Sunny Optical Technology (Group) Company Limited

To: Business Editors

[For Immediate Release]

【19 March 2019, Hong Kong】 The leading integrated optical components and products producer in the PRC, Sunny Optical Technology (Group) Company Limited ("Sunny Optical" or the "Company", stock code: 2382.HK, together with its subsidiaries, the "Group"), today announced its annual results for the year ended 31 December 2018 ("year under review").

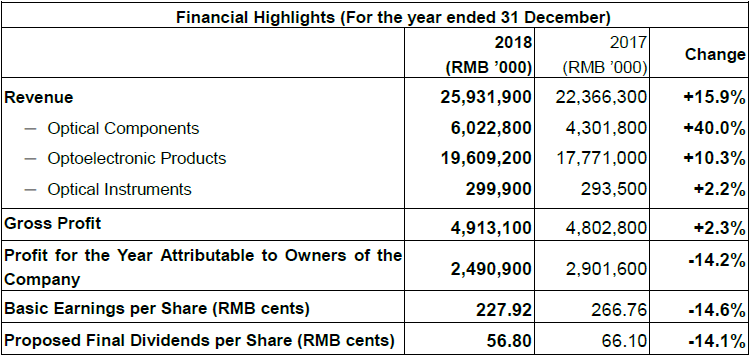

During the year of 2018, the core businesses of the Group have achieved steadily growth, with its revenue increased by approximately 15.9% compared to that of last year, to approximately RMB 25,931.9 million. The satisfactory overall performance in revenue was mainly benefited from the Group's better development in the industry of smartphone related businesses and vehicle imaging field. The Group's gross profit increased by approximately 2.3% compared to that of last year to approximately RMB4,913.1 million. The gross profit margin was approximately 18.9%, which was 2.6 percentage points lower than that of last year. The decrease in gross profit margin was mainly attributable to: (i) the utilisation rate of the new factory which remained in the course of the improvement in the year of 2018; (ii) the increased material costs due to the depreciation of Renminbi in the year of 2018; and (iii) the handset camera modules business which was in the process of the production line optimization and the automation level improvement, which hindered the production efficiency and led to an increase in production costs. The profit for the year attributable to owners of the Company decreased by approximately 14.2% to approximately RMB2,490.9 million. Basic earnings per share decreased by approximately 14.6% to approximately RMB227.92 cents.

The Board of Directors of the Group proposed payment of a final dividend of approximately RMB 0.568 per share (equivalent to HK$ 0.662) for the year ended 31 December 2018.

Commenting on the Group's performance during the year under review, Mr. Ye Liaoning, Chairman of the Board of Directors of Sunny Optical, said, "Looking back to 2018, the world economy maintained a modest growth but its momentum has slowed down. The economic situation, inflation level and monetary policy of major economies have been greatly diversed. As the world's second largest economy, China's economy was largely stable with uncertainties. Under the influence of multiple factors such as the heating up of trade tensions between China and the USA and the deleveraging in China, resulting in higher volatility in the financial market, the exchange rate of USD to RMB nearly reached "7" twice this year. The cooling down of macro environment further lowered the growth momentum of smartphones, which has already shown a sign of saturation. The smartphone market of China has been continuously weak. According to the report of China Academy of Information and Communications Technology, the shipment volume of smartphones in China was approximately 390,000,000 units in 2018, representing a year-on-year decrease of approximately 15.5%. However, Chinese domestic mobile brands seized opportunities amid crises in due time. They rapidly captured part of the mid- and high-end market by continuously increasing investment in technological innovation and product upgrade, with a special focus on perfecting product quality and customer experience. In terms of market position, they have turned from followers to innovators. Apart from the good performance in the Chinese market, they actively explored overseas markets and achieved rapid progress in the Indian and Southeast Asian markets. Meanwhile, with the promising prospect of the commercialization of 5G technology, smartphone manufacturers have made significant investment in such business, showing enormous potential in the future. Furthermore, affected by unstable macro environment, the global vehicle sales volume in 2018 was slightly decreased than that of last year. Nevertheless, it is encouraging that intellectualization has become the development trend of the automobile industry. Various kinds of intelligent operating systems are no longer for luxury cars only and mid-end cars are increasingly equipped with such systems. Currently, advanced driver assistance systems ("ADAS") has become one of the fastest-growing sectors in the automotive electronic market. Cameras, mainly used for capturing images, identifying objects/people, real-time monitoring and intelligent interaction in the ADAS system, are expected to see rapid growth. Being a leading handset lens sets and handset camera modules provider as well as the largest vehicle lens sets supplier in the world, the Group has benefited thereby."

Benefiting from the continuous development of the mid- to high-end smartphone market and the vehicle camera field, the Group's active response to market changes with its timely adjustment of strategies, and the breakthroughs of various key technologies and the enhancement of R&D ability, the Optical Components business segment has achieved satisfactory results. During the year under review, the revenue from the Optical Components business segment amounted to approximately RMB6,022.8 million, representing an increase of approximately 40.0% as compared to that of last year. This business segment accounted for approximately 23.2% of the Group's total revenue, as compared to approximately 19.2% for last year.

During the year under review, the shipment volume of handset lens sets of the Group increased by approximately 56.4% as compared to that of last year. In addition, the Group also focused on R&D investment in products and the improvement of product specifications, especially investment in large-aperture, miniaturization, ultra-wide angle and other new specifications. During the year under review, the Group successfully completed the development of a number of products, including ultra-large aperture (FNo.1.4) handset lens set with 7 pieces plastic aspherical lenses ("7P"). Meanwhile, 48-mega pixel handset lens sets, 32-mega pixel miniaturized head handset lens sets and variable aperture (7P) handset lens sets have achieved mass production. In respect of 3D field, the 3D collimating lens sets have successfully achieved mass production. Further, the Group has actively promoted the design and development of semiconductor optics and micro/nano optical products, as well as developed a wide range of products applied in emerging fields such as lenses and lens sets used in VR/AR, biological recognition, motion tracking and so on. Some of such products have commenced mass production and achieved further breakthroughs in sales, resulting in considerable economic benefits.

The shipment volume of vehicle lens sets of the Group increased by approximately 25.3% as compared to that of last year, maintaining its ranking as the first in the industry globally.

The Group achieved a series of technological breakthroughs in the field of vehicle lens sets, has completed the R&D of 8-mega pixel vehicle lens sets and has received orders from a number of international tier-one clients. At the same time, the Group has achieved gratifying results in the field of new future products. Not only did it extend the applications of automotive optical products, the Group also laid foundation for the Company to form new strategic growth points in the future. During the year under review, the Group has successfully achieved the technological breakthrough in the core optical device of vehicle's head-up display ("HUD") and became one of the few HUD optical system solution providers capable of integrating design and manufacturing. Meanwhile, the Group seized the market opportunity of the automotive optical system in the field of autonomous driving and quickly promoted the technical R&D and market development of automotive LIDAR products, as well as comprehensively laid out the design and development of key components of automotive LIDAR and entered the automotive smart pixel headlight sector. Currently, the Group has conducted substantive business cooperation with several tier-one clients.

Under the multiple pressures of slowing growth rate in the global mobile phone market, intensified market competition, Sino-US trade friction escalation and RMB depreciation, the Optoelectronic Products business segment still could satisfactorily capture the wave of technology upgrades in the mid- to high-end smartphone market. Through the market expansion, technological innovation and the strengthening of the supply chain management, the sales of this business segment have achieved a considerable growth. During the year under review, the revenue from the Optoelectronic Products business segment amounted to approximately RMB19,609.2 million, representing an increase of approximately 10.3% as compared to that of last year. This business segment accounted for approximately 75.6% of the Group's total revenue, as compared with approximately 79.5% for last year.

The shipment volume of handset camera modules of the Group increased by approximately 30.3% as compared to that of last year. Meanwhile, the dual-camera penetration rate continued to increase, but as the performance of the algorithm increased, the tendency to take away the stent for dual-camera became more obvious, and the form of monomer supply increased. However, with the gradual increase in consumer demand for higher time optical zoom, triple-camera and other new solutions are beginning to attract people's eyes. The Group has successfully mass produced the periscope type ultra-small optical zoom module with the establishment of a good and long-term relationship with mainstream customers. In addition, with the development of applications, the demand for 3D depth camera products continued to increase. It led to the relatively rapid increase in the shipment volume of the TOF modules and structured light modules on the mobile terminal. The Group simultaneously developed diverse 3D depth camera products so as to respond to the new market demands. At the same time, the Group has successfully developed various kinds of surround view, front view and in-car automotive camera modules, some of which are or will be put into mass production. The Group continued to innovate in new packaging technologies and has developed the latest generation of packaging technology to further reduce the module height, which will be in line with demand for higher screen-to-body ratio. Meanwhile, the Group continuously optimised the production process and increased investment in production line automation. With extensive experience in the optical industry and various innovative production techniques and packaging technology, the Group has successfully carried out mass production of mid- and high-end products for a famous customer in Korea, further enhancing the internationalization of customer base.

The Group's business in deep vision module products has made rapid progress. The system solution products for target recognition such as face and object which based on 3D data have entered the mass commercial stage and have been applied to the new sectors of logistics, smart retail, etc. In addition, the Group has successfully developed linear TOF products and such products have been embedded sweeping robots for famous customers. At the same time, the Group has also successfully developed wide-angle high-profile area array TOF products for full coverage for large-scale probing and interactive applications in AR/ VR, robots, drones and so on. The Group has completed the upgrade and mass application of the self-developed software of 3D products such as TOF, dual-camera and structured light products, which has established the Group's advantages in the large-scale efficient production of the relevant products.

The demand for optical instruments has recovered, the revenue from the Optical Instruments business segment amounted to approximately RMB300.0 million, an increase of approximately 2.2% as compared to that of last year. The business segment accounted for approximately 1.2% of the Group's total sales revenue, as compared to approximately 1.3% for last year.

For more information, please visit http://doc.irasia.com/listco/hk/sunnyoptical/annual/2018/respress.pdf.

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |