Hong Kong Aircraft Engineering Company Limited

FINANCIAL HIGHLIGHTS

Note: The average number of shares in issue is 166,324,850 in 2016 (2015: 166,324,850).

CHAIRMAN'S LETTER

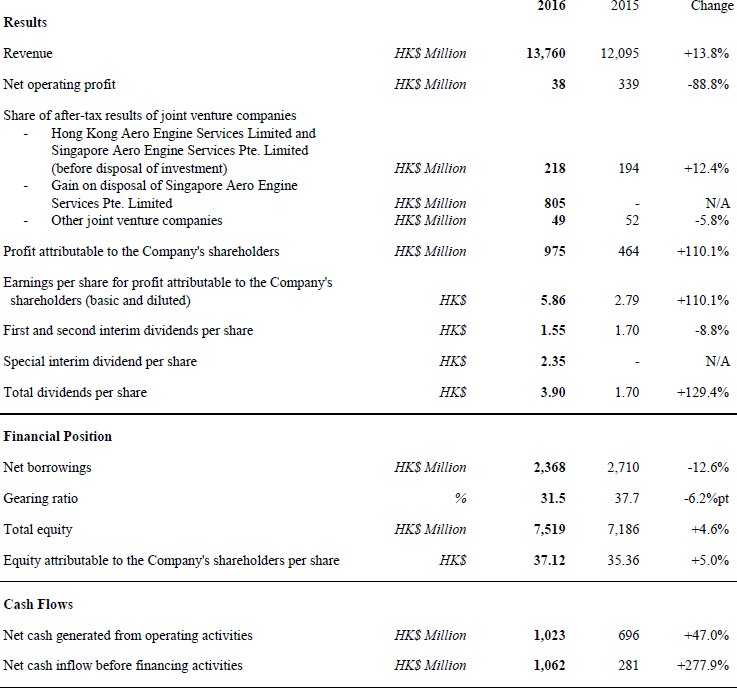

The HAECO Group reported an attributable profit of HK$975 million in 2016. The profit included a gain of HK$805 million on disposal of the interest of Hong Kong Aero Engine Services Limited ("HAESL") in Singapore Aero Engine Services Pte. Limited ("SAESL") and an impairment charge of HK$285 million in respect of the goodwill recorded on the acquisition of TIMCO Aviation Services, Inc. ("TIMCO"). The HAECO Group's 2015 attributable profit was HK$464 million. Disregarding the gain on disposal in 2016 and impairment charges in both years, the HAECO Group's 2016 attributable profit was HK$516 million, 8.2% higher than in 2015.

The Directors have declared a second interim dividend of HK$0.92 per share for the year ended 31st December 2016. Together with the first interim dividend of HK$0.63 per share and a special interim dividend of HK$2.35 per share paid on 20th September 2016, this results in total dividends for the year of HK$3.90 per share and represents a total distribution of HK$649 million, 129.4% higher than that made in respect of 2015. The second interim dividend, which totals HK$153 million (2015: HK$183 million), will be paid on 25th April 2017 to shareholders on the register at the close of business on 31st March 2017. Shares of the Company will be traded ex-dividend as from Wednesday, 29th March 2017.

Manhours sold by HAECO in Hong Kong ("HAECO Hong Kong") for airframe services decreased by 4.6% in 2016. This reflected deferral of work by some customers to 2017. Line services results benefited from increased aircraft movements and more work being done per movement. More components and avionics maintenance manhours were sold in Hong Kong. The profit of HAECO ITM Limited ("HAECO ITM") decreased. This reflected lower demand for the loan of aircraft parts and higher financing charges. The profits of HAESL increased, as more work was done per engine.

The agreements for the restructuring of shareholdings in HAESL and SAESL were completed in June 2016. The gain to HAESL arising from selling its 20% shareholding in SAESL was US$229 million. 45% of the gain to HAESL, equivalent to approximately HK$805 million, is included in the profit of the HAECO Group in 2016. Under the restructuring, HAECO increased its shareholding in HAESL from 45% to 50% and HAESL no longer has any shareholding in SAESL.

HAECO USA Holdings, Inc. ("HAECO Americas") recorded a higher loss in 2016. This principally reflected losses on some seat contracts and a reduction in the number of seats sold and in cabin integration work. Airframe services results improved, with more manhours having been sold, but the benefit of this was offset in part by costs incurred with a view to improving efficiency and work flow.

An impairment charge of HK $285 million was made in respect of the goodwill recorded on the acquisition of TIMCO. The charge relates to the cabin and seats business. It reflects a reduction in the expected profitability of the seats business and a weak cabin integration order book.

CHAIRMAN'S LETTER (cont'd)

The profit of Taikoo (Xiamen) Aircraft Engineering Company Limited ("HAECO Xiamen") increased in 2016. Fewer airframe services manhours were sold but the work was more profitable. More line services work was done and more aircraft parts were manufactured. Taikoo Engine Services (Xiamen) Company Limited ("TEXL") performed well, with more engines overhauled and more component repair work. Taikoo (Xiamen) Landing Gear Services Company Limited ("HAECO Landing Gear Services") did more work than in 2015. However, its losses increased. This principally reflected an impairment charge in respect of plant, machinery and tools. The impairment charge reflected the fact that less work is expected because of strong competition. The overall contribution from the Group's other activities in Mainland China improved.

The Group continued to invest in order to increase the scale of operations and technical capabilities and to improve and widen the range of services it can offer to customers. Total capital expenditure for 2016 was HK$727 million. Capital expenditure committed at the end of the year was HK$1,396 million.

Prospects

The prospects for the Group's different businesses in 2017 are mixed. HAECO Hong Kong expects its results to be affected again by deferral of airframe services work by some customers. Demand for line services in Hong Kong is expected to be firm. The component and avionics overhaul business is expected to improve gradually with the development of new capabilities. Demand for HAECO Americas airframe services is expected to increase in 2017. However, its airframe services results will depend on the outcome of efforts to improve efficiency and work flow. The number of seats sold is expected to grow, sales of the new Vector seats are expected to remain modest. Forward bookings for cabin integration work are weak. Less Panasonic communication equipment installation kits are expected. Demand for HAECO Xiamen's airframe services is expected to improve. Demand for TEXL's overhaul services is expected to be stable in 2017. HAESL is expected to have a similar level of workload in 2017 to that in 2016. But its results will be adversely affected by higher depreciation and training costs associated with developing the capability to overhaul Trent XWB engines from 2018. HAECO Landing Gear Services is expected to do more work in 2017, but to continue to make losses.

The municipal government of Xiamen announced that the proposed new airport at Xiang'an would commence operations in 2020. This remains subject to the National Development and Reform Commission's approval. Management maintains regular communications with the local authorities about the new airport and its opening, which will be material to the operations of the HAECO Group in Xiamen.

The commitment and hard work of employees of the Company and its subsidiary and joint venture companies are central to our continuing success. I take this opportunity to thank them for jobs well done.

By Order of the Board

Hong Kong Aircraft Engineering Company Limited

John Slosar

Chairman

Hong Kong, 14th March 2017

For more information, please visit http://doc.irasia.com/listco/hk/haeco/annual/2016/respress.pdf.

| © Copyright 1996-2023 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |