Hysan Development Company Limited

| To: Business/Property Editor | Date: 24 February 2022 |

| For immediate release |

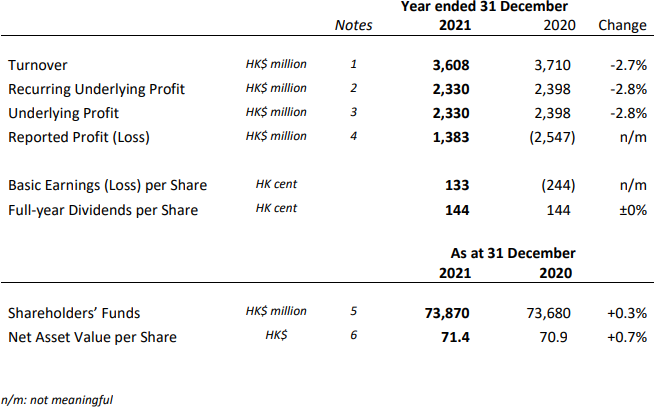

HIGHLIGHTS

RESULTS

Notes:

Results

Hysan Development Company Limited (Stock Code: 00014) today (24 February 2022) announced the Group's turnover for 2021 was HK$3,608 million, representing a year-on-year decrease of 2.7% from HK$3,710 million for 2020.

Both Recurring Underlying Profit (our key leasing business performance indicator) and Underlying Profit declined by 2.8% to HK$2,330 million in 2021 (2020: HK$2,398 million)

The Group recorded a Reported Profit of HK$1,383 million in 2021 as compared to a Reported Loss of HK$2,547 million in the same period last year, mainly due to fair value changes of investment properties of the Group and its associates between two periods.

Shareholders' Fund was HK$73,870 million as at 31 December 2021 (31 December 2020: HK$73,680 million)

As at 31 December 2021, the investment properties of the Group were valued at HK$95,107 million, an increase of 26.8% from HK$74,993 million as at 31 December 2020, mainly due to successful tender of a commercial site at Caroline Hill Road, Causeway Bay Hong Kong in May 2021 at land premium of HK$19,778 million.

Dividends

The Board of Directors has declared a second interim dividend of HK117 cents per share (2020: HK117cents) which will be payable in cash. Together with the first interim dividend of HK27 cents per share (2020: HK27 cents per share), there is an aggregate distribution of HK144 cents per share. (2020: HK144 cents per share). Please see the table for all the relevant dates:

| Closure of register of members | Friday, 11 March 2022 |

| Ex-dividend date | Wednesday, 9 March 2022 |

| Latest time to lodge transfer documents | Not later than 4pm on Thursday, 10 March 2022 |

| Record date for second interim | Friday, 11 March 2022 |

| Second interim dividend payment date | On or about Friday, 25 March 2022 |

Hysan's core portfolio

Hysan has a renowned mixed-use portfolio in one of Hong Kong's most well-known, premier destinations. This has been our core for close to a century and will continue to be our centre of excellence. Lee Gardens is a tangible brand that people identify with. Our natural advantage includes high traffic flows concentrated in a dense land mass, which gives us the critical mass as a community lab to roll out and test digital solutions that bring convenience and added value to our patrons. Our smart community business model and our street shop curation connect people and promote 'wellness'. Lee Gardens is accessible and inclusive. We engage in responsible and sustainable development, which includes environmental and social considerations. Importantly, Hysan is well known for the quality of care and high standards of service throughout our malls and properties.

We will continue to enhance and rejuvenate our core business, especially with the planned extension to the Caroline Hill Road site. This will expand our core footprint while also adding a notable lifestyle element through the inclusion of a significant green community space. We will also provide major enhancements to our existing portfolio, including the creation of an exclusive destination for luxury retail flagship stores, an update of Hysan Place to maintain its leadership as a trend-setter, and the addition of rich textures to the neighbourhood streetscape.

The world is changing quickly, and there are plenty of threats and, equally, many opportunities. In addition to our core business, we have identified several strategic pillars which will deliver a more balanced, diversified, risk-adjusted and complementary portfolio over the medium to long term.

Our investment thesis for these growth pillars is predicated on a number of factors: that they complement our core, are asset-light, rely less on us being a pure capital provider but leverage our strength to partner with established and specialized operators, and, importantly, provide geographic diversification.

Summary of key achievements in 2021

2021 was a watershed year for Hysan. We executed a series of significant investments in our medium to long-term strategic plan, delivering strategic growth pillars which drive geographic diversification, invest in asset-light operating businesses, and target business opportunities that complement and reinforce our core business. In addition, we started a trading asset pillar with our first "develop and sale" project in Tai Po, which should produce periodic earnings 'pops'.

Our investments in 2021 included winning a tender for the Caroline Hill Road project in Hong Kong; acquiring a commercial complex development in Jing'an, Shanghai; partnering with IWG to promote flexible workspaces in the Greater Bay Area, and investing in New Frontier Group to expand its premium healthcare business throughout Mainland China.

For more information, please visit http://doc.irasia.com/listco/hk/hysan/annual/2021/respress.pdf.

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |