Hi Sun Technology (China) Limited

(Incorporated in Bermuda with limited liability)

| [Press Release] | 19 March 2024 |

Results Highlights

Financial Highlights

[19 March, 2024, Hong Kong] Hi Sun Technology (China) Limited (the "Company", Stock code: 818.HK), a leading payment and digital services & finance solutions provider in China, announced the audited consolidated results of the Company and its subsidiaries (the "Group") for the twelve months ended 31 December, 2023 (the "Year").

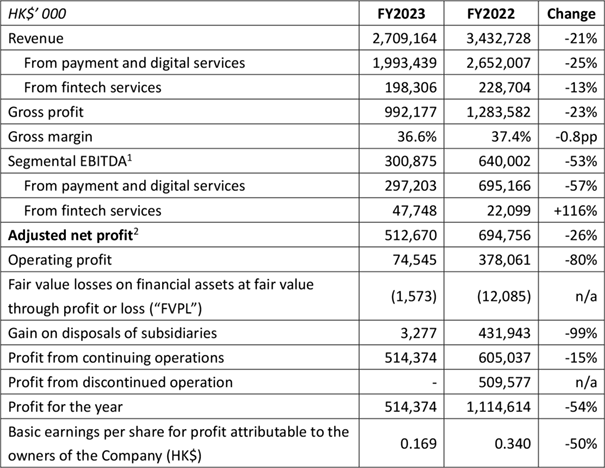

In 2023, the Group positively reacted to the complex and volatile macroeconomic environment both home and abroad, and continued to promote the digital strategic transformation. During the Year, the Group's consolidated revenue was HK$2,709.2 million, representing a decrease of 21% compared with HK$3,432.7 million for the same period last year; Segmental EBITDA amounted to HK$300.9 million. Adjusted net profit was HK$512.7 million, a decrease of 26% from HK$694.8 million for the same period last year.

Business Review

Continued Significant Effectiveness in Digital Transformation Strategy, and Continued Penetration into Business Scenarios

During the Year, the Group's payment and digital services accelerated the pace of digital transformation, achieving a year-on-year increase of more than 100% in digital payment volume to approximately RMB640 billion. In terms of business scenarios, the Group's PaaS platform continued to provide high-quality digital solutions for various industry segments and attracted more than 300 new partners joining in 2023.

At the same time, the Group's digital management product for the retail industry (Diansansan) has served a number of top chain retail customers, including supermarket chains, convenience store chains and fresh food store chains. With four types of products, namely "Smart Supply Chain", "Smart Category Management", "Smart Store Management" and "KPI Monitoring and Analysis", the Group helps merchants carry out smart management of the whole cycle of commodity circulation, helping customers improve the commodity inventory turnover rate, reduce capital occupation, and comprehensively improve the operational efficiency and sales capabilities of merchants.

During the Year, the Group launched the new generation of automobile asset digital service platform "Jiexingchejia", which has provided one-stop digital solutions integrating transaction, payment, management and finance for more than 100 second-car dealers, helping enterprises achieve digital transformation and rapid growth.

The cross-border payment business also continued to grow steadily. The Group continued to adhere to the differentiation strategy. In addition to maintaining its differentiation advantages in new regions and small currencies, the Group also continued to explore the cross-border payment scenarios in emerging industries and niche emerging platforms to provide safe and reliable capital entry and exit solutions, and gained certain industry-leading advantages. At the same time, the Group increased the expansion of B2B foreign trade collection business during the Year, and the transaction scale achieved a nearly ten-fold increase. The Group has also made critical breakthroughs in some core industries, where the Group's CoGoLinks one-stop capital solutions have become the primary choice in the second-hand car export market.

The Comprehensive Financial Technology Service Capabilities Continue to Improve, Helping Small and Medium-Sized Enterprises Achieve High-Quality and Efficient Development

In terms of fintech services, the Group's Suixin Cloud Chain Technology Service Platform ("Suixin Cloud Chain") has built two major business systems, namely subject credit and digital credit, to provide enterprises with comprehensive one-stop supply chain financial services. Sunxin Could Chain is committed to solving various financing needs of small and medium-sized enterprises in different scenarios in the whole chain of upstream and downstream industries.

In view of the continued low interest rates in the domestic market in 2023, Suixin Cloud Chain seized the opportunity to strengthen close cooperation with major financial institutions to provide credit support for small and medium-sized enterprises with higher efficiency and lower interest rates. The Group not only fully supported the acceptance of new-generation bills and supply chain bills, but also strengthened the acceptance of bank acceptance bills, cooperating with nearly 10 banks. With the further improvement of service acceptance capabilities of Suixin Cloud Chain, the transaction scale exceeded RMB10 billion in 2023, representing a year-on-year increase of 131% as compared to last year. In particular, the bill business increased by 185% year-on-year, driving the operating profit of the fintech services segment to HK$43.0 million, representing a year-on-year increase of 190%.

The Group's newly launched digital inclusive financial services business also achieved phased results. The Group has established two business systems of corporate credit loan and scenario-based credit loan, and successfully launched products of nine financial institutions, providing small and medium-sized enterprises with pure credit, unsecured, unguaranteed and fully online financing products, effectively meeting the financing needs of micro, small and medium-sized enterprises in various industries in production and operation.

Focus on Business Expansion and Innovation of New Products in Other Business Segments

Platform operation solutions: during the Year, the scale of the main business remained stable. The Group continued to provide product development, business operation and system maintenance to the major customer, China Mobile Financial Technology Co., Ltd. Meanwhile, the Group made progress in enterprise marketing tools and agency operations. During the Year, the Group cooperated with operators in some regions to provide customers with SaaS tools and overall business agency operation solutions. In addition, the Group continued to optimise and upgrade the basic platform and tool software, and maintained the synchronisation with the advanced technology in the industry, and was successfully selected into the Super SIM Sub-chain Industry Alliance, marking the Group's industry-leading cooperation with the eight strategic products of the Mobile Group.

Financial solutions: BJ ABS remained focused on the delivery and maintenance of banking system products. During the Year, the Group focused on completing the commissioning of the core system project of Dah Sing Bank and the commissioning of the distributed core system of China Guangfa Bank. At the same time, the Group focused on the upgrading and transformation of the payment system, and assisted banking customers in Hong Kong and Macau to complete the upgrading and transformation of the CHATS and Swift systems in the context of the change in the interface standard of ISO20022. Under the wave of IT application innovation in Mainland China, BJ ABS will continue to deepen the domestic alternative solutions based on the accumulation of relevant projects, and help financial institutions to realise the mainframe downshift at the lowest consideration. For overseas financial IT service opportunities, Hi Sun FinTech Global continuously improves its overseas service capabilities. The Group completed the establishment of overseas offices in Kuala Lumpur on the basis of overseas offices in Laos and Cambodia, which will provide customers with better local technical support services. Meanwhile, the Group actively carried out market expansion, and successfully signed contracts with eight new customers during the Year, achieving business breakthroughs in the local market of Malaysia and Thailand. The Group also completed the recruitment of local sales personnel in Myanmar, Thailand and other markets. In terms of new product technology research and development, the Group made new breakthroughs in the new generation of distributed and micro-service core systems, and successfully signed a contract with a local customer in Malaysia during the Year. In addition, the Group optimised and improved the new generation of e-wallet payment products based on customer needs. The Group also actively carried out technical research and development in response to the business opportunity of mainframe downshift, and signed a contract with a local customer in Thailand during the Year.

The Group commented "Despite the uncertainties in the global economic outlook, we maintain our conviction that the underlying fundamentals supporting the continuous improvement of China's economy remains unchanged, while the impact of digitalisation on various industries is both positive and far-reaching. In the face of numerous opportunities arising from industrial policies and technological advancements, the Group is committed to collaborating with our partners to cultivate an open, collaborative and mutually beneficial digital ecosystem. Our aim is to empower micro, small and medium-sized enterprises and expedite their digital transformation journey. In addition, the Group will remain vigilant in monitoring industry trends and understanding the evolving needs of our customers. By prioritising transformation and fostering technological innovation, we are dedicated to creating greater value for our shareholders, customers and society."

1. EBITDA is calculated by excluding interest expense, taxes, depreciation, amortisation, write off of property, plant and equipment and fair value losses on financial assets at FVPL from segmental operating profit/(loss).

2. Excluding fair value losses on financial assets at FVPL, and gains on disposals of subsidiaries.

About Hi Sun Technology (China) Limited

Hi Sun Technology (China) Limited ("Hi Sun Technology", Stock Code: 818.HK) is a leading integrated solutions provider of payment, finance and telecommunications in China. Hi Sun Technology is principally engaged in the provision of payment and digital services, fintech services, platform operation solutions and financial solutions.

For investor enquiries

Please email to ir@hisun.com.hk

* For identification purpose only

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |