Phoenix Media Investment (Holdings) Limited

(Formerly known as Phoenix Satellite Television Holdings Limited)

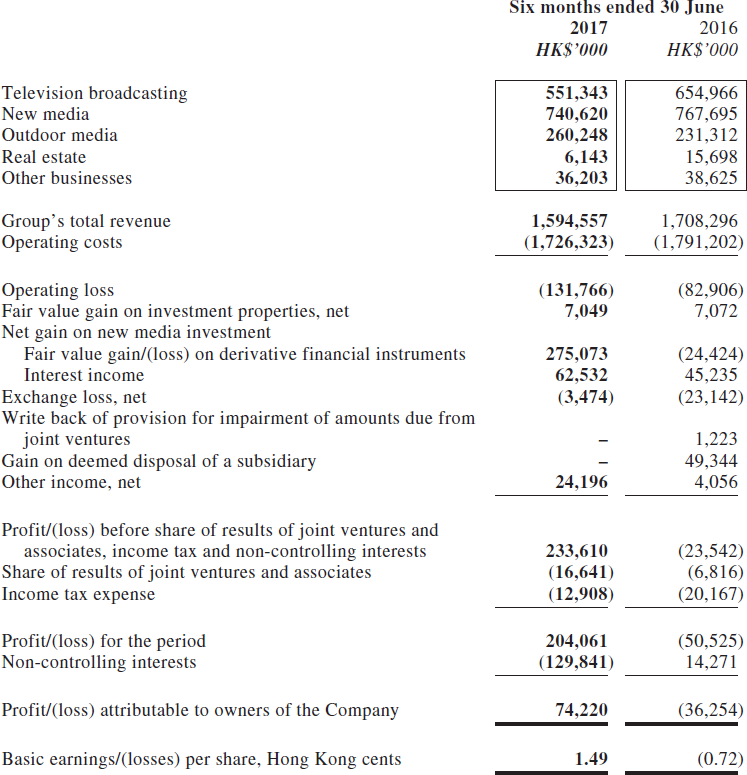

(Incorporated in the Cayman Islands with limited liability)

The Chairman and Chief Executive Officer of Phoenix Satellite Television Holdings Limited, Mr. Liu Changle, said today that the Group's revenue for the six-month period ended 30 June 2017 was approximately HK$1,594,557,000, which represented a decrease of 6.7% over the same period last year. The profit attributable to owners of the Company was approximately HK$74,220,000, compared to a loss attributable to owners of the Company of approximately HK$36,254,000 during the same period last year. In short, as the Group expanded into new areas, Mr. Liu was very confident about the future of the business.

FINANCIAL REVIEW

The revenue of the Group for the Period was approximately HK$1,594,557,000 (six months ended 30 June 2016: HK$1,708,296,000), which represented a 6.7% decrease in comparison with the same period last year, as cross-media placement and cross-platform measurement are becoming more important for marketers to engage with consumers over the various screens and devices they use. The operating costs for the Period have decreased by 3.6% to approximately HK$1,726,323,000 (six months ended 30 June 2016: HK$1,791,202,000).

The operating loss of the Group for the Period was approximately HK$131,766,000 (six months ended 30 June 2016: HK$82,906,000) which represented an increase in the operating loss of 58.9% compared to the previous year.

Fair value gain on derivative financial instruments related to subsequent measurement of new media's investment in Particle Inc. for the Period was approximately HK$275,073,000 (six months ended 30 June 2016: loss of HK$24,424,000). Particle Inc. is a strategic investment of Phoenix New Media and it mainly operates the Yidian Zixun mobile APP featuring personalized interest-based information and news feed function targeting the mass market.

The net exchange loss of the Group for the Period was approximately HK$3,474,000 (six months ended 30 June 2016: HK$23,142,000) mainly resulting from the depreciation of Renminbi ("RMB").

The profit attributable to owners of the Company for the Period was approximately HK$74,220,000 (six months ended 30 June 2016: loss of HK$36,254,000).

The chart below summarises the performance of the Group for the six months ended 30 June 2017 and the same period in 2016.

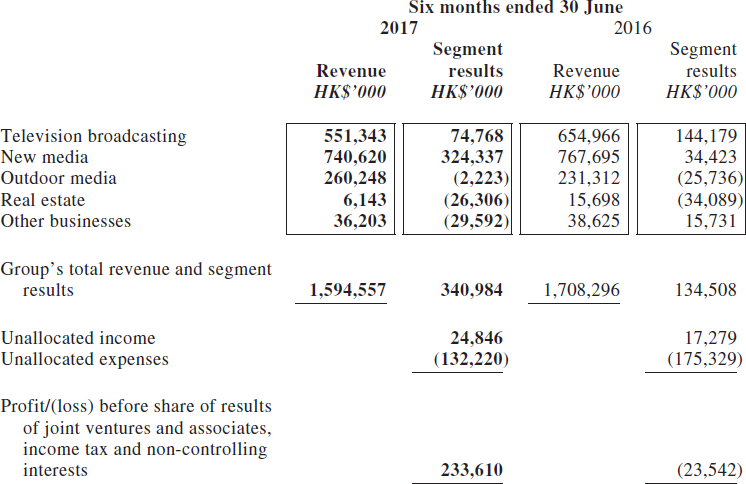

COMMENTS ON SEGMENTAL INFORMATION

Revenue from television broadcasting, comprising advertising, subscription and other revenue sources, which accounted for 34.6% of the total revenue of the Group for the Period, decreased by 15.8% to approximately HK$551,343,000 (six months ended 30 June 2016: HK$654,966,000). The presence of new media has continued to pose a challenge to conventional media. Due to the relatively fixed cost structure, the segmental profit for television broadcasting business decreased to approximately HK$74,768,000 for the Period (six months ended 30 June 2016: HK$144,179,000).

The revenue from Phoenix Chinese Channel and Phoenix InfoNews Channel, which accounted for 31.3% of the total revenue of the Group for the Period, decreased by 17.1% to approximately HK$498,611,000 (six months ended 30 June 2016: HK$601,818,000).

The total revenue of Phoenix Hong Kong Channel, Phoenix Movies Channel, Phoenix North America Chinese Channel, Phoenix Chinese News and Entertainment Channel and others decreased by 0.8% to approximately HK$52,732,000 as compared to the same period last year (six months ended 30 June 2016: HK$53,148,000).

The revenue of the new media business for the Period decreased by 3.5% to approximately HK$740,620,000 (six months ended 30 June 2016: HK$767,695,000) due to the decrease in portal advertising revenues and mobile value-added services resulting from the decrease in user demands. The segmental profit for new media business for the Period was approximately HK$324,337,000 (six months ended 30 June 2016: HK$34,423,000). Increase in segmental result for new media was primarily due to the increase in net gain related to subsequent measurement of the investment in Particle Inc.

The revenue of the outdoor media business for the Period increased by 12.5% to approximately HK$260,248,000 (six months ended 30 June 2016: HK$231,312,000). The segmental loss of outdoor media business for the Period decreased by 91.4% to approximately HK$2,223,000 (six months ended 30 June 2016: HK$25,736,000).

The segmental loss for real estate business for the Period was approximately HK$26,306,000 (six months ended 30 June 2016: HK$34,089,000), which mainly comprises depreciation and interest expenses.

For more information, please visit http://www.irasia.com/listco/hk/phoenixtv/interim/2017/intpress.pdf.

| © Copyright 1996-2023 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |