Guoco Group Limited

Guoco Group Limited

(Incorporated in Bermuda with limited liability)

Guoco Group Limited

Guoco Group Limited

| For immediate release | 20 February 2023 |

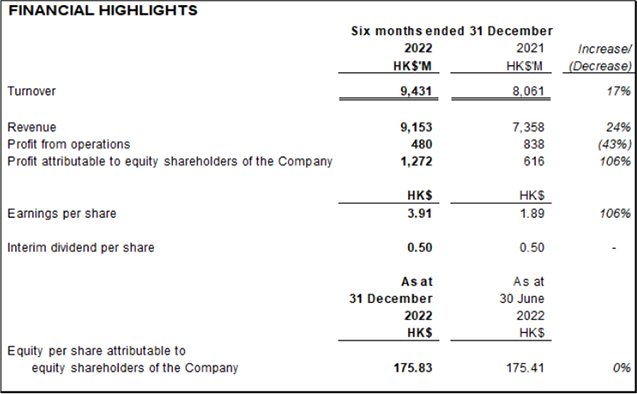

20 February 2023, Hong Kong - Guoco Group Limited ("Guoco", or the "Company" or together with its subsidiaries the "Group", stock code: 53) announced today its interim results for the six months ended 31 December 2022.

Key Results Highlights

Key Segment Highlights

The Principal Investment segment recorded a pre-tax profit of HK$288.0 million amidst the volatile and complex market developments over the first half of the financial year.

The revenue and gross profit of GuocoLand Limited (listed on the Singapore Exchange) increased 46% and 18% respectively year-on-year. Higher progressive recognition of sales from the residential projects in Singapore and higher rental income drove the respective revenue growth of its property development business and investment properties.

The Clermont Hotel Group ("formerly known as "GLH Hotels Group") overturned the loss-making position in the same period last year and recorded a profit after tax of GBP22.8 million (approximately HK$209.3 million), as supported by the strong domestic demand across all segments and the return of international visitors throughout summer and autumn.

The Rank Group Plc (listed on the London Stock Exchange) recorded a net gaming revenue amounted to GBP338.9 million (approximately HK$3,110.5 million) as driven by the growth in digital business by 9% but offset by the decline in venue business by 1%. It recorded a loss after tax of GBP101.2 million (approximately HK$928.8 million) for the period, primarily due to the impairment charges of GBP95.4 million (approximately HK$874.6 million) relating to the downturn in performance expectations for Grosvenor and Mecca venues in the period.

FINANCIAL RESULTS

"The results are mainly attributable to the positive performances of most of the Group's segments, while taking into account the loss from the Hospitality and Leisure segment," said the Executive Director and Group Chief Financial Officer of the Company, Mr. CHEW Seong Aun. "The Principal Investment segment, Property Development and Investment segment, Financial Services segment and Others segment reported profits before taxation of HK$288.0 million, HK$557.6 million, HK$634.2 million and HK$244.7 million respectively. However, they were partially offset by the Hospitality and Leisure segment, which recorded a loss before taxation of HK$649.6 million due to impairment of assets. The resultant profit after tax attributable to shareholders increased by 106% to HK$1,271.5 million."

Basic earnings per share amounted to HK$3.91 as compared to HK$1.89 in the prior period.

Revenue for the six months ended 31 December 2022 increased by 24% to HK$9.2 billion, primarily due to an increase of HK$1.0 billion in revenue from the Property Development and Investment segment attributable to the higher progressive recognition of sales from the residential projects in Singapore.

GROUP OUTLOOK

Going into 2023, as China reopens its economy and global financial conditions gradually improve, with the peak of interest rates expected to be reached this year, more cautious optimism has returned to the equity markets. However, there are expectations of a slower recovery across major economies with weaknesses in corporate earnings undermined by substantial risks remaining in the near term outlook, not least ongoing high inflation. The persistency of the Ukraine war, rate hikes and increased US-China geopolitical tensions also give rise to continued uncertainties.

"With this outlook in view, the Group will remain vigilant under the evolving landscape and will be cautious in managing its Principal Investment portfolio. It will also continue pragmatic strategies for its other core businesses to deal with short term challenges, whilst strengthening business fundamentals to achieve a long term sustainable growth strategy." Mr. Chew commented.

For more details, please refer to Guoco's full interim results announcement:

https://doc.irasia.com/listco/hk/guoco/announcement/a278349-e_2023022000889.pdf

About Guoco Group Limited

Guoco Group Limited ("Guoco") (Stock Code: 53), listed on The Stock Exchange of Hong Kong Limited, is an investment holding and management company with the vision of achieving long term sustainable returns for its shareholders and creating prime capital value. Guoco's operating subsidiary companies and investment activities are principally located in Hong Kong, China, Singapore, Malaysia and the United Kingdom. Guoco has four core businesses, namely, Principal Investment; Property Development and Investment; Hospitality and Leisure Business; and Financial Services. Please visit www.guoco.com for details.

Contacts :

Ms. Stella Lo

Group Company Secretary

Tel: ( 852 ) 2283 8710

Fax: ( 852 ) 2285 3210

E-mail: stella.lo@guoco.com

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |