Swire Pacific Limited

(Incorporated in Hong Kong with limited liability)

Media Information

12 March 2025

FOR IMMEDIATE RELEASE

Financial and Operational Highlights

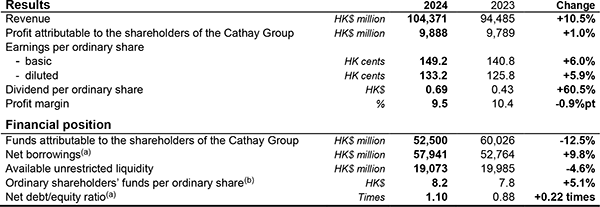

Group Financial Statistics

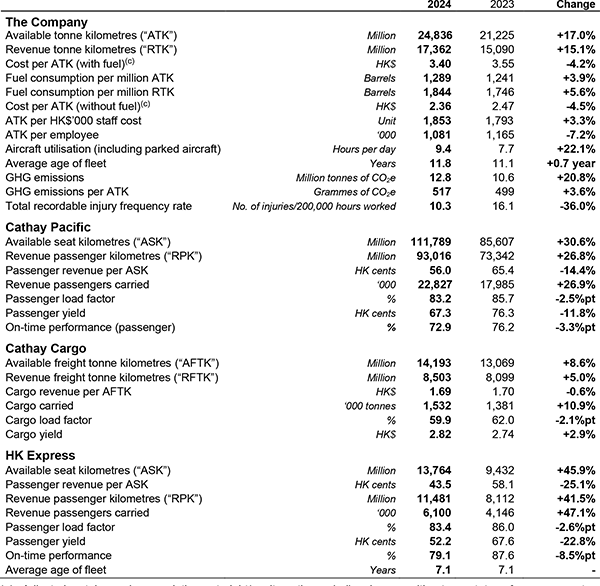

Operating Statistics - Cathay Pacific

(a) Adjusted net borrowings and the net debt/equity ratio excluding leases without asset transfer components are HK$47,097 million (2023: HK$41,443 million) and 0.90 (2023: 0.69) respectively.

(b) Ordinary shareholders' funds in 2023 were arrived at after deducting preference shares reserve of HK$9,750 million and unpaid cumulative dividends attributable to the preference shareholder of HK$191 million as at 31st December 2023.

(c) Cost per ATK represents total operating costs divided by ATK for the period.

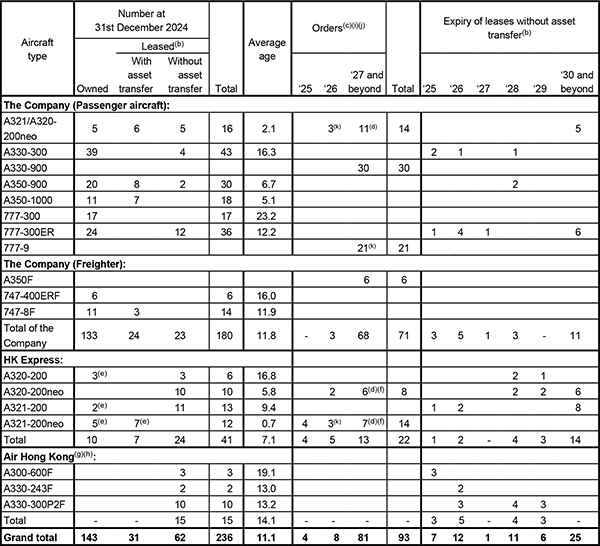

Fleet Profile(a)

(a) The table does not reflect aircraft movements after 31st December 2024.

(b) Leases without asset transfer components are accounted for in a similar manner to leases with asset transfer components under accounting standards. The majority of leases without asset transfer components in the above table are within the scope of HKFRS 16.

(c) The Group believes that based on its available unrestricted liquidity as at 31st December 2024, as well as its ready access to both loan and debt capital markets, it will have sufficient financing capacity to fund this material investment in the fleet.

(d) Final number subject to reallocation between the Company and HK Express.

(e) The aircraft are sub-leased to HK Express.

(f) Final split between Airbus A320-200neo and A321-200neo subject to adjustment in accordance with future operational requirements.

(g) The contractual arrangements relating to the freighters operated by Air Hong Kong do not constitute leases in accordance with HKFRS 16.

(h) The Group plans to replace its entire fleet of Airbus A300-600F freighters with second-hand A330F freighters. The remaining three A300-600F freighters are expected to be returned in 2025.

(i) The Group took delivery of 12 aircraft in 2024.

(j) The Group also has the right to acquire 82 additional aircraft.

(k) According to the latest expectation as at end of February 2025.

Chair's Statement

I am pleased to report that the Cathay Group achieved a number of milestones in 2024, as we focused our efforts on completing our two-year rebuilding journey while also investing for the future.

Throughout 2024, we continued to rebuild connectivity at our home hub, culminating in the Cathay Group reaching 100% of our pre-pandemic flights from January 2025. We fully repaid the Hong Kong SAR Government's investment in Cathay by buying back the remaining preference shares, in addition to paying preference share dividends and buying back the warrants that had been issued to the Government. I would like to thank the Government, its two Board observers, and all of our shareholders for the critical support they have provided Cathay.

In 2024 we also announced more than HK$100 billion in new investments to coincide with the commencement of the Three-Runway System at Hong Kong International Airport. This major new investment programme reflects our absolute commitment the Hong Kong international aviation hub, as we seek to increase air travel and cargo capacity and elevate customer experience. It includes more than 100 new-generation aircraft that we started taking delivery of during the year, along with new world-leading cabin interiors, flagship lounges, and digital innovations.

Our focus is now firmly on the future as we continue to do our part to elevate Hong Kong's status as a world-leading international aviation hub connecting Hong Kong, the Chinese Mainland and the world.

Financial Results

The Cathay Group, including airlines, subsidiaries and associates, reported an attributable profit of HK$9,888 million in 2024 (2023: HK$9,789 million). The earnings per ordinary share in 2024 were HK149.2 cents (2023: HK140.8 cents).

2024 marked our second consecutive year of solid financial performance. The second half of the year has historically been the stronger of the two halves for the Group and this was the case in 2024 as it was in 2023. Our solid second-half financial result was driven by elevated cargo demand, higher passenger volumes, lower fuel prices and higher cost efficiencies compared with the previous year. This was partly offset by a continued normalisation of passenger yields as the supply of flights increased to meet demand in the overall market as expected.

Our airlines and subsidiaries reported an attributable profit of HK$8,849 million for the full year of 2024 (2023: HK$9,225 million). The results from associates, the majority of which are recognised three months in arrears, were a full-year profit of HK$288 million (2023: loss of HK$1,562 million).

The attributable profit for 2024 included a non-recurring non-cash gain of HK$578 million as a result of a dilution of our interest in Air China following the completion of its H-shares offering in February 2024 and completion of its A-shares offering in December 2024, as well as a dilution of our interest in Air China Cargo following its listing on the Shenzhen Stock Exchange in December 2024.

In July, we bought back the remaining 50% - HK$9,750 million - of the preference shares held by the Hong Kong SAR Government. We also paid the remaining preference share dividends up to 31st July 2024, bringing the total amount of preference share dividends paid to the Government over its holding period to HK$2,440 million. Then, in September, we completed the buyback of all of the warrants we had issued to the Government in 2020 as part of our recapitalisation for a total consideration of HK$1,532 million.

Our full-year result has allowed us to announce a second interim dividend payment to ordinary shareholders of HK$0.49 per ordinary share. This will be paid on 8th May 2025 to ordinary shareholders registered at the close of business on the record date, 3rd April 2025. Ordinary shares of the Company will be traded ex-dividend as from 1st April 2025. Together with the first interim dividend that had already been paid, a total of HK$0.69 per share or HK$4,443 million will have been paid in ordinary share dividends in respect of 2024.

In addition, in early January 2025 we repurchased approximately 68%, or HK$4,558 million of the HK$6,722 million 2.75% guaranteed convertible bonds due 2026, which were issued in February 2021. The outstanding principal amount of the bonds is HK$2,164 million. The buyback reflects our confidence in our long-term business prospects.

As at 31st December 2024, our available unrestricted liquidity balance amounted to HK$19,073 million.

Looking ahead

With the launch of the Three-Runway System in Hong Kong, Cathay is now firmly focused on the future as we seek to maximise the many exciting opportunities that our newly expanded home hub offers.

Together, Cathay Pacific and HK Express will continue to add more flights and destinations for our customers. The two airlines will operate passenger services to more than 100 destinations around the world within 2025, a meaningful milestone for the Cathay Group. For cargo, we remain confident in the strength of our business bolstered by the opportunities provided by the Three-Runway System, and we are cautiously monitoring the potential impact on air cargo in light of the current geopolitical situation.

Over the coming years, we will continue to see enhancements as part of our HK$100 billion investment. The state-of-the-art and fuel-efficient aircraft we are adding will expand and modernise our fleet, helping us to achieve our goal of net-zero carbon emissions by 2050. Decarbonising aviation is an important but challenging mission, and one that will require collaboration across the supply chain.

Appreciation

Finally, I would like to extend my sincere appreciation to our customers for their enduring support of Cathay, which has been and remains invaluable as we strive to become one of the world's greatest service brands.

I would also like to sincerely thank our global teams at Cathay for their outstanding efforts over the past year and their determination to always exceed our customers' expectations.

Patrick Healy

Chair

Hong Kong, 12th March 2025

For more information, please visit https://doc.irasia.com/listco/hk/swire/press/p250312.pdf.

| © Copyright 1996-2024 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |