Hopson Development Holdings Limited

For Immediate Release

Hopson Announces 2012 Interim Results

Turnover increased by 6% to HK$5,123 million

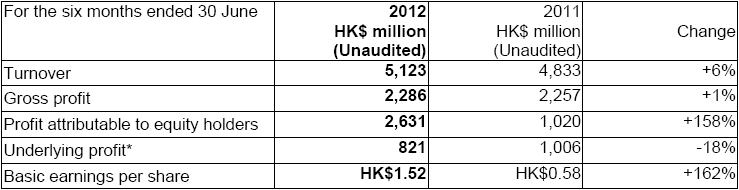

Financial Highlights

* Excluding gain on disposal of available-for-sale financial assets, revaluation surplus, negative goodwill and minority interests

(28 August 2012 - Hong Kong) - Hopson Development Holdings Limited ("Hopson" or the "Company", together with its subsidiaries, the "Group"; Stock code: 00754) announced today its interim results for the six months ended 30 June 2012.

During the period under review, the Group's turnover was HK$5,123 million, representing a year-on-year increase of 6%. Profit attributable to equity holders was HK$2,631 million for the first half of 2012 (1H2011: HK$1,020 million). Basic earnings per share was HK$1.52. Excluding the effect of the net of tax gain from investment property revaluation of HK$80 million and gain on disposal of available-for-sale financial assets of HK$1,730 million, underlying profit for the period under review was HK$821 million, down 18% year on year. The Board of Directors does not recommend a payment of the interim dividend for the six months ended 30 June 2012.

Along with the austerity measures of the Central Government showing effects, demand and supply in the market has gradually been improving despite the challenges to established real estate developers. During the reporting period, total GFA of recognized sales amounted to 248,871 square metres (1H2011: 233,454 square metres). The overall average selling price in respect of delivered and completed properties slightly decreased by 6% to RMB14,989 per square metre (1H2011: RMB16,014).

The Group recorded a total of RMB5.82 billion contracted sales (1H2011: RMB5.32 billion). Average contracted selling price increased by 11% to RMB16,263 per square metre (1H2011: RMB14,714 per square metre) while the GFA of contracted sales was 357,885 square meters.

Property development continued to be the Group's core business activity (90%). In the first half of the year, the Group continued to develop its business in the three core economic regions, namely the Pearl River Delta, Yangtze River Delta and Huanbohai Area. Eastern China (including Shanghai, Hangzhou and Ningbo) contributed 50% to the total revenue of the Group, followed by Northern China (including Beijing, Tianjin, Dalian, Taiyuan and Qinhuangdao) (26%), and Southern China (including Guangzhou, Huizhou and Zhongshan) (24%).

Commenting on the interim results, Mr. Zhang Yi, Executive Director of Hopson, said, "In the first half of 2012, the macro-economy of China showed continued slowdown in growth. Meanwhile, the Central Government launched a number of austerity measures on the real estate industry in a bid to increase the effective supply and promote the healthy development of the real estate market. Despite the effects brought by the austerity measures, the Group leveraged on its enormous comprehensive strengths, wide operational experience, mature management principle, well-established governance structure as well as its scientific operation system to ride through the adjustment process on a solid note."

To maintain a stable and continuous business development and to secure its ability for sustainable development, the Group adopted a prudent principle in land bank acquisition. As of 30 June 2012, the Group had a landbank of approximately 31.85 million square metres in terms of GFA.

Looking ahead, Mr. Chu Mang Yee, Chairman of Hopson, concluded, "Looking ahead the second half of 2012, the Group will continue to closely adapt to changes in the market, size up the situation, adjust its strategy, capture the demand of the market and continuously enhance its core competiveness. In the second half of 2012, the Group will launch a series of new projects and they will either be in prime locations of the cities, or countryside villas with natural landscape, or in large-scale composite projects with comprehensive facilities in second-tier cities. Adhering to our high quality standard for developed products with target customers, these projects are highly receptive and recognized by potential buyers and we expect that they will generate satisfactory sales to the Group with accumulating positive influence of brand recognition and effective marketing strategies. We will continuously strengthen the profitability of the Group's operating sales by all means, and thus, thereby bringing fruitful returns to our shareholders."

- End -

For further information, please contact:

iPR Ogilvy Ltd.

Kiki Zhang / Polly Leung / Tina Law / Natalie Tam

Tel: 3920 7626 / 2139 8059 / 2136 6181 / 2136 6182

Fax: 3170 6606

Email: kiki.zhang@iprogilvy.com / polly.leung@iprogilvy.com / tina.law@iprogilvy.com / natalie.tam@iprogilvy.com

| © Copyright 1996-2023 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |