[For Immediate Release]

Financial Highlights

(25 March 2014 - Hong Kong) - Hengan International Group Company Limited ("Hengan International" or the "Company", SEHK stock code: 1044, together with its subsidiaries, the "Group") announces today its annual results for the year ended 31 December 2013.

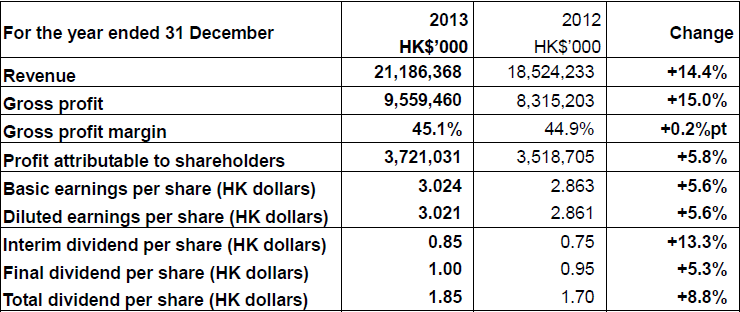

For the year ended 31 December 2013, the Group's revenue increased by about 14.4% to approximately HK$21,186,368,000. Profit attributable to shareholders grew by about 5.8% to approximately HK$3,721,031,000. The Board of Directors has declared a final dividend of HK$1.00 per share for the year ended 31 December 2013. Taking into account the interim dividend of HK$0.85 per share, the total dividend for the full year is HK$1.85 per share.

During the year, the pressure from slight increase in raw material prices and negative impact of intensified market competition were offset by the Group's optimized product portfolio, effective cost control measures and enhanced economies of scale that resulted from business expansion. The overall gross profit margin of the Group was about 45.1%, which remained fairly stable as compared with that of the previous year. Distribution costs and administrative expenses increased and accounted for about 24.8% of turnover (2012: 22.3%), mainly due to the increased investment in marketing and brand promotion as well as research and development.

Commenting on the Group's annual results, Mr. Sze Man Bok, Chairman of Hengan International, said, "In 2013, both Europe and the United States experienced gradual economic recovery while China maintained steady economic growth by stepping up a series of measures. Continuing economic growth and urbanization boosted personal incomes in both the urban and rural areas of China, and led to rising living standard and awareness of hygiene. This is conducive to the development of markets for high-quality personal and household hygiene products, for which Hengan International is well known as an industry leader in the country. The Group leverages its solid fundamentals, strong brand and economies of scale, and adopts effective cost control measures to cope with the changes in the market environment. With these advantages, the Group seeks steady business growth by capturing the opportunities in the flourishing market."

Tissue papers

In 2013, revenue from the tissue paper business grew by about 11.6% to approximately HK$10,204,020,000, accounting for about 48.2% of the total revenue (2012: 49.4%). During the year, the Group's tissue paper business launched upgraded products and continued to take advantage of the Group's brand and sales network as its development strategy to drive sales growth. The Group's revenue from tissue paper sales in the mainland China market increased by approximately 14.2%. Nevertheless, the raw paper export sales, which had a lower margin relatively, saw a double-digit decline in revenue due to keen price competition and hence dragged down the growth rate of total revenue.

For the year, the gross profit margin of the tissue paper business dropped to approximately 34.1% (2012: 35.4%), reflecting the increase in production costs as a result of the slight increase in prices of tissue wood pulp, the major raw material for manufacturing tissue paper, in the second half of the year, and enhanced efforts in marketing and brand promotion campaigns. As the global supply of tissue wood pulp will begin to rise in 2014, the management expects that the upward pressure of raw material costs could be eased in the second half of 2014.

In 2013, the Group did not add any new production line. The annual production capacity is expected to be approximately 900,000 tons. The Group plans to increase the annual production capacity by around 360,000 tons in the second half of 2014 and 120,000 tons in 2015. With new additional production capacity gradually going on stream, the management now consider beginning overseas market expansion in the second quarter of 2014 while consolidating its presence in mainland China in order to increase sales revenue.

Sanitary napkins

In 2013, revenue of the sanitary napkin business grew by about 21.5% to approximately HK $5,972,695,000, which accounted for about 28.2% of the total revenue (2012: 26.5%). The gross profit margin of the sanitary napkin business was approximately 66.3% (2012: 65.8%), which remained fairly stable as compared with that of the previous year. During the year, the pressure from slight increase in raw material prices and negative impact of intensified market competition were offset by the optimization of product portfolio. Looking ahead, the Group will continue to focus on product innovation, optimize the product mix, improve product quality and increase the sales of mid-priced and high-end products in order to satisfy the demand.

Disposable diapers

In 2013, revenue of the disposable diaper business increased by about 9.4% to approximately HK$2,938,186,000, accounting for about 13.9% of the total revenue (2012: 14.5%). The sales of the upgraded versions of diapers were not satisfactory in 2012 due to the overstocking of the old versions in various distribution channels. Nonetheless, as the inventories of the old versions in the distribution channels were substantially cleared in the first quarter of the year, and the upgraded versions were well accepted by the market, the Group's diaper sales recovered with a growth.

The Group's efforts in strengthening marketing and promotion of mid-priced and high-end diaper products, together with the introduction of new product series ("拉拉褲") in the fourth quarter of 2013, resulted in an increase of approximately 17.9% in sales revenue of the mid-priced and high-end diaper products. On the other hand, revenue from sales of low-end diapers decreased by approximately 10.6% as market competition remained fierce. The higher proportion of mid-end and high-end products with higher margins in sales offset the impact of the slight increase in raw material prices during the year, thus gross profit margin of the Group's disposable diapers business increased to approximately 44.5% (2012: 42.9%).

Apart from strengthening the existing distribution network management, the Group also actively expanded its presence in new distribution channels during the year by entering various maternity stores and expanding online sales network on a number of platforms, including "yhd.com", "Tmall.com" and "JD.com", in order to gain more comprehensive market coverage. With the implementation of the above measures, the management is cautiously optimistic about grasping the market opportunities which will arise from China's loosened birth control policy and the products' increasing market penetration.

Food and snacks business

In 2013, revenue of the food and snacks business grew by about 15.7% to approximately HK$1,604,655,000, accounting for about 7.6% of the total revenue (2012: 7.5%). Due to the decline in costs of major raw materials such as sugar and palm oil during the year, the gross profit margin of the Group's snacks business increased to approximately 42.3% (2012: 38.2%). In 2014, the Group will continue to commit resources to enriching its product portfolio so that it will be able to cater to the different tastes of consumers, and boost the revenue growth of its snack business.

Liquidity, Financial Resources and Bank Loans

The Group maintained a solid financial position. As at 31 December 2013, the Group's cash and bank balances, long-term bank deposits and restricted bank deposits amounted to approximately HK$20,438,069,000 in total. The Group's outstanding convertible bonds (liability portion) and bank borrowings amounted to approximately HK$5,227,130,000 and HK$14,192,557,000 respectively. As at 31 December 2013, the Group's gross gearing ratio was approximately 117.5%, which was calculated on the basis of the total amount of borrowings as a percentage of the total shareholders' equity (not including non-controlling interests). The net gearing ratio, which was calculated on the basis of the amount of borrowings less cash and bank balances and long-term time deposits as a percentage of the shareholders' equity (not including minority interests), was approximately negative 5.8% as the Group was in a net cash position.

Outlook

Mr. Sze said, "Looking ahead to 2014, we expect that the imminent economic recovery in Europe and the United States will lead to the revival of global trade and economic development, and will also benefit China's economy. Consistent growth in personal income and accelerating urbanization will also pave the way for the growth in China's market for personal hygiene products. In addition, China relax its one-child policy, and beneficial effects of such move on the baby products market will gradually become manifest from the fourth quarter of 2014 onwards. To seize the opportunity in the growing market, the Group will continue to step up product promotion and develop markets with good potential. With our extensive distribution network and proactive business expansion strategy, the Group is confident of maintaining steady growth and its industry leadership in China on the back of the country's steady economic growth."

Company Background

Hengan Group was established in 1985. It is principally engaged in production, distribution and sales of personal hygiene products and food and snacks products in China. The shares of Hengan International have been listed on the Hong Kong Stock Exchange since 1998. The Group has become a Hang Seng Index constituent since June 2011.

For further information, please contact:

iPR Ogilvy Ltd.

Charis Yau / Karen Tse/ Candy Tam/ Clara Liu

Tel : (852) 2136 6183/ 2136 6950/ 3920 7626/ 3920 7631

Fax : (852) 3170 6606

E-mail: hengan@iprogilvy.com

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |