ENN Energy Holdings Limited

(Formerly known as XinAo Gas Holdings Limited)

(Incorporated in the Cayman Islands with limited liability)

[For Immediate Release]

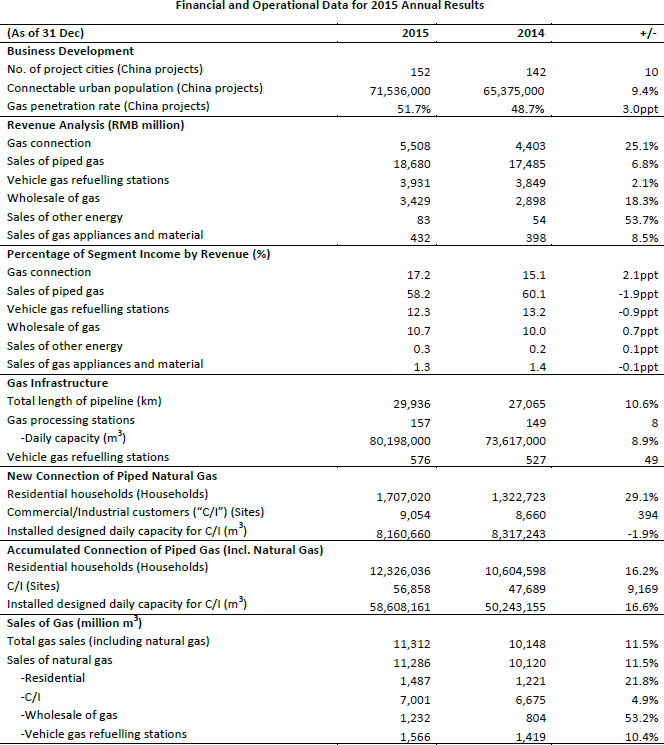

(Hong Kong, 22 March 2016)-ENN Energy Holdings Limited ("ENN Energy" or "the Group") (stock code: 2688), one of the largest clean energy distributors in China, announced its annual results as of 31 December 2015 ("the year"). Revenue increased by 10.2% to RMB32.06 billion. Stripping out one-off items including foreign exchange loss, recurring profit increased by 16.9% year-on-year to RMB2.74 billion. The Board of Directors has resolved to recommend a final dividend of HK$0.76 per share.

Although the natural gas market encountered tremendous challenges in 2015 as a result of plunging oil prices and the weak macro-economy, the Chinese government has continuously promoted energy structure adjustment, green and low carbon urbanization, low-energy intensity industrial development and environmental protection, which has presented opportunities for the sector development. China has also accelerated the pace of its reform on the marketization of natural gas pricing. To align with the movements of substitute energy price, China reduced the city-gate price for non-residential users twice on 1 April 2015 and 20 November 2015 respectively. Moreover, the new city-gate price would no longer be the ceiling price but it would become a benchmark price, which is subject to negotiation between suppliers and buyers, where any upward adjustment not exceeding 20% or floorless downward adjustment could be made. The Group believes that the pricing reform will restore the price advantage of natural gas over substitute energies, thus facilitate the Group's development of downstream clients, which will have a positive impact on the Group's gas sales volume growth. Mr. Wang Yusuo, Chairman of ENN Energy, stated, "In such a challenging market environment, the Group, upholding its customer-oriented philosophy and driven by reform and innovation, was able to sustain an excellent operational performance. The Group further developed the potential of its traditional businesses, while fully utilizing the internet and technological means to expand new businesses. With the concerted efforts of its employees, the Group continued to maintain substantial growth, with the total natural gas sales volume up by 11.5% to 11.29 billion m3."

As of the end of December, the Group had approximately RMB7.36 billion cash on hand while its total debts amounted to RMB15.68 billion. The Group's net gearing ratio was 51.7%. The Group had sufficient sources of funds and unutilized banking facilities to meet the future capital expenditure and working capital requirements. During the year, the Group continued to maintain a sound financial position. In particular, the credit rating agency Moody's has upgraded the Group's outlook from "stable" to "positive" and maintained a Baa3 investment-grade rating. Standard & Poor's and Fitch both maintained their BBB investment-grade ratings and "stable" outlook.

Development of New Business

During the year, as LNG price declined significantly, its economic advantages surged and thus demand rose correspondingly. Given the ample LNG supply arising from the successive commencement of operation of domestic LNG processing plants and receiving terminals, the Group's successfully developed more wholesale customers which led to its natural gas wholesale volume reaching 1.23 billion m3, representing a year-on-year growth of 53.1%. Upon the commencement of operation of Shanghai Petroleum and Natural Gas Exchange ("SHPGX") in July 2015, the Group, one of the shareholders, actively participated in the trading of piped gas and LNG on the SHPGX, and managed to acquire competitive gas sources at market prices. While the global LNG price plummeted to historical low, the Group seized opportunities to sign ten-year supply contracts with three overseas suppliers. The Group will receive 1.5 million metric tons of LNG annually and the deliveries would begin in 2018 or 2019. The Group will continue to utilize its advanced dispatch system, transportation fleet and strong ability of acquiring upstream resources to develop natural gas distribution business, while unleashing more potential business opportunities to broaden its profit sources.

During the year, the National Development and Reform Commission and the National Energy Administration officially published six supportive documents on China's reform of the electricity regime, including the "Implementation Proposal for Promoting Power Transmission and Distribution Pricing Reform", to encourage social capital to invest in the establishment of electricity sales entities, and at the same time encourage water, gas and heat suppliers and other public utility service providers and energy-saving solution companies to engage in the electricity sales business. Drawing on the support of relevant policies and opportunities brought by the liberalization of the electricity sales business, the Group announced on 8 January 2016 that it would explore and enter into the electricity sales business in Kunming High Tech Zone in Yunnan and Zhaoqing New Zone in Guangdong as pilot projects. The Group has been engaged in China's downstream gas distribution business for many years, has accumulated large customer resources, and established a sound management and customer service platform. In addition, the Group has exclusive city-gas operation rights in Kunming High Tech Zone and Zhaoqing New Zone. For this reason, the Company expects, by bringing into full play the existing resources of city-gas operations in these two regions, to engage in electricity sales business which is customer service oriented, so as to maximize the utilization of the Group's existing resources and facilities, enhance the Group's operational efficiency and bring along sustainable growth and returns for its shareholders.

City-gas Business

During the year, the revenue attributable to piped gas sales reached RMB18.68 billion, up 6.8% over last year and accounted for 58.2% of the total revenue. The Group captured opportunities arose from the central and local governments' coal-to-gas conversion initiative, to greatly promote coal-to-gas conversion for industrial coal-fired boilers with stable gas consumption.

The Group also helped its customers reduce overall energy consumption costs and enhance energy efficiency via industrial energy saving solutions. Meanwhile, the Group redoubled its efforts in developing commercial users and further optimized its customer base. During the year, the Group completed new natural gas connections to 9,054 C/I customers (with total installed designed daily capacity of 8.16 million m3), aggregated number of connected C/I customers was 56,858 (with total installed designed daily capacity of 58.61 million m3). In terms of residential connection, the Group leveraged on emerging demand resulting from the country's urbanization and also focused on expanding into customers in existing buildings, the Group accomplished 1.71 million new natural gas connections during the year, total number of connected residential households reached 12.33 million. The Group's connection revenue increased 25.1% year-on-year to RMB5.51 billion.

New Projects

Despite the increasingly competitive market, the Group managed to acquire 10 new projects during the year, leveraging its outstanding management system, solid track record and ability to secure gas supply. These new projects are located in seven provinces, namely Guangdong, Guangxi, Fujian, Henan, Hebei, Jiangxi and Anhui. In particular, Ningde city in Fujian Province has connectable population of 1.06 million. At present, 12 key industries including electrical appliances, food and bio-pharmaceutical etc. are deemed to be the pillars of the industrial structure in Ningde. The development of residential and C/I users is anticipated to be promising with tremendous market potential. The Group also secured 19 new concessions near existing projects. The high concentration of C/I users of the above projects will help increase the Group's gas sales volume and further enhance its operating efficiency through economies of scale. As of 31 December 2015, the Group had 152 projects in China, with total connectable population of 71.54 million and overall gas penetration rate of 51.7%.

Vehicle Refuelling and Bunkering Business

During the year, the Group's revenue attributable to vehicle gas sales increased by 2.1% to RMB3.93 billion, accounting for 12.3% of the total revenue. Vehicular natural gas sales volume in the PRC rose by 10.4% to 1.57 billion m3 , in particular, gas sales of LNG refuelling stations surged by 49.2% to 580 million m3. The Group constructed and put into operation 20 CNG and 29 LNG refuelling stations during the year, bringing the total number of CNG and LNG refuelling stations in operation to 306 and 270 respectively. Leveraging its positive brand image and operational experience, the Group further reinforced its influence and market share in the vehicular natural gas industry through different means such as alliance cooperation. The Group also optimized its station network via the "smart card" alliance program and implemented "E vehicle E station" value-added services, such as quick repair, supermarkets and insurance, in order to enhance customer loyalty and broaden revenue streams. The "E vehicle E station" value-added services were launched in one CNG refuelling station and one LNG refuelling station in Langfang. It is planned that "E vehicle E station" will be expanded into 30 stations in 2016. In regards to bunkering business, the Group fostered industry development through strategic alliances and the development of key ports, and signed strategic cooperation agreements with various parties such as Xijiang Group, Samchully Company from Korea, Nantong Port, Wuhan New Port and Beijing Tianhai. Looking ahead, the Group will continue to develop more new LNG-powered vessels and to seize opportunities to set up more stations at major ports through alliance cooperation.

Outlook

Mr. Wang Yusuo concluded, "China is expected to push forward the implementation of environmental protection policies and promote the integrated application of natural gas and other clean energy resources with the commencement of the Thirteenth Five-Year Plan. In the long term, the natural gas market will continue to grow sustainably. The Group strives to become a reputable integrated energy supplier through business innovation and enhancement of operational capability. "

About ENN Energy Holdings Limited

ENN Energy is one of the largest clean energy distributors in China. The principal business of the Group is the investment in, and the operation and management of gas pipeline infrastructure, vehicle/ship gas refuelling stations, wholesale of gas, the sales and distribution of piped gas, LNG and other energy, and the provision of other services in connection with gas supply. The Group also operates vehicle/ship refuelling business in Europe and North America. As of 30 June 2015, the Group has 152 project cities in China in 17 provinces, municipalities and autonomous regions, namely Anhui, Beijing, Fujian, Guangdong, Guangxi, Hainan, Hebei, Henan, Hunan, Inner Mongolia, Jiangsu, Jiangxi, Liaoning, Sichuan, Shandong, Yunnan and Zhejiang, covering a connectable urban population of over 71.54 million. The Group has an offshore gas project in Vietnam located in Ho Chi Minh, Hanoi and Danang, covering a connectable urban population of over 9 million. The Group's total coverage of connectable urban population in China and overseas reaches over 80.54 million.

ENN Energy is a constituent of the Hang Seng Composite LargeCap Index and the MSCI China Mid Cap Index. For more information, please visit the Group's website at http://ir.ennenergy.com/.

| IR Enquiry: | Media Enquiry: |

| ENN Energy Holdings Limited | Hill+Knowlton Strategies Asia |

| Shirley Kwok / Hedy Shen | Ada Leung / Renee Chen |

| Tel:(852) 2528 5666 | Tel:(852) 2894 6225 /2894 6232 |

| Fax:(852) 2865 7204 | Email: ENN.Energy@hkstrategies.com |

| Email:wm.kwok@ennenergy.com/ yihui.shen@ennenergy.com |

| © Copyright 1996-2023 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |