage and travel business) compared with last year and the fair value appreciation of investment properties over last year.” The Board is pleased to recommend a final dividend of HK30 cents per share (2022: HK29 cents per share) payable to the shareholders whose names are on the Register of Members as of 18 June 2024. Including an interim dividend of HK23 cents per share (2022: HK21 cents per share) paid on 12 October 2023, the total dividend payout for the whole year will be HK53 cents per share (2022: HK50 cents per share).

After more than three years of efforts to combat the COVID-19 outbreak, the pandemic finally came to an end. The Hong Kong Government lifted all pandemic prevention measures and resumed full border opening in early 2023, bringing significant improvement to the tourism and hospitality industries in Hong Kong. Nevertheless, the passenger volume of Hong Kong's aviation industry had only recovered to 80% of the pre-pandemic level by the end of 2023, and the cross-border coach services in the Pearl River Delta had only recovered by 30% to 50%, posing a direct impact on the growth of occupancy rate of the hotel industry in terms of both long-haul and short-haul visitors. Fortunately, the Hong Kong section of the high-speed rail resumed operation in early 2023, and its passenger volume reached 17 million in November of the same year, exceeding the annual passenger volume in 2019. The Group seized the opportunity and shifted its marketing focus from international travelers at the airport to medium- and long-haul mainland visitors using the high-speed rail. A series of sales initiatives targeting Individual Visit Scheme ("IVS") travelers and high-speed rail passengers were also launched at The Mira Hong Kong and Mira Moon Hotel. These efforts successfully attracted visitors from various provinces in mainland China, including business tours and IVS travelers, resulting in a steady growth in occupancy rates and banquet business for both hotels in 2023.

In terms of the food and beverage business, the Group quickly seized the opportunities presented in the post-pandemic rebound after the full removal of pandemic control measures. We stepped up our promotional efforts and focused on developing e-commerce to enhance the user experience of our online shops. As a result of these measures, the food and beverage business rebounded successfully and recorded a revenue of HK$279.4 million during the year. The property rental business of the Group remained stable during the year, benefiting from the retail market recovery and our solid customer traffic. As early as last year, we adjusted our strategies and prepared for the post-pandemic market recovery. This included launching a number of activities targeting the active young customer segment, such as themed decorations, inviting various brands to set up pop-up stores in our malls and organizing special weekend markets. In addition, the Group actively responded to the HKSAR Government's economic stimulus measures and organized district events to boost footfall. We also continued to enhance the quality of our properties for rental, including improvement works in the mall and office tower lift lobbies, thereby enhancing the appeal of the properties and improving the tenant experience. In terms of travel business, revenue increased significantly to HK$896.1 million during the period, thanks to the full recovery and border reopening in Hong Kong.

Hotels and Serviced Apartments Business

During the year, the overall revenue from the hotel and serviced apartment business amounted to HK$581.9 million, an increase of 82.8% compared with HK$318.4 million for the same period last year; and earnings before interest, taxes, depreciation and amortization (EBITDA) recorded a profit of HK$153.5 million, representing an increase of 763.6% compared with HK$17.8 million for the same period last year.

The Hong Kong Government lifted all pandemic prevention measures and resumed full border opening in 2023. The number of visitor arrivals and overnight visitors to Hong Kong exceeded 34 million and 17 million, respectively, representing a significant growth of 55.7 times and 28.8 times compared with the same period last year. The tourism and hospitality industries of Hong Kong significantly improved accordingly. With foresight into the opportunities, the Group has early prepared itself for the return to normalcy in Hong Kong. In terms of manpower, we jointly organized the "From Retraining to Direct Employment Program" with the HKFTU Study Centre and Hotels, Food & Beverage Employees Association to provide professional training for those who aspire to become hotel room attendants. Starting from February 2023, the Group collaborated with the Federation of Hong Kong and Kowloon Labour Unions to co-organize the "Certificate Program in Housekeeping". The program response has been positive, with close to 90% of the students applying to become room attendants at the Group's hotels upon completion of the course. In respect of the employment of ethnic minorities, the Group cooperated with Yau Tsim Mong District Council members and Hong Kong Nepalese Federation to host the "Recruitment Day for Ethnic Minorities". With satisfactory response on the recruitment, the Group will continue to organize similar activities to promote an inclusive society in the future. In terms of hotel accommodation, we launched a number of accommodation plans targeting mainland business travelers, IVS travelers, high-speed rail passengers, and overseas tourists. These plans included offering customized 24-hour FlexiStay plans and flexible check-in and check-out schedules, all of which have successfully attracted mainland business tours, IVS tourists, and overseas visitors to stay at our hotels and use our banquet services. The Group's food and beverage business also actively introduced various seasonal thematic menus and partnered with different local brands and restaurants from around the world to launch food and beverage events. This not only enhanced our international competitiveness but also brought a richer dining experience to local customers and travelers.

Thanks to the properly formulated business and operational strategies mentioned above, the occupancy rate of The Mira Hong Kong and Mira Moon reached 90% and 95% in 2023, respectively, representing a significant growth of 22 percentage points and 54 percentage points compared with the occupancy rate of 68% and 41% in 2022, respectively, while the average room rate also reached HK$1,432 and HK$1,706, increasing by 61% and 40%, respectively. As a result, the revenue from the room rental business of The Mira Hong Kong recorded a significant increase of 126.2%, and the revenue from room rental business of Mira Moon also climbed by 215.2% due to the asset quality enhancement project carried out last year. Revenue from the food and beverage business under the hotel segment of the Group also recorded an increase of 49.6% compared with the same period last year.

Property Rental Business

The revenue from the Group's property rental business remained stable at HK$795.2 million during the year, while EBITDA recorded a profit of HK$670.1 million, compared with revenue of HK$800 million and EBITDA of HK$676.6 million last year, representing a slight decrease of 0.6% and 1.0% over last year, respectively.

Hong Kong's retail market has gradually recovered following the full reopening of the border at the beginning of the year, leading to overall improvements in business conditions. To capitalize on the rebound in consumer spending, the Group launched a number of distinctive themed decorations and promotional campaigns during the year, which attracted footfall and enhanced the customer shopping experience successfully. These campaigns included the Rabbit Shrine-themed Chinese New Year campaign, annual music event "Gimme LiVe Music Festival 2023", "Mira After 8" Night Fever campaign, and "Find Your Santa Zo-mate" Christmas event, which successfully garnered market attention. In addition, we invited a number of local and international brands to set up pop-up stores and organize special weekend markets in our malls during the year, diversifying the mall's offerings and resulting in a steady growth in footfall at Mira Place. Internally, the Group continued to enhance the quality of its properties for rental, including the improvement works in the mall and office tower lift lobbies that incorporated green and sustainable elements to promote the concepts of "Mi Go Green" and sustainable development. These enhancements aimed to increase the appeal of its properties and enrich the tenant experience while contributing to a green Earth and the efficient use of resources.

Change in fair value of investment properties

The Group's investment properties are stated at fair value and are reviewed on a semi-annual basis. The fair value of investment properties is determined with reference to the opinions obtained by the Group from an external professional surveyor firm (Cushman & Wakefield Limited). The fair value of the Group's total investment properties increased by HK$159.5 million (2022: a decrease of HK$23.2 million) during the year. The book value of the overall investment properties as at 31 December 2023 was HK$15.3 billion. The investment properties of the Group are held for the long term with the purpose of earning recurring income. The revaluation gain was non-cash in nature and had no substantive impact on the cash flow of the Group.

Food and Beverage Business

During the year, the business environment of the food and beverage industry has greatly improved as the Hong Kong Government lifted the social distancing measures for restaurants and banquets. In addition, thanks to the full border reopening between Hong Kong and the Mainland on 6 February this year, the food and beverage sector and consumer market both saw a positive sentiment. In 2022, with its insight into opportunities on the post-pandemic rebound, the Group launched two new brands: "Chinesology" (唐述), offering modernized Chinese cuisine, and "JAJA", offering innovative vegetarian options. In late 2023, the Group continued to seize opportunities by opening "Mue Mue", a restaurant that offers modernized Thai cuisine with a Chinese twist in Mira Place 1. This expansion has further diversified the food and beverage business portfolio, allowing for the development of a wider customer base.

According to the statistics of total receipts of restaurants from the Census and Statistics Department of the Hong Kong Government, the performance of the food and beverage sector in Hong Kong for 2023 recorded a growth of 26.1% over the same period last year, while the food and beverage business of the Group also performed strongly with significant growth in both restaurant cover and spending per person, resulting in an overall revenue growth of 61.3%, which notably outperformed the peer average in Hong Kong. In addition, the Group continued to strengthen sales promotions for dine-in, takeaway, and Mira eShop during the period, catering to the diverse needs of customers. In terms of festival food, revenue for the year also grew by 49.1%, with the sales of Chinese New Year pudding reaching a record high. During the year, the Group's food and beverage business recorded revenue of HK$279.4 million and an EBITDA profit of HK$29.9 million, compared with revenue of HK$173.3 million and EBITDA loss of HK$1.9 million in the same period last year.

For more information, please visit https://doc.irasia.com/listco/hk/miramar/annual/2023/respress.pdf.

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |