HIGHLIGHTS

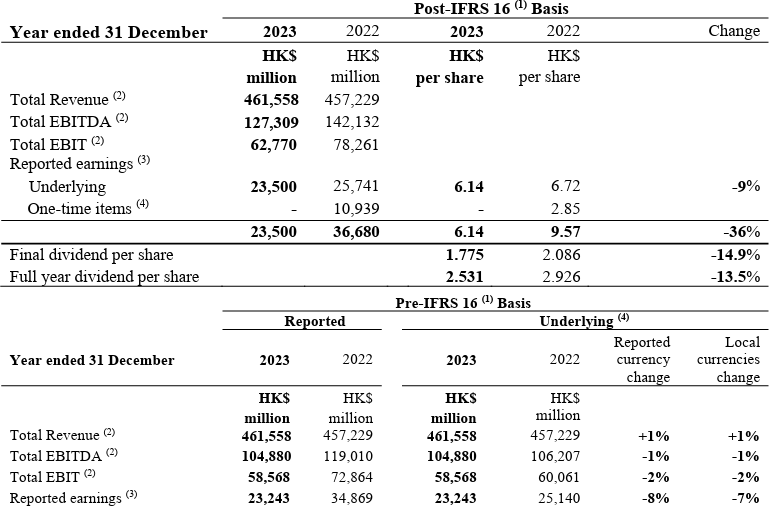

| (1) | As Hong Kong Financial Reporting Standards are fully converged with International Financial Reporting Standards in the accounting for leases, for ease of reference, International Financial Reporting Standard 16 "Leases" ("IFRS 16") and the precedent lease accounting standard International Accounting Standard 17 "Leases" ("IAS 17") are referred to in this results announcement interchangeably with the relevant Hong Kong Financial Reporting Standards. The Group believes that the IAS 17 basis ("Pre-IFRS 16 basis") metrics, which are not intended to be a substitute for, or superior to, the reported metrics on a IFRS 16 basis ("Post-IFRS 16 basis"), better reflect management's view of the Group's underlying operational performance. IAS 17 basis metrics financial information is regularly reviewed by management and used for resource allocation, performance assessment and internal decision-making. As a result, the Group has provided an alternative presentation of the Group's EBITDA, EBIT and Reported earnings prepared under the Pre-IFRS 16 basis relating to the accounting for leases. Unless otherwise specified, the discussion of the Group's operating results in this results announcement is on a Pre-IFRS 16 basis as mentioned above. |

| (2) | Total revenue, earnings before interest expenses and other finance costs, tax, depreciation and amortisation ("EBITDA") and earnings before interest expenses and other finance costs and tax ("EBIT") include the Group's proportionate share of associated companies and joint ventures' respective items. |

| (3) | Reported earnings represent profit attributable to shareholders. Reported earnings per share for the year ended 31 December 2023 and 2022 is calculated based on profit attributable to ordinary shareholders and CKHH's weighted average number of shares outstanding during the periods of 3,830,044,500 and 3,834,106,390 respectively. |

| (4) | Underlying results for the year ended 31 December 2022 exclude one-time net gain of HK$12.8 billion at EBITDA, EBIT and HK$9.7 billion at Reported earnings, under pre-IFRS 16 and HK$10.9 billion at post-IFRS 16 Reported earnings, comprising net gain from the disposal of UK tower assets, the Indonesian telecommunication business merger and non-cash impairments of the Italy and Sri Lanka telecommunication businesses. |

CHAIRMAN'S STATEMENT

Operating conditions for the Group's businesses were mixed in the year. General economic trends improved in the second half, with inflation in the US and Europe ebbing although still significantly elevated against central bank targets when food and energy prices are excluded. The US dollar rose significantly in the third quarter and declined in the fourth quarter. Monetary policy remained tight, with the Federal Funds Rate peaking in July at 5.25-5.5% and remaining unchanged throughout the remainder of the year. Significant energy price volatility persisted, particularly in the third quarter, due to an uncertain demand outlook and escalating geo-political risks. Growth was mixed: while the US showed continued resilience, conditions remained challenged in Europe, Hong Kong, and the Mainland.

Overall, headwinds continued to affect the Ports division as well as profit contribution from Cenovus Energy, the latter being significantly impacted by FIFO losses resulting from sharp declines in commodity prices in the fourth quarter, offsetting improving operating performance. The Telecommunications division, although growing revenues, continued to be adversely impacted by cost price inflation. The infrastructure division continued to perform steadily, and the Retail division overall continued to achieve excellent year-on-year growth in the second half despite continued weakness in consumer spending in Hong Kong and the Mainland.

The Group's year-on-year earnings performance was most affected by the absence of one-time gains in 2023. On a post IFRS-16 basis, excluding one-time gains in 2022 from the comparison, the decline in underlying earnings was 9%, whereas on a reported basis, the Group's earnings declined by 36%. Cash generation remained steady, with cash flow from operations excluding proceeds from one-time gains in 2022 declining by less than 5% and Free Cash Flow increasing 12% year-on-year.

The Group continued to pursue value accretive transaction activities. In particular, the UK telecom merger announced in the first half has entered Phase 1 review by the competition authorities in the UK, representing satisfactory progress to date. However, important conditions precedent to the agreements relating to a proposed network joint venture in Italy were not met and accordingly these agreements were terminated in February 2024.

Profit attributable to ordinary shareholders on a pre-IFRS 16 basis of HK$23,243 million, excluding the one-time net gain in 2022, declined by 8% in reported currency and 7% in local currencies against last year. On a reported basis, the decrease was 33% in reported and local currencies when compared to 2022.

Reported earnings per share were HK$6.14 for the year ended 31 December 2023 (31 December 2022 - HK$9.57).

Dividend

The Board of Directors recommends a final dividend of HK$1.775 per share (2022 final dividend - HK$2.086 per share), payable on Thursday, 13 June 2024, to shareholders whose names appear on the Register of Members of the Company at the close of business on Wednesday, 29 May 2024, being the record date for determining shareholders' entitlement to the proposed final dividend. Combined with the interim dividend of HK$0.756 per share, the full year dividend amounts to HK$2.531 per share (2022 full year dividend - HK$2.926 per share).

Ports and Related Services

The Ports and Related Services division handled 82.1 million twenty-foot equivalent units ("TEU") through 293 operating berths in 2023, a 3% drop compared to 2022 as recovery of global demand remained sluggish across major economies. However, the fourth quarter showed improving trends, mainly in HPH Trust from volume rebound in Yantian Ports, and Asia, Australia, and Others region driven by improving consumption in South East Asia, Middle East and Central America, resulting in growth of 9% and 1% in the second half as compared to the first half in 2023 and second half in 2022 respectively.

Due to a 24% drop in storage income and the adverse performance of a shipping line associated company which was heavily affected by the sharp decline of freight rates in 2023, this division's total revenue of HK$40,851 million, EBITDA(1) of HK$13,628 million and EBIT(1) of HK$9,328 million, decreased by 7%, 14% and 18% respectively compared to 2022. However, with the improved volumes in the fourth quarter and higher storage income from Mexico due to increased import laden containers, revenue, EBITDA and EBIT in the second half improved 6%, 9% and 15% respectively, compared to the first half of 2023.

Looking ahead to 2024, there are signs of cautious optimism for growth in demand, as observed through the US retailers who have sufficiently de-stocked to start planning for a stable ramp-up in purchase orders in 2024, as well as positive outlook on general market demands in other regions such as India, Middle East, Africa and South America. With the new major container facility at Abu Qir in Egypt commencing operation in the first quarter of 2024, the division expects moderate growth in volume and earnings going into 2024.

The Ports division has submitted its near-term and net-zero targets to the Science Based Targets initiative for validation and has successfully received their approval in the fourth quarter of 2023. The target is to reduce 54.6% of its scope 1 and 2 emissions and 32.5% of its scope 3 emission versus a 2021 baseline by 2033, and to achieve a net-zero emission operation by 2050. To achieve these targets, among other initiatives, all of the division's new investments in mobile and stationary machinery will be fully electrified or supplemented with other forms of clean energy going forward. Approximately 93,000tCO2 of the emissions reduction on scope 1 and 2 emission has been achieved in 2023, representing a reduction of around 19% versus the 2021 baseline emissions.

Retail

The Retail division had 16,491 stores across 28 markets at the end of December 2023, a 2% increase compared to last year. The division's total revenue, EBITDA(2) and EBIT(2) of HK$183,344 million, HK$16,226 million and HK$12,888 million increased by 8%, 13% and 17% respectively in reported currency against last year. In local currencies, total revenue, EBITDA and EBIT increased by 8%, 11% and 14% respectively. The year-on-year improvements were primarily due to favourable performances in Europe and Asia, partly offset by weak performance in Hong Kong and the Mainland mainly due to stagnant store traffic and soft consumer sentiment.

The Health and Beauty segment, which represented 87% of the Retail division's revenue last year, reported total sales growth in local currencies of 12% from a strong 10% growth in comparable stores sales, contributing to the EBITDA and EBIT growth, in local currencies, of 15% and 18% respectively compared to last year. The majority of Health and Beauty operations in both Europe and Asia have exceeded pre-pandemic levels. Health and Beauty Europe reported 14% increase in EBITDA and EBIT in local currencies against last year with a 10% growth in comparable stores sales, primarily from the UK, Germany and Poland. Health and Beauty Asia reported 23% and 27% increase in EBITDA and EBIT in local currencies driven primarily by higher sales from the increase in store footfall and store network expansion, with a robust 16% growth in comparable stores sales. Despite softer trading momentum, Health and Beauty China reported increase in EBITDA and EBIT of HK$22 million and HK$123 million in local currency respectively compared to last year mainly due to margin and productivity improvements, as well as optimisation of store opening strategies.

Looking ahead, the European and Asian businesses, which have already exceeded pre-pandemic levels, should continue to deliver solid performances, while improvement is expected for the Mainland and Hong Kong operations through store network optimisation and various initiatives. With its 159 million loyalty customer base, this division will continue to enhance customer engagement and lifetime value, prioritising store quality over quantity and maintaining a short payback on store opening, as well as delivering top line growth through its online plus offline platform strategy.

The Retail division continues its commitment to achieving its emission reduction targets which have been validated by the Science Based Targets initiative. It has committed by 2030 (versus a 2018 baseline) to reduce scope 1 and 2 emissions by 50.4%; reduce scope 3 emissions from purchased goods and services, upstream transportation and distribution, and use of sold products by 58% per Hong Kong dollar value added and 33% of supplier emissions from purchased goods and services, upstream transportation and distribution to be subject to science-based targets by 2027. In 2023, an approximate 167,000tCO2 emission reduction against its scope 1 and 2 targets has been achieved, which represents around 26% reduction as compared to its set targets. In addition and with over 90% of its footprint being attributable to scope 3 emissions, this division continues to implement a major supplier engagement programme including trainings and tools to report more accurate data through a dedicated scope 3 emissions platform.

Infrastructure

The Infrastructure division comprises a 75.67% interest in CK Infrastructure Holdings Limited ("CKI"), a subsidiary listed in Hong Kong as well as interests in six co-owned infrastructure investments with CKI.

CKI

CKI announced a net profit attributable to shareholders under Post-IFRS 16 basis of HK$8,027 million. CKI's 2022 results included the one-off gain from the partial disposal of Northumbrian Water in 2022, excluding which, net profit increased by 12% year-on-year. On a reported basis, net profit was 4% higher than last year. CKI also generated a record high funds from operations of HK$8.6 billion in 2023 with steady and robust revenue streams from the strong asset base.

Looking into 2024, this division's regulated businesses will continue to provide steady and recurring income and the non-regulated businesses will also generate good growth contributions. Together with its strong financial position, this division is well placed to capitalise on investment opportunities as they arise.

The division remains focused to decarbonise its own operations and is well positioned to meet the challenges presented by climate change through innovative alternatives and cleaner sources of energy. The division's electricity distribution networks are leading the way in adopting low carbon technologies through smart grid schemes, expanding use of electric vehicles and integrating renewable energy into its charging facilities. EDL continued to be a leading global sustainable energy provider. As for the gas distribution network, Northern Gas Networks, Wales & West Gas Networks, and Australian Gas Infrastructure Group are at the forefront of the hydrogen transition, while Dutch Enviro Energy and Enviro NZ continue to be major operators of waste management and recycling in their own countries. Other operations including UK Rails' battery trains, ista's new heating, energy and water consumption tracking devices, as well as Canadian Power's Okanagan wind farms and HK Electric's Offshore Terminal are all major sustainability projects facilitating decarbonisation of this division. In 2023, an approximate 740,000tCO2 of scope 1 and 2 emission reduction has been achieved reaching around 18% of the set reduction targets.

| (1) | Under Post-IFRS 16 basis, EBITDA was HK$16,415 million (2022: HK$19,007 million); EBIT was HK$10,583 million (2022: HK$13,024 million). |

| (2) | Under Post-IFRS 16 basis, EBITDA was HK$25,507 million (2022: HK$23,359 million); EBIT was HK$13,849 million (2022: HK$11,831 million). |

For more information, please visit http://doc.irasia.com/listco/hk/ckh/annual/2023/respress.pdf.

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |