Miramar Hotel and Investment Company, Limited

(Incorporated in Hong Kong with limited liability)

| Press Release | [For Immediate Release] |

[Hong Kong - 18 March 2025] Miramar Hotel and Investment Company, Limited ("Miramar" or 'the Group", HKSE stock code: 71) announced today the audited results for the year ended 31 December 2024.

Overview

Annual Results

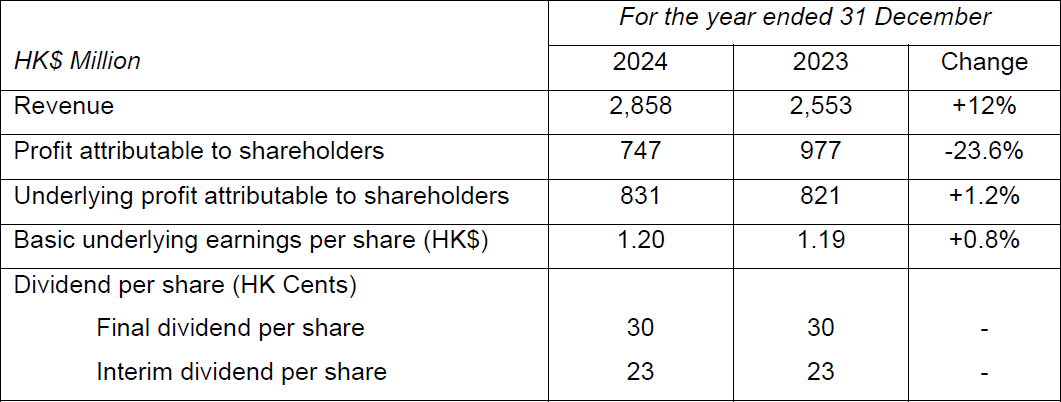

The Group's revenue for the year 2024 amounted to HK$2,858.4 million (2023: HK$2,552.6 million), an increase of 12.0% against last year. The underlying profit attributable to shareholders (excluding the fair value of investment properties) increased by 1.2% to HK$830.5 million compared with last year (2023: HK$820.5 million). Mr. Lai Ho Man, Director of Group Finance, said, "The revenue from the Group's four business segments performed steadily, with the travel segment posting an impressive 31.6% growth in revenue over last year". The Board recommends a final dividend of HK30 cents per share to the shareholders listed on the Register of Members at the close of business on 17 June 2025 (Tuesday). The proposed final dividend is expected to be distributed to shareholders on 10 July 2025 (Thursday). Adding up with an interim dividend of HK23 cents per share paid on 14 October 2024, the total dividend payment for the whole year will be HK53 cents per share.

In 2024, the business environment in Hong Kong remained challenging. However, Miramar Group demonstrated remarkable resilience and maintained steady growth through its outstanding management team, diversified business portfolio and flexible response strategies in a dynamic global economic landscape.

The volatility of the global economy has posed significant challenges to the hospitality industry. Among these, the persistent strength of the US dollar has led to a high exchange rate for the Hong Kong dollar, dampening the sentiment of visitors' traveling to Hong Kong and curbing their consumer spending. Meanwhile, China's addition of 15 new unilateral visa-free and mutual visa-free countries in 2024 has expanded the number of visa-free countries to 63, resulting in a substantial 93.4% year-on-year increase in the number of international flights from China to 580,000. More mainland visitors opted to travel to other countries via China's three major international aviation hubs - Beijing, Shanghai and Guangzhou - which, in turn, affected the number of overnight visitors and the hospitality business in Hong Kong. Apart from that, the increased northbound spending among Hong Kong residents in recent years has also exerted further pressure on the business environment of the local retail and food and beverage industries.

In response to these challenges, we implemented a series of strategic measures, including flexible pricing adjustments to maintain market competitiveness, actively launching creative products and services, and strengthening joint promotions with merchants and partners to expand our customer base. We also fully leveraged our e-commerce platform and customer database to drive business growth through precise marketing, ensuring stable development in the challenging environment. During the year, our travel business performed particularly well, with revenue increasing by 31.6% year-on-year. The annual average occupancy rate of office buildings and shopping malls exceeded 95%, and our hotel business also delivered strong performance, with The Mira Hong Kong and Mira Moon achieving annual average occupancy rates of 92% and 95%, respectively, reflecting the success of our marketing strategies and promotional efforts.

To further expand our customer base and ensure business stability, the Group has capitalized on the opportunity of Hong Kong's development as an Islamic offshore financial center by actively developing Muslim-friendly hotels and restaurants to broaden our market and customer base. Chinesology, the Group's Chinese restaurant, has become the first fine-dining Chinese restaurant in Hong Kong to receive the ''Halal-friendly Restaurant'' certification granted by the Incorporated Trustees of the Islamic Community Fund of Hong Kong (Board of Trustees (BOT)). The Mira Hong Kong and Mira Moon were also accredited as Muslim-friendly hotels with a Level 5 Rating from ''CrescentRating'', an internationally renowned Muslim travel certification authority, further strengthening the Group's market competitiveness.

Business Review

Hotels and Serviced Apartments Business

During the year, the overall revenue from the hotel and serviced apartment business amounted to HK$597.4 million, representing an increase of 2.7% compared with HK$581.9 million for the same period last year. Meanwhile, earnings before interest, taxes, depreciation and amortization (EBITDA) recorded a profit of HK$139.9 million, representing a decrease of 8.8% compared with HK$153.5 million for the same period last year.

During the period under review, the persistently strong exchange rate of the US dollar continued to affect the tourism industry of Hong Kong. In response to this challenge, the Group's hotels took proactive and multi-pronged measures to expand their customer base and enhance competitiveness. In addition to implementing a more flexible pricing strategy, the Group focused on expanding the sales network through active promotion in the Greater Bay Area (GBA) and around the world. We launched a wide range of tour packages in collaboration with travel agencies in Mainland China and participated in the delegation visits to Hong Kong organized by the Hong Kong Tourism Board for the overseas tourism sector. In addition, the hotels launched various offers and promotional campaigns to enhance sales performance during low seasons, such as the introduction of air-ticket-and-hotel and high-speed-rail-and-hotel packages, which successfully attracted more travelers. In terms of the banquet business, we pursued innovation and change by organizing a number of thematic and festive events during the year. For example, various themed events were successfully organized in collaboration with consulates of various countries, in which the traditional rental mode of banquet venue was replaced with the revenue mode of tickets and meal coupons, which attracted a large number of guests, resulting in the outstanding performance of the banquet business. Meanwhile, the banquet business also introduced various thematic activities and adopted supporting online sales strategies to effectively broaden its customer base.

In terms of market expansion, the hotels also achieved significant results. For example, The Mira Hong Kong and Mira Moon of the Group, actively developed the Middle East and ASEAN markets during the year, and introduced various Muslim-friendly facilities and services, earning certification as Muslim-friendly hotels with a Level 5 Rating from ''CrescentRating'', an internationally recognized authority on Muslim tourism. These efforts successfully attracted more international travelers.

Thanks to the properly formulated business and operational strategies mentioned above, the occupancy rate of The Mira Hong Kong and Mira Moon increased further to 92.1% and 95.4% in 2024, compared with 89.8% and 95.0% in 2023, respectively, while the average room rate also reached HK$1,416 and HK$1,636. The revenue from the room rental business of The Mira Hong Kong recorded an increase of 1.7%, while the revenue from the room rental business of Mira Moon declined by 3.5%. Revenue from the food and beverage business under the hotel segment of the Group also recorded an increase of 3.8% compared with the same period last year.

Property Rental Business

The revenue from the Group's property rental business remained stable at HK$791.3 million during the year, while EBITDA recorded a profit of HK$663.9 million, compared with revenue of HK$795.2 million and EBITDA of HK$670.1 million last year, indicating a slight decrease of 0.5% and 0.9% from last year, respectively. The average occupancy rate of office buildings and shopping malls for the year exceeded 95%.

During the year, the Group continued to enhance its semi-retail portfolio and actively expanded its customer base and foot traffic by upholding its core strategy for diversified tenant mix and unique shopping experience. In terms of tenant mix, we further optimized the tenant structure and adjusted the layout of its malls to improve foot traffic and extend customers' visiting time. Additionally, we strategically introduced lifestyle brands and international fashion brands to strengthen the competitiveness of our malls. Notably, the arrival of the iconic ''Swatch'' fashion watch store during the year not only enhanced the trendy image of the malls but also gave them a fresh look. Meanwhile, the international lifestyle brand MUJI expanded its business scale during the period under review, and added the MUJI Café as food and beverage (F&B) element to provide customers with a new shopping and dining experience, further enhancing the appeal of the malls. In addition, Mira Place partnered with MUJI for the first time to create the world's first large-scale Christmas decoration in a mall, ''Mira Giftmas with MUJI'', featuring a Christmas town fantasy that provided customers with a comprehensive festive experience integrating dining, shopping, and entertainment.

For the beauty sector, recognizing the market potential and trend, we stepped up our promotional efforts during the year and launched a thematic campaign named ''Beautiful Mi'', which incorporated beauty experiences, fashion, and a healthy lifestyle to bring customers a holistic sense of beauty and enjoyment, further reinforcing the market positioning of Mira Place in the beauty sector.

In addition, the mall launched thematic decorations and promotional campaigns covering festivals, food and beverage and culture, which not only effectively created a new shopping atmosphere but also maximized public relations and publicity benefits, drawing in substantial visitor traffic.

For more information, please visit https://doc.irasia.com/listco/hk/miramar/annual/2024/respress.pdf.

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |