China Unicom (Hong Kong) Limited

(Incorporated in Hong Kong with limited liability)

To: Business/Finance Editors

Highlights:

Hong Kong, 9 August 2023 - China Unicom (Hong Kong) Limited and its subsidiaries ("China Unicom" or "the Company") (HKEx: 0762) is pleased to announce today its 2023 interim results.

In the first half of 2023, the Company steadily advanced the deepening and implementation of its strategic planning system, actively coordinated current operations and long-term development, and achieved steady growth in operating results, strong momentum in innovation, and continuous enhancement of core functions, taking a more solid step towards the transformation into an innovative enterprise in digital technologies.

STEADY BUSINESS GROWTH DRIVEN BY STRATEGY

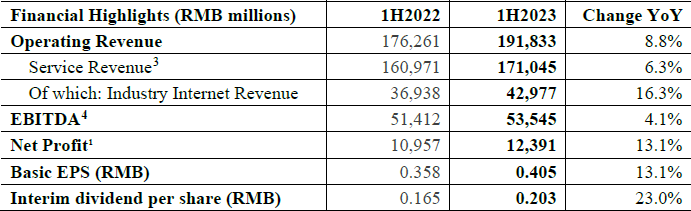

In the first half of the year, the Company's revenue and profit scale once again reached new highs since listing. Operating revenue reached RMB191.833 billion, up by 8.8% year-on-year. Service revenue reached RMB171.045 billion, up by 6.3% year-on-year. EBITDA reached RMB53.545 billion, up by 4.1% year-on-year. Net profit reached RMB12.391 billion, representing a year-on-year increase of 13.1% and a double-digit growth for the seventh consecutive year. In the first half of the year, the Company's return on equity reached 3.6%. The foundation of the Company's high-quality steady and long-term development was further strengthened.

The Company continued to strengthen its network capabilities. In the first half of the year, capital expenditure reached RMB27.6 billion, which provided a solid network foundation for the high-quality development of the Company.

The Company attached great importance to shareholders' return. After due consideration of the Company's robust business development, the Board resolved to distribute an interim dividend of RMB0.203 per share (pre-tax), up by 23% year-on-year, which is significantly higher than the 13% growth in basic earnings per share. Shareholders' return continues to enhance.

CAPTURING DIGITAL OPPORTUNITIES BY RIDING ON TRENDS

Facing the profound changes and huge opportunities brought by the in-depth integration of the digital and real economies, the Company coordinated foundational strengthening as well as innovative transformation, and actively promoted the synergetic development of both basic and innovative businesses. The new integration of mobile and broadband was building up momentum, and achieved steady growth in both scale and value.

Solid performance of basic businesses better underpinned overall results. Mobile business achieved dual improvement in both scale and value. The number of mobile subscribers exceeded 328 million, with a net addition of 5.34 million in the first half of the year, which was a new high during the same period in four years. 5G package subscriber penetration exceeded 70%, as subscriber structure was further optimised. The Company strengthened product supply capability. The number of active subscribers of Personal Digital Smart Living products, such as Video Ringtone, Unicom Assistant and Unicom Cloud Drive, exceeded 87 million, and revenue thereof increased by 90% year-on-year, driving mobile ARPU to increase. The innovative growth of broadband business further accelerated. The Company took advantage of "dual-gigabit" network upgrade to drive integrated development of subscribers. The number of fixed-line broadband billing subscribers reached 108 million. Net addition exceeded 4 million in the first half consecutively, with the integration penetration rate reaching 75%. In particular, the Company accelerated the promotion and application of Fibre to the Room ("FTTR") which unleashed new potential for the sustainable growth and value enhancement of broadband business.

The Company focused on both the scale and quality of innovative businesses. The core competitiveness of digital products and solutions continued to improve. In the first half of the year, the Company's Industry Internet revenue reached RMB42.977 billion, accounting for more than a quarter of service revenue for the first time and becoming a key driver of the Company's revenue growth and structure optimisation. The Company expanded the growth potential of Big Connectivity. In the first half of the year, IoT business revenue reached RMB5.4 billion, representing a year-on-year growth rate of 24%, which instilled new vitality into Big Connectivity development. High-, mid- and low-speed access scenarios were all covered with integrated development of "terminals, network, cloud, AI and security". The Company leveraged Gewu platform to empower industry breakthroughs, effectively driving faster development in industrial Internet, smart city, and ecological environmental protection. The Company enhanced in-house R&D capabilities in Big Computing. The Company's in-house R&D capabilities continued to improve. It has established a brand image of "secure, digital and intelligent cloud", and developed the unique edges of "security and reliability, cloud-network integration, Big Data and AI integration, tailored customisation, and multi-cloud collaboration", fully empowering the digital transformation of industries. In the first half of 2023, Unicom Cloud5 achieved revenue of RMB25.5 billion, up by 36% year-on-year. The Company maintained industry leadership in Big Data. The Company fully leveraged its first-mover advantage in the industry in centralising data and unifying operations, combined with artificial intelligence and blockchain technology, to establish a comprehensive Big Data capability system. With a view to unleashing the value of data factors, the Company deeply penetrated sectors such as digital government affairs, digital finance, smart tourism, industrial Internet, etc. In the first half of the year, the Company's Big Data business achieved revenue of RMB2.9 billion, up by 54% year-on-year, with market share of over 50% for consecutive years. The Company empowered thousands of industries with Big Application. The Company actively promoted the deep integration of next-generation digital technologies and the real economy. The cumulative number of 5G industry application projects exceeded 20,000, and has comprehensively covered 60 categories of the national economy. The Company promoted the transition of 5G applications from "show flats" to "commercial properties". The cumulative number of customers served by 5G virtual private networks exceeded 5,800 and the contract value of 5G industry applications reached RMB6.2 billion. The Company achieved rapid growth in Big Security revenue. The Company accelerated the scale replication of the "platform + product + service" model, and launched more than 80 products in the security cloud market to widely meet the security needs of the digital economy. Big Security revenue grew 178% year-on-year in the first half of the year.

Continuous Enhancement in Network Capabilities

The Company accelerated the construction of four premium networks, namely 5G, broadband, government and enterprise, and computing power. The number of 5G mid-band base stations exceeded 1.15 million, with the scale and coverage on par with the industry. Its broadband networks in cities, counties and towns are fully gigabit-ready. Its government and enterprise premium network fully covered 335 local networks in the country. The Company made great efforts to build a computing power base with abundant computing power, sufficient capacity, multi-cloud synergy and computing-network integration, and built a new IDC system to comprehensively undertake the national "Eastern Data and Western Computing" project. The number of cabinets exceeded 380,000. Unicom Cloud pool covered more than 200 cities. The average backbone network latency remained leading in the industry. The co-build co-share with China Telecom has been deepening. In addition to adding 150,000 5G co-build co-share base stations, the Company promoted a single 4G mid-band network, with the number of shared base stations exceeded 2 million and a sharing ratio of over 90%. The Company also actively promoted cross-sector co-build co-share of infrastructure such as poles and pipelines and made good progress.

Significant improvement in technological innovation

The Company continued to enhance its technological innovation capability, with R&D investment intensity reaching 2.94%, leading the industry. The number of patents granted reached 1,326, an increase of 70% year-on-year. The Company has actively promoted network technology innovation, created more than 10 innovative network products, and accumulated more than 100 network intelligent operation scenarios, driving production and operation to increase revenue and reduce costs. It highly emphasized on the development of next-generation artificial intelligence technology represented by large models, and made active deployment in the cutting-edge field of artificial intelligence, accelerating the enhancement of the Company's AI capability. In the first half of the year, the Company won two first prizes from China Institute of Communications, a first prize from China Institute of Electronics, the National Patent Silver Award, the "Best Connected Health Mobile Innovation Award" from GSMA, and the "5G Industry Challenge Award" from AMO, etc. Strategic planning in emerging industries has further accelerated.

In the second half of the year, the Company will promote the synergetic development of both basic and innovative businesses. It will focus on improving its core competitiveness and core functions, and strive to achieve steady growth of service revenue, double-digit growth in net profit, and continuous improvement in ROE for the full year, so as to create greater value for shareholders, customers and the society, and make new and greater contributions to Chinese style modernisation via China Unicom's high-quality development.

1 Net profit represented profit attributable to equity shareholders of the Company

2 Return on equity = the profit attributable to equity shareholders of the Company in the period/average balance of equity attributable to equity shareholders of the Company at the beginning and end of the period

3 Service revenue = operating revenue - sales of telecommunications products.

4 EBITDA represents profit for the period before finance costs, interest income, share of net profit of associates, share of net profit of joint ventures, other income-net, income tax expense, depreciation and amortisation.

5 Unicom Cloud revenue includes revenue of cloud resources, cloud platform, cloud service, cloud integration, cloud interconnection, cloud security, etc. generated from integrated innovative solutions.

Certain statements contained in this press release may be viewed as "forward-looking statements". Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward looking statements. In addition, we do not intend to update these forward-looking statements. Neither the Company nor the directors, employees or agents of the Company assume any liabilities in the event that any of the forward-looking statements does not materialise or turns out to be incorrect.

For media enquiries, please contact:

China Unicom (Hong Kong) Limited

Investor Relations Department

Mr. Billy Tang/ Ms. Emma Zhou

Tel: (852) 2121 3275/ (852) 2121 3206

Email: billy@chinaunicom.com.hk/ emma@chinaunicom.com.hk

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |