HIGHLIGHTS

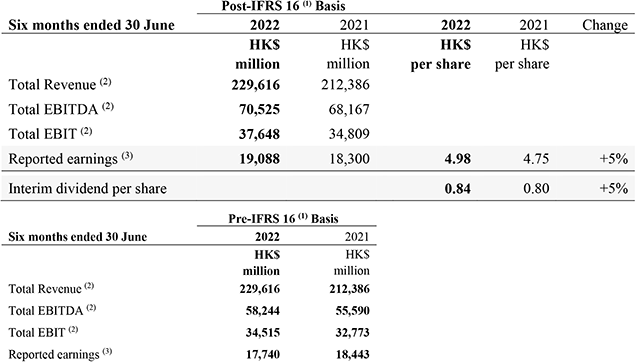

(1) As Hong Kong Financial Reporting Standards are fully converged with International Financial Reporting Standards in the accounting for leases, for ease of reference, International Financial Reporting Standard 16 "Leases" ("IFRS 16") and the precedent lease accounting standard International Accounting Standard 17 "Leases" ("IAS 17") are referred to in this results announcement interchangeably with Hong Kong Financial Reporting Standard 16 "Leases" ("HKFRS 16") and Hong Kong Accounting Standard 17 "Leases" ("HKAS 17"), respectively. The Group believes that the IAS 17 basis ("Pre-IFRS 16 basis") metrics, which are not intended to be a substitute for, or superior to, the reported metrics on a IFRS 16 basis ("Post-IFRS 16 basis"), better reflect management's view of the Group's underlying operational performance. IAS 17 basis metrics financial information is regularly reviewed by management and used for resource allocation, performance assessment and internal decision-making. As a result, the Group has provided an alternative presentation of the Group's EBITDA, EBIT and profit attributable to ordinary shareholders prepared under the Pre-IFRS 16 basis relating to the accounting for leases for the six months ended 30 June 2021 and 2022. Unless otherwise specified, the discussion of the Group's operating results in this results announcement is on a Pre-IFRS 16 basis as mentioned above.

(2) Total revenue, earnings before interest expenses and other finance costs, tax, depreciation and amortisation ("EBITDA") and earnings before interest expenses and other finance costs and tax ("EBIT") include the Group's proportionate share of associated companies and joint ventures' respective items.

(3) Reported earnings represent profit attributable to shareholders. Reported earnings per share for the six months ended 30 June 2022 and 2021 is calculated based on profit attributable to ordinary shareholders and CKHH's weighted average number of shares outstanding during the periods of 3,834,506,599 and 3,855,552,464 respectively.

CHAIRMAN'S STATEMENT

Economic activity rebounded during the first half in many of the Group's markets as countries eased or removed pandemic restrictions entirely. However, the COVID situation remained worrisome in Hong Kong and the Mainland with lockdown and movement restrictions affecting the Group's businesses there.

More generally, global supply chain disruptions together with energy and food price inflation drove headline inflation rates to multi-year highs, particularly in Europe, where inflationary pressures have been exacerbated by the conflict in the Ukraine. Fiscal and monetary policy responses have been mixed leading to increased currency volatility. Global equity and debt capital markets have seen significant turbulence. Expectations for growth this year and next have been and are being revised substantially downward, with heightened risk of recessions expected in several of the markets in which the Group operates.

During the first half, the Group continued to respond nimbly to changing economic and trading environments in various segments and geographies and has remained highly resilient to the challenging economic conditions. Although the Group's results were adversely affected by serious weakening in GBP and EUR exchange rates, the Group benefitted from the high energy prices, while remaining relatively unaffected by interest rates hike due to our limited exposure to floating rate borrowings. The Group also reported steady operating contributions from the Infrastructure businesses, which are well-insulated from inflationary and business pressures. Together with the geographical diversity of our asset portfolios, the Group was able to deliver an overall steady underlying performance in the period.

On a pre-IFRS 16 basis, EBITDA and EBIT both increased 5% in reported currency compared to the first half of last year. Excluding the adverse translation impact from the depreciation of major foreign currencies, EBITDA and EBIT both increased 9% against the same period last year in local currencies, primarily due to the better performances in the Ports division and Cenovus Energy, as well as higher contribution from the Group's Indonesia telecommunication joint venture following the completion of the merger in January 2022. The favourable variances were partly offset by lower one-off benefits from strategic transactions, lower contributions from the Retail division due to lockdowns in the Mainland and from the Telecommunications division, mainly due to Italy and overall higher depreciation reflecting the capital cost of network enhancements in building 5G infrastructure across all operations.

The Group's results in the first half of 2022 included a net gain attributable to shareholders of HK$5.1 billion(1) from the completion of the merger of the Indonesian telecommunication business, partly offset by a non-cash impairment in the Group's telecommunication business in Sri Lanka. In the same period last year, the Group recognised a one-off net earnings benefit of HK$6.3 billion(2), comprising the disposal gains from the tower asset sales in Italy and Sweden, partly offset by a non-cash impairment of goodwill on the Group's Italian telecommunication business, as well as recognition of a non-cash foreign exchange reserve loss arising from the merger with Cenovus Energy.

Subject to the regulatory approval which is at its final stage, the completion of the disposal of the Group's interest in the UK tower assets to Cellnex for a total consideration of approximately €3.7 billion is expected to occur in August 2022. The resulting disposal gain will be recognised in the second half of 2022.

On a Post-IFRS 16 basis, profit attributable to ordinary shareholders for the first half of 2022 was HK$19,088 million, a 4% increase compared to the same period last year. Profit attributable to ordinary shareholders on a Pre-IFRS 16 basis of HK$17,740 million was a decrease of 4% in reported currency but remained flat in local currencies when compared to the first half of 2021.

Reported earnings per share were HK$4.98 for the six months ended 30 June 2022, an increase of 5% from HK$4.75 for the same period last year.

Dividend

The Board of Directors declares an interim dividend of HK$0.84 per share (30 June 2021 - HK$0.80 per share), payable on Friday, 16 September 2022, to shareholders whose names appear on the Register of Members of the Company at the close of business on Tuesday, 6 September 2022, being the record date for determining shareholders' entitlement to the interim dividend.

Ports and Related Services

The Ports and Related Services division handled 42.4 million twenty-foot equivalent units ("TEU") through 293 operating berths in the first half of 2022, a marginal 1% decline compared to the same period last year, mainly resulting from pandemic restrictions in Shanghai and the rest of Asia affecting vessel schedules and trade disruptions arising from the conflict in the Ukraine, largely offset by new volumes from newly acquired Delta II terminal in the Netherlands and better performance in Mexico.

In reported currency, total revenue of HK$22,651 million, EBITDA(3) of HK$8,273 million and EBIT(3) of HK$6,042 million increased by 14%, 18% and 27% respectively compared to the same period last year. Excluding the adverse currency translation impact, total revenue, EBITDA and EBIT increased 18%, 21% and 30% respectively from better performances in Europe and Mexico, higher storage income, strong performance of an associated company in the container shipping business that benefitted from the elevated shipping rates in the period.

Going forward, the division will continue to expand its existing facilities and to build additional berths to cater for growth, will diversify revenues through expanding logistics businesses and maximising landside income, and will continue with exploring strategic partnerships across its portfolio to enhance profitability and returns.

The Ports division continues to roll out a global electrification programme of its vehicles and infrastructure to progressively phase out diesel in favour of zero emissions infrastructure. In June 2022, Port of Felixstowe partnered with UK Power Networks to take this UK's largest container port a step closer to its net-zero ambition. Through this collaboration, the port will embark on a three-year decarbonisation project including upgrading the existing 11,000V electricity network to supply new electrical rubber-tyred gantry cranes and tractors to enable zero emissions movement of containers around the port.

(1) Under Post-IFRS 16 basis, the net gain attributable to shareholders in the first half of 2022 was HK$6.2 billion. For further information, please see Note 5(b)(xvi) to the Financial Statements of this Announcement.

(2) Under Post-IFRS 16 basis, the net gain attributable to shareholders in the first half of 2021 was HK$6.3 billion. For further information, please see Note 5(b)(xvii) and Note 5(b)(xviii) to the Financial Statements of this Announcement.

(3) Under Post-IFRS 16 basis, EBITDA was HK$9,622 million (30 June 2021: HK$8,406 million); EBIT was HK$6,583 million (30 June 2021: HK$5,372 million).

For more information, please visit https://doc.irasia.com/listco/hk/ckh/interim/2022/intpress.pdf.

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |