| For immediate release | 27 February 2015 |

(27 February 2015, Hong Kong) Guoco Group (Guoco Group Limited, Stock Code: 53) announced today its interim results for the six months ended 31 December 2014.

FINANCIAL RESULTS

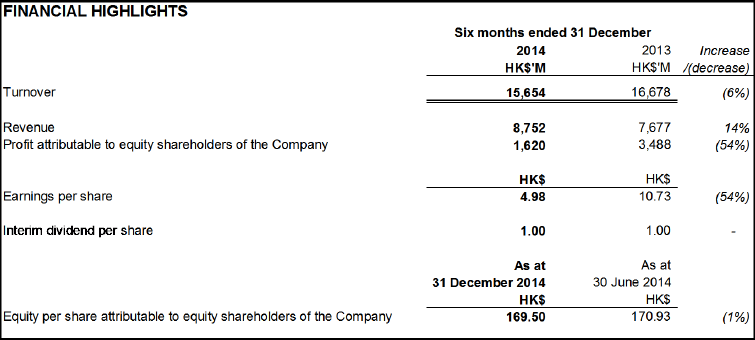

The unaudited consolidated profit attributable to equity shareholders for the six months ended 31 December 2014, after taxation and non-controlling interests, amounted to HK$1,620 million, as compared to HK$3,488 million for the previous corresponding period. Basic earnings per share amounted to HK$4.98.

For the six months ended 31 December 2014, operating profits were generated from the following sources:

Revenue increased by 14% to HK$8.8 billion. The increase was mainly attributable to the increase in revenue derived from the property development and investment sector of HK$951 million.

INTERIM DIVIDEND

The Directors have declared an interim dividend of HK$1.00 per share for the financial year ending 30 June 2015.

GUOCO'S CORE BUSINESSES

Principal Investment

The six months to December 2014 was an eventful period for financial markets. Oil prices tumbled at a time when the USD appreciated sharply across all currencies. In equity markets, A-shares experienced a powerful rebound while US stock indices made consecutive all-time highs but emerging markets remained major laggards. In view of rising volatility and vulnerability for price consolidation after recent price rallies, we decided to realise more profits from our portfolio during the period under review.

With expectations for divergent monetary policies between USA and the rest of the world driving the USD higher, Group Treasury continued to fully hedge the FX exposures of our investment portfolios. Riding on the opportunities for yield enhancement provided by volatile market conditions in the foreign exchange and money markets, the Group was able to lower the overall net interest expense for the period.

Property Development and Investment

GuocoLand Limited ("GuocoLand")

GuocoLand ended its half year with a profit attributable to equity holders of S$69.5 million, as compared to a profit of S$96.6 million for the previous corresponding period. The drop in profit was mainly because there had been a once-off gain from disposal of subsidiaries in the previous corresponding period.

Revenue for the half year ended 31 December 2014 increased by 19% to S$579.3 million as compared to the previous corresponding period. Higher revenue was mainly due to recognition of the sale of an office tower in Shanghai Guoson Centre during the period.

Amidst a continued challenging operating environment, GuocoLand will focus on execution, sales and leasing of its current projects.

Hospitality and Leisure Business

GuocoLeisure Limited ("GuocoLeisure")

GuocoLeisure recorded a profit after tax for the half year ended 31 December 2014 of US$31.2 million, an increase of 4.0% as compared to US$30.0 million in the previous corresponding period.

Revenue stood at US$200.6 million, which is 6.5% lower than that of the previous corresponding period. This was mainly due to lower revenue generated from the gaming and property development segments. Hotel revenue was stable as compared to previous corresponding period.

GuocoLeisure's first hotel under its new "Amba" brand, the Amba Hotel Charing Cross, was launched in the final quarter of 2014. The first hotel under GuocoLeisure's new "every" brand is on track to be launched in first quarter of 2015. The refurbishment of its hotels is expected to continue over the next 12 months. The impact of rooms not available for sale due to the refurbishment will continue to be felt over this period. Average occupancy for the London hotel market is expected to remain stable, with average room rates rising at modest levels.

The Rank Group Plc ("Rank")

Rank registered an increase of 11% in its profit after taxation (before exceptional items and discontinued operations) for the half year ended 31 December 2014 to GBP26.9 million.

For the half year ended 31 December 2014, Rank's revenue from continuing operations grew by 3% to GBP361.7 million, driven by a 16% growth in revenue from digital operations and continued growth from its casino venues.

Trading since the start of the second half has followed the trends seen in the first half of the year. Rank remains in a strong financial position, possesses market-leading brands and has a clear strategy for long-term growth.

Financial Services

Hong Leong Financial Group Berhad ("HLFG")

HLFG Group achieved a profit before tax of RM1,543.1 million for the half year ended 31 December 2014 as compared to RM1,565.8 million for the previous corresponding period, a decrease of RM22.7 million or 1.4%. The overall decrease in profit before tax was mainly due to lower contributions from the insurance division.

HLFG remains cautiously positive that the core businesses will still grow although at a more modest pace. HLFG continues to be on the lookout for selected regional opportunities to expand into new markets as well as where HLFG operates.

OUTLOOK

Looking ahead, the backdrop of low interest rates, significantly lower commodity prices and a recovering US economy should remain supportive to equities but they will be offset by valuation concern and the prospect of an eventual rate hike by the Fed. While it is perhaps too early to turn negative on markets, we are mindful that the risk-reward profile for stocks has deteriorated further as prices continue to move higher. Whereas for the currency market, the non-USD countries are using lower currency rates to boost export competitiveness and overcome deflation through import inflation. Consumption is expected to be boosted by lower commodity prices. Regulatory reforms will stay and increased capital requirements for both asset and liabilities management in financial institutions would continue to stifle trading activities and market liquidity.

We expect the operating environment for our core businesses to continue to be volatile and challenging. Our Principal Investment division will continue its approach of focusing on under-valued stocks with good recovery potential as well as identifying long-term cyclical trends in sectors and markets. Our other core businesses will remain vigilant to stay focused on implementation of their transformation plans and business strategies that enhance their competitiveness and achieve sustainable growth.

(Please visit www.guoco.com or www.hkexnews.hk for Guoco's full interim results announcement.)

Guoco Group Limited ("Guoco") (Stock Code: 53), listed on The Stock Exchange of Hong Kong Limited, is an investment holding and investment management company with the vision of achieving long term sustainable returns for its shareholders and creating prime capital value. Guoco's operating subsidiary companies and investment activities are principally located in Hong Kong, China, Singapore, Malaysia, Vietnam and the United Kingdom. Guoco has four core businesses, namely, Principal Investment; Property Development and Investment; Hospitality and Leisure Business; and Financial Services.

Contacts :

Ms. Stella Lo

Group Company Secretary

Tel: ( 852 ) 2283 8710

Fax: ( 852 ) 2285 3210

E-mail: stella.lo@guoco.com

| © Copyright 1996-2023 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |