China Unicom (Hong Kong) Limited

(Incorporated in Hong Kong with limited liability)

To: Business/Finance Editors

Highlights:

Hong Kong, 13 March 2019 - China Unicom (Hong Kong) Limited and its subsidiaries ("China Unicom" or "the Company" and "the Group") (HKEx: 0762; NYSE: CHU) is pleased to announce today its 2018 annual results.

2018 was China Unicom's first full year of the implementation of mixed-ownership reform. Over the past year, the Company engaged in active implementation of its new development philosophy, as it deepened the execution of the Strategy of Focus, Innovation and Cooperation. It proactively advanced Internet-oriented operations, while comprehensively deepening mixed-ownership reform. There were notable enhancements in the momentum, quality and efficiency of our development and in our corporate vibrancy.

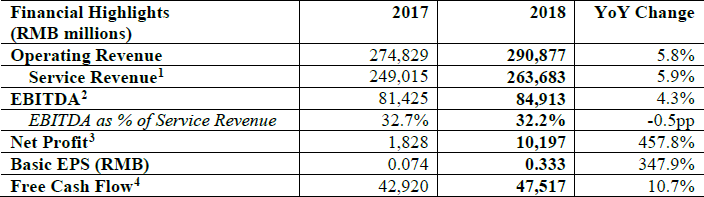

The Company continued to report remarkable growth in operating results for 2018. Service revenue for the full year amounted to RMB263.7 billion, representing a 5.9% year-on-year growth which outperformed the industry average growth rate of 3.0%. EBITDA amounted to RMB84.9 billion, up by 4.3%, year-on-year. Profit before income tax5 reached RMB13.1 billion and profit attributable to equity shareholders of the Company increased by 458%, year-on-year, to RMB10.2 billion, extending the "V-shaped" rebound in profit.

The Company persisted in enhancing network efficiency through precise investment, sharing and cooperation. While maintaining the edges of our network, the full year capital expenditure continued to be under effective control at RMB44.9 billion. Thanks to the sustainable growth in revenue and sound control in expenditure, the Company registered the record high again in free cash flow in the amount of RMB47.5 billion.

The Company attached great importance to shareholders' returns. With due regards to the Company's profitability, debt and cash flow level, capital requirements for its future development etc., the Board of Directors recommended the payment of a final dividend of RMB0.134 per share. Going forward, the Company will continue to strive to enhance its profitability and shareholders' returns.

Mr. Wang Xiaochu, Chairman and CEO of China Unicom said, "Looking ahead, the mixed-ownership reform has powered up the Company with differentiated advantages, bringing invaluable opportunities for development. We endeavor to chart new heights in China Unicom's "Five New" establishment and high quality development.We intend to unleash more institutional benefits brought by New Governance, activate greater internal vibrancy with New DNA, achieve better efficiency and returns with New Operation, tap into the broader blue ocean with New Energy, and put together greater synergetic advantages with New Ecology."

Deepened Internet-oriented innovative operation underpinned highly effective mobile service growth

In 2018, the Company pressed forward the innovative operation of its mobile service in response to the pressure from market competition and "Speed Upgrade and Tariff Reduction" policy, achieving the effective growth for the mobile service with reduced channel commission and handset subsidy. Mobile service revenue for the full year reached RMB165.1 billion, representing a year-on-year growth of 5.5% that exceeded the industry average of 0.6%. Mobile billing subscribers saw a net addition of 30.87 million, representing a year-on-year growth of 51.8% and taking the total number of mobile billing subscribers to 320 million.

During the year, the Company chose not to simply match the competition of low-price "unlimited data" products introduced by peers, nevertheless persistently promoted Internet-oriented operational transformation and deepened 2I2C business collaboration with Internet companies. The Company's 4G subscriber base saw a net addition of 45.05 million to a total of 220 million. Our 4G subscriber market share was up by 1.3 percentage points, year-on-year. The proportion of 4G subscribers as a percentage of total mobile billing subscriber increased by 8 percentage points, year-on-year, to 70%. The Company strived to achieve win-win by advancing data traffic operation and leveraging price elasticity of mobile data. In 2018, the unit pricing for the Company's mobile handset data decreased substantially, while the mobile data volume consumption grew by 1.8 times. The monthly average DOU per mobile handset subscriber reached approximately 6 GB, while handset Internet access revenue grew by 13.7%, year-on-year, to RMB104.8 billion.

Continuous improvement in broadband service while actively countering intense competition

In 2018, the Company actively responded to the challenge of market competition in broadband service by resorting to "Big Video, Big Integration and Big Bandwidth". Leveraging rich resources afforded by our strategic investors, we strengthened our content portfolio with quality video and stepped up with the deployment of smart home services to boost subscriber stickiness and product competitiveness. For 2018, the Company's fixed-line broadband subscriber saw a net addition of 4.34 million, representing a 234% year-on-year growth, to over 80 million in total. Fixed-line broadband access revenue amounted to RMB42.3 billion, indicating a considerable reduction of the rate of decline year-on-year and basically achieving a steady development.

Industry Internet business continued to mark new breakthrough promoting healthy growth of fixed-line services

In 2018, led by the model of "Cloud + Smart Networks + Smart Applications", the Company stepped up market expansion and drove scale development in key innovative businesses, such as Cloud Computing, Big Data and the Internet of Things ("IoT"), accruing energy for highly efficient and sustainable development in the future. Focusing on key sectors such as government affairs, education, medical and healthcare, finance, transportation and tourism, and actively bringing into play the complementary resources and business synergies afforded by strategic investors with in-depth business and capital cooperation, the Company fostered differentiated advantages. In 2018, the Company's innovative business was gradually becoming the key driver of revenue growth. For the full year, the industry Internet business reported revenue of RMB23.0 billion, representing a 45% growth, year-on-year, and increasing to 8.7% as a percentage of service revenue. Benefitting from notable improvements in the broadband service and growth in innovative services, the Company's fixed-line service revenue amounted to RMB96.3 billion, up by 6.0% year-on-year.

Leveraging external resources and capability to boost new energy for innovative development

During the year, cooperation in Internet touchpoints with Tencent, Alibaba, Baidu, JD.com and Didi, etc was deepened to facilitate precise and effective acquisition of new customers. In connection with content aggregation, premium video contents from Baidu, iQIYI and Tencent, among others, were introduced to enhance the competitiveness of our IPTV and mobile video content business. In industry Internet, the Company focused on Cloud Computing, Big Data, IoT and Artificial Intelligence (AI), promoting in-depth cooperation with Tencent, Baidu, Alibaba, JD.com and Didi, etc. We entered into cooperation with Alibaba and Tencent for public cloud products, branded "WO Cloud", and hybrid cloud products. In deepening capital cooperation, we set up joint ventures, namely Yunlizhihui Technology, Yunjing Wenlv Technology and Yunjizhihui Technology, with Alibaba, Tencent and Wangsu respectively, aiming to better capture the market opportunities in industry Internet with an asset-light business model and accrue energy for our innovative development in the future.

Proactive deployment of 5G scale trial to advance industry ecosystem

The Company is actively promoting 5G network and industry applications trial in key cities and plans to expand the scale of trial as appropriate based on the testing results and maturity of equipment. It will track closely the progress of the industry and strengthen the synergetic development of terminal, network and business, riding on the benefits of the value chain advantages of 3.5GHz. It concurrently promotes the maturity of the value chain of Non-Standalone (NSA) / Standalone (SA). The Company will closely monitor the schedule of 5G licensing and accelerate the upgrade of the auxiliary facilities for 5G. The Company is taking an active approach in researching and driving network co-building and co-sharing of 5G with various cooperation modes to lower the network construction cost. Looking ahead, the Company will maintain precise investment with due regards to the technological advancement, regulatory policies, market demand and competitive landscape, etc.

Certain statements contained in this press release may be viewed as "forward-looking statements" within the meaning of Section 27A of the U.S. Securities Act of 1933 (as amended) and Section 21E of the U.S. Securities Exchange Act of 1934 (as amended). Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. In addition, we do not intend to update these forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in the Company's most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the "SEC") and in the Company's other filings with the SEC.

For media enquiries, please contact:

China Unicom (Hong Kong) Limited

Investor Relations Department

Mr. Ivan Wong / Ms. Joeling Law / Mr. Billy Tang

Tel: (852) 2121 3210 / (852) 2121 3225 / (852) 2121 3275

Email: ivanw@chinaunicom.com.hk / joeling.law@chinaunicom.com.hk / billy@chinaunicom.com.hk

1 Service revenue = operating revenue - sales of telecommunications products.

2 EBITDA = profit for the year before finance costs, interest income, shares of net profit of associates, share of net profit of joint ventures, other income - net, income tax, depreciation & amortization. As the telecommunications business is a capital intensive industry, capital expenditure and finance costs may have a significant impact on the net profit of the companies with similar operating results. Therefore, the Company believes that EBITDA may be helpful in analysing the operating results of a telecommunications service operator like the Company.

3 Net profit represented profit attributable to equity shareholders of the Company.

4 Free cash flow = operating cash flow - CAPEX.

5 In August 2018, China Tower Corporation Limited ("Tower Company"), an associate company of the Company, was listed on the Hong Kong Stock Exchange with the issuance of new shares, leading to a change in the shareholding percentage of the Company in Tower Company and the share of net profit of associates accounted for under equity method to increase by RMB1,474 million.

| © Copyright 1996-2023 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |