Swire Pacific Limited

(Incorporated in Hong Kong with limited liability)

| For immediate release | 8th August 2024 |

8th August 2024, Hong Kong – Swire Pacific Limited ("the Group") today released its 2024 Interim Results. The Group achieved solid financial results, especially in the context of what is a challenging operating environment and considering the impact on comparisons of the disposal of Swire Coca-Cola, USA ("SCCU") in the second half of 2023. The Aviation Division continued to be the driving force behind the Group's underlying profit in the first half of 2024, with the Cathay group benefitting from robust demand for travel and cargo services, as well as the continuous recovery of line maintenance and growth in engine overhaul at the HAECO group. The Beverages Division was stable, while the Property Division performed well despite increasing headwinds.

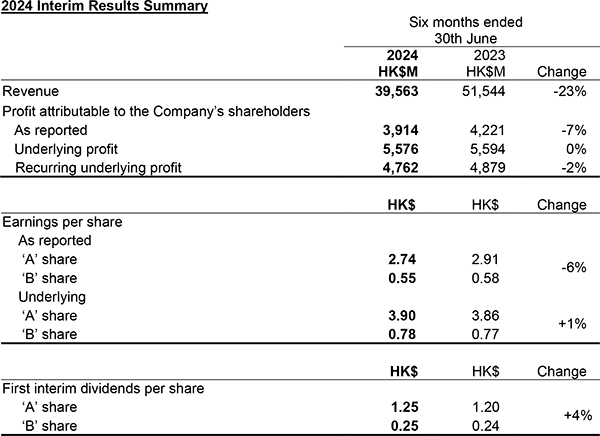

In the first six months of 2024, Swire Pacific's consolidated profit attributable to shareholders was HK$3,914 million, compared with HK$4,221 million in the same period in 2023. The underlying profit attributable to shareholders for the period under review, adjusted for changes in the value of investment properties, was HK$5,576 million compared with HK$5,594 million in the first six months of 2023. Disregarding changes in the value of investment properties and significant non-recurring items in both periods, Swire Pacific recorded a recurring underlying profit of HK$4,762 million in the first half of 2024, compared with HK$4,879 million in the same period of 2023.

The Group continued to improve its shareholder returns with its share buy-back programme of up to HK$6 billion, which will run through to the conclusion of the Company's annual general meeting to be held in May 2025. During the first six months of 2024, the Company repurchased 26,380,000 ‘A' shares and 29,112,500 ‘B' shares for an aggregate cash consideration of HK$2,014 million at an average price of HK$65.1 per ‘A' share and HK$10.2 per ‘B' share.

First interim dividends are HK$1.25 per ‘A' share and HK$0.25 per ‘B' share, an increase of 4% over the first interim dividends for 2023.

Below is a summary of the 2024 interim results:

Commenting on the Group's strategic developments in the first half of the year, Guy Bradley, Chairman of Swire Pacific, said, "We continued our strategic, long-term plan of investment in our core markets of Hong Kong, the Chinese Mainland and South East Asia. We also maintained our focus on enhancing returns for shareholders through ordinary dividends and our share buy-back programme, which will run until May 2025."

Swire Properties' ten-year HK$100 billion investment plan is ongoing. As of 2nd August 2024, 65% had been committed to development projects in core markets. In Hong Kong, Swire Properties obtained the occupation permit for Six Pacific Place, the newest addition to Pacific Place, in February 2024. Swire Properties has reached a major milestone in the redevelopment of Taikoo Place with the unveiling of Taikoo Square, as well as the completion of covered walkways.

In the Chinese Mainland, construction is progressing at Taikoo Li Xi'an and Taikoo Li Sanya, as well as at the New Bund Mixed-use Project and Lujiazui Taikoo Yuan in Shanghai. This latter development will feature Swire Properties' residential debut in the Chinese Mainland. Swire Properties also has a number of projects in the pipeline, including the Julong Wan Project and the retail addition to Taikoo Hui in Guangzhou, and INDIGO Phase Two in Beijing.

In February 2024, Swire Coca-Cola entered into an agreement and conditionally agreed to acquire a majority stake in ThaiNamthip Corporation Ltd. ("TNTC"), which owns and operates the Coca-Cola franchise in the majority of Thailand and through its subsidiary in Laos, in two phases, for an aggregate consideration of approximately THB42,615.7 million (approximately HK$9,470.1 million). In May 2024, Swire Coca-Cola broke ground on the Greater Bay Area Intelligent Green Factory in Guangdong. This state-of-the-art facility represents a RMB1.25 billion investment and is set to become Swire Coca-Cola's largest green, intelligent and diversified plant in the Chinese Mainland.

The Cathay group is now in the final stretch of its rebuild journey, with passenger flights reaching 80% of pre-pandemic levels by the second quarter. In June, Cathay Pacific returned to the world's top five airlines in industry rankings, marking another important milestone. In July, the Cathay group repurchased the remaining 50% of preference shares from the HKSAR Government at a redemption amount of HK$9.75 billion. It has committed more than HK$100 billion in investments over the next seven years for its fleet, cabin products, lounges, and digital and sustainability leadership. It has also worked hard to strengthen its existing major routes, and develop new ones connecting Hong Kong with more destinations in the Chinese Mainland and Belt and Road countries, including to Riyadh in Saudi Arabia. Recruitment and training efforts are ongoing.

Swire Pacific has a long-standing commitment to sustainability through our SwireTHRIVE strategy. In June, we became an adopter of the Taskforce on Nature-related Financial Disclosures (TNFD), and was among nine Hong Kong companies to commit to making TNFD-related disclosures. In 2023, we piloted an internal carbon pricing mechanism at Swire Properties, Swire Coca-Cola and HAECO, and this continued in the first half of 2024. Our operating companies continue to lead the way on sustainability within their respective industries.

On the Group's prospects for the second half of the year, Mr Bradley said, "We will continue to build on our strengths. Our businesses are well-positioned to cope with any immediate adversity and economic challenges, and our long-term focus on investing in our core markets remains unchanged."

The divisional highlights of the 2024 Interim Results are in the Appendix.

Property Division

Beverages Division

Aviation Division

Cathay Group

HAECO Group

Healthcare

*Following a change in accounting policy resulting from the agenda decision approved by the IFRS Interpretation Committee on "Lessor Forgiveness of Lease Payments (IFRS 9 and IFRS 16)", the comparative figures for the six months ended 30th June 2022 have been restated.

About Swire Pacific Limited

Swire Pacific (HKEX: 00019/00087) is a Hong Kong-listed international conglomerate with a diversified portfolio of market leading businesses. The company has a long history in Greater China, where the name Swire or Taikoo (太古) has been established for over 150 years. Swire Pacific's strategy is focused on Greater China and South East Asia, where we seek to grow our core businesses of Property, Beverages, and Aviation, as well as new areas of growth, such as healthcare. Swire Pacific is the largest shareholder in two other listed companies in Hong Kong: Swire Properties Limited and Cathay Pacific Airways Limited. Swire Pacific is listed on the Hang Seng Corporate Sustainability Index, the Dow Jones Sustainability Asia Pacific Index and MSCI All Country World Index (ACWI) ESG Leaders Index.

Visit Swire Pacific's website at www.swirepacific.com

Disclaimer

This document may contain forward‑looking statements that reflect the Company's beliefs, plans or expectations about the future or future events. These forward‑looking statements are based on a number of assumptions, estimates and projections, and are therefore subject to inherent risks, uncertainties and other factors beyond the Company's control. The actual results or outcomes of events may differ materially and/or adversely due to a number of factors, including changes in the economies and industries in which the Group operates (in particular in Hong Kong and the Chinese Mainland), macro‑economic and geopolitical uncertainties, changes in the competitive environment, foreign exchange rates, interest rates and commodity prices, and the Group's ability to identify and manage risks to which it is subject. Nothing contained in these forward‑looking statements is, or shall be, relied upon as any assurance or representation as to the future or as a representation or warranty otherwise. Neither the Company nor its directors, officers, employees, agents, affiliates, advisers or representatives assume any responsibility to update these forward-looking statements or to adapt them to future events or developments or to provide supplemental information in relation thereto or to correct any inaccuracies.

References in this document to Hong Kong are to Hong Kong SAR, to Macau are to Macao SAR and to Taiwan are to the Taiwan region.

For more information, please visit https://doc.irasia.com/listco/hk/swire/interim/2024/intpress.pdf.

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |