Herald Holdings Limited

(Incorporated in Bermuda with limited liability)

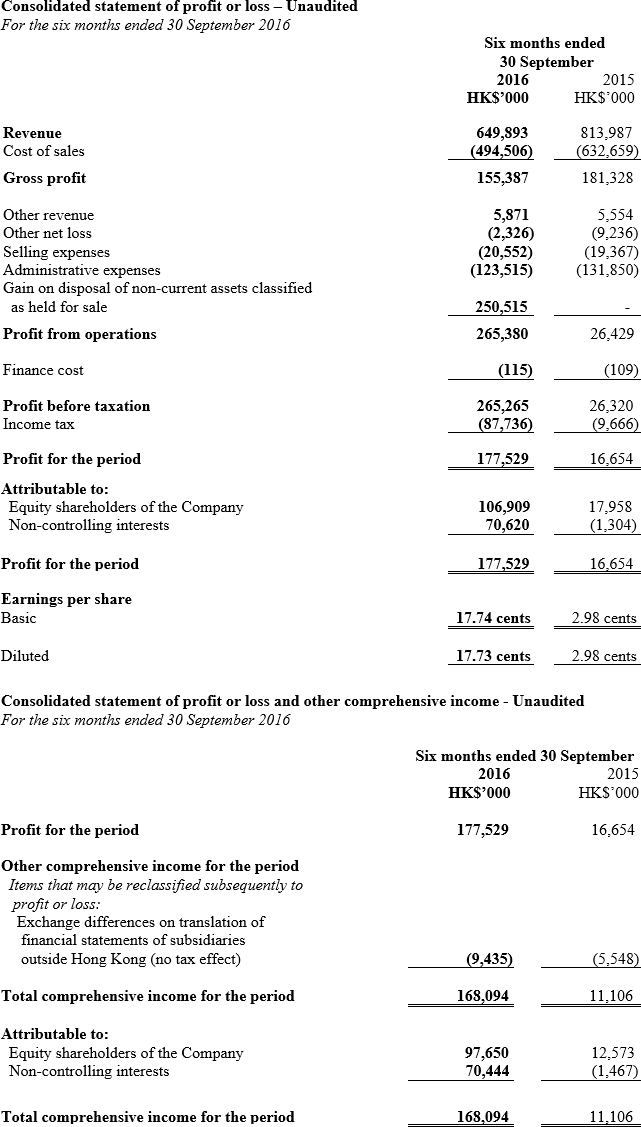

The Board of Directors (the "Board") of Herald Holdings Limited (the "Company") presents the unaudited consolidated results of the Company and its subsidiaries (collectively the "Group") for the six months ended 30 September 2016, together with the comparative figures for the corresponding period in 2015, as follows:

BUSINESS REVIEW

The Group's revenue for the six months ended 30 September 2016 amounted to HK$650 million, representing a decline of 20% as compared with HK$814 million in the corresponding period last year. The net profit attributable to the equity shareholders for the same period was HK$106.9 million which was close to 6 times the net profit of HK$17.9 million a year earlier.

The increase in net profit was primarily due to a pre-tax gain of approximately HK$250.5 million on disposal of properties in Shenzhen (the "Disposal"). The total amount of Land Appreciation Tax and Corporate Income Tax in relation to the Disposal is estimated to be approximately HK$73.2 million. The properties were owned by a non-wholly owned subsidiary in which the Group has 60% interest. Other details of the Disposal were disclosed in the circular dated 29 April 2016. After tax and non-controlling interests, the net gain on the Disposal attributable to the equity shareholders was approximately HK$106.4 million. Further analysis of the operating results is set out in the following paragraphs.

The Toys Division started the current fiscal year with a strong order position. However, the division's business in the second fiscal quarter was not as good as that a year earlier and, for the whole period under review, its revenue decreased by 26% year-on-year from HK$497 million to HK$366 million. Nonetheless, with gain on the Disposal, the first-half operating profit of the division surged to HK$283.1 million from HK$46.0 million in the same period last year.

The Computer Products Division suffered a slowdown in its performance with a 10% drop in halfyearly revenue to HK$104 million from HK$116 million a year earlier. The revenue decline was mainly attributable to sluggish demand for thin-film computer heads. The division incurred an operating loss of HK$3.6 million for the six months ended 30 September 2016 as compared with an operating profit of HK$2.9 million in the year-ago period.

The revenue of the Housewares Division experienced a satisfactory growth in the first half of the fiscal year and increased by 16% year-on-year from HK$61 million to HK$71 million. Weaker sales in the prior-year period were mainly due to a fire accident at our Zhuhai factory that caused a suspension of production for five weeks in 2015. Because of higher revenue, the division saw its half-yearly operating loss shrink to HK$1.3 million from HK$5.1 million a year ago.

The business of the Timepieces Division was impacted by a difficult trading environment, particularly in the Asian markets. Some of its brands performed below expectations. Compared with the same period last year, the division's revenue dropped 23% from HK$141 million to HK$109 million, while its operating loss increased from HK$2.5 million to HK$6.7 million.

The Group recorded net realised and unrealised gains on trading securities of HK$6.8 million for the period under review compared with losses of HK$12.2 million a year ago. At 30 September 2016, the Group's trading securities increased to HK$147 million from HK$143 million as at the beginning of the fiscal year.

At the end of August 2016, the Group completed the acquisition of a property in Wong Chuk Hang at a cost of HK$34 million, comprising the consideration of HK$31 million and stamp duty and professional fees of HK$3 million, for use by the Computer Products Division. The acquisition was financed partly by internal funding and partly by a mortgage loan of HK$12.4 million, repayable over 5 years and secured by the property.

PROSPECTS AND GENERAL OUTLOOK

Due to seasonal factors, the business of the Toys Division will slow down in the second half of the fiscal year. The Computer Products Division continues to be adversely affected by the weak demand in thin-film computer heads. However, it is anticipated that the sales of smart connected devices will pick up in the coming year. On the other hand, both the Timepieces and Housewares Divisions still face difficult challenges ahead amid weak consumer spending.

Despite the favorable results in the first half of the fiscal year, the Group's overall orders at the end of October 2016 fell 30% from those at the same time in 2015. With weaker orders on hand, the management has some concerns about the results of the Group in the second half of the fiscal year.

LIQUIDITY, FINANCIAL RESOURCES AND FUNDING

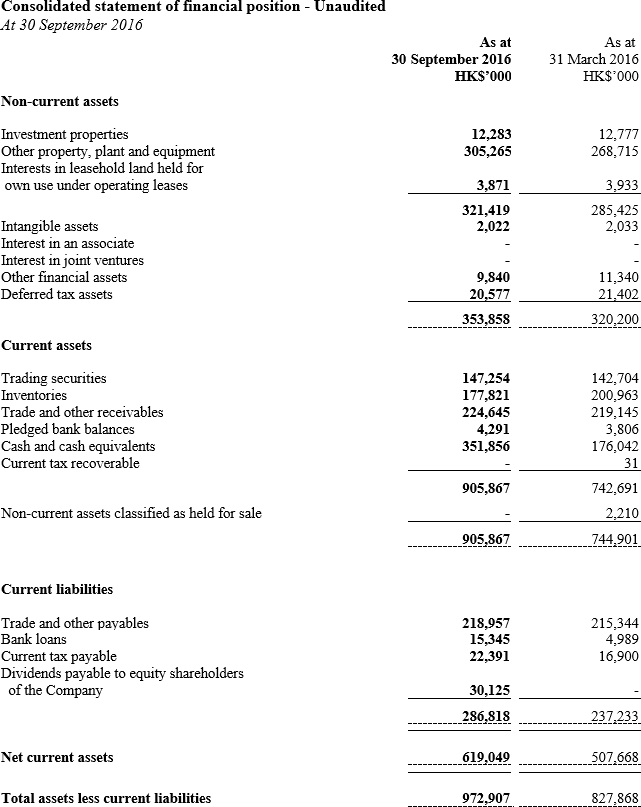

The Group continued to exercise prudence in managing its financial resources. As in the past, the Group maintains a sound liquidity position. At 30 September 2016, the Group's cash surplus amounted to HK$356 million (at 31 March 2016: HK$180 million).

At 30 September 2016, the Group's total current assets were HK$906 million (at 31 March 2016: HK$745 million). The trade and other receivables amounted to HK$225 million (at 31 March 2016: HK$219 million) and the current liabilities HK$287 million (at 31 March 2016: HK$237 million) which included mortgage loan balances of HK$15 million (at 31 March 2016: HK$5 million) secured by two (at 31 March 2016: one) of the Group's properties with a carrying value of HK$66 million (at 31 March 2016: HK$33 million). The mortgage loan balances of HK$12 million and HK$3 million are repayable by fixed monthly instalments with maturity date in August 2021 and July 2017 respectively. Certain trading securities and bank deposits totalling HK$136 million (at 31 March 2016: HK$128 million) are pledged to the banks to secure banking facilities granted to the Group.

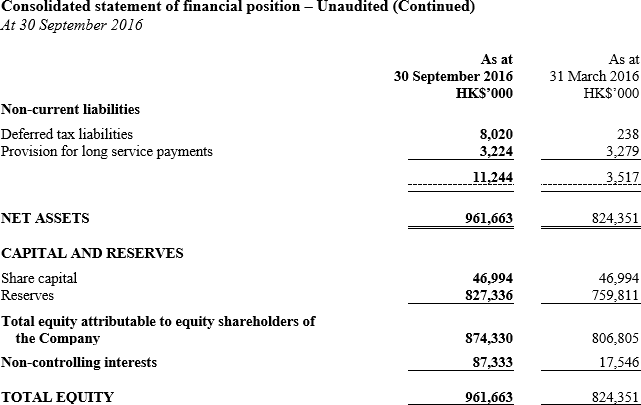

The Group monitors its capital structure on the basis of gearing ratio, which is calculated as a percentage of total liabilities over total assets. The gearing ratio of the Group as at 30 September 2016 was 24% (at 31 March 2016: 23%).

As at 30 September 2016, the Group's working capital ratio, an indicator of liquidity represented by a ratio between the current assets and the current liabilities, was 3.16 compared to 3.14 at 31 March 2016. The quick ratio, another ratio that gauges the short term liquidity and measured by trade debtors and cash and cash equivalents over current liabilities, increased to 1.93 from 1.53 at 31 March 2016.

DIVIDEND

The Directors have declared an interim dividend of HK4 cents per share (2015: HK3 cents). The total amount of dividend payment of HK$24 million (2015: HK$18 million) was based on the total number of shares in issue as at 28 November 2016, being the latest practicable date prior to the announcement of the interim results. The dividend will be paid on Friday, 13 January 2017 to shareholders registered in the Register of Members on Friday, 30 December 2016.

CLOSURE OF REGISTER OF MEMBERS

For determining the entitlement to the interim dividend, the Register of Members of the Company will be closed from Thursday, 29 December 2016 to Friday, 30 December 2016, both days inclusive, during which period no transfer of shares will be effected. In order to be qualified for the interim dividend, shareholders should ensure that all transfers of shares, accompanied by the relevant share certificates, are lodged with the Company's share registrar in Hong Kong, Tricor Tengis Limited, Level 22, Hopewell Centre, 183 Queen's Road East, Hong Kong for registration no later than 4:30 p.m. on Wednesday, 28 December 2016.

Herald Holdings Limited

Hong Kong, 29 November 2016

Contact Person:

| Mr. Robert Dorfman, Chairman | 2522 6181 |

| Mr. Shum Kam Hung, Managing Director | 2522 6181 |

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |