China Telecom Corporation Limited

(A joint stock limited company incorporated in the People's Republic of China with limited liability)

Press Release

16 August 2022

For Immediate Release

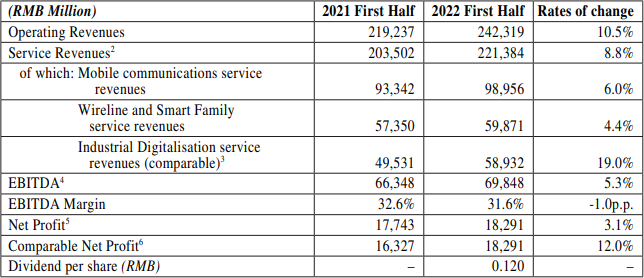

FINANCIAL HIGHLIGHTS

BUSINESS HIGHLIGHTS

China Telecom Corporation Limited (hereinafter "China Telecom" or the "Company")(Stock Code on the Hong Kong Stock Exchange: 728) (Stock Code on the Shanghai Stock Exchange: 601728) announces its 2022 interim results today in Hong Kong.

In the first half of 2022, the digital economy has become a stabiliser and an important engine for the national economic development, as the scale commercialisation of the new-generation digital technologies accelerated while the integration and innovation of multiple technologies further drove industrial transformation. Adhering to the new development principles, the Company seized strategic opportunities brought about by the new round of technological revolution and industrial transformation, responded to the challenges brought about by the COVID-19 Epidemic ("Epidemic") in the country, coordinated Epidemic prevention and control with corporate operation and development, and fully implemented its "Cloudification and Digital Transformation" strategy. The Company intensified sci-tech innovations, deepened the cloud-network integration and continued deepening its system and mechanism reforms. The Company proactively expanded the new open ecosystem of win-win cooperation and accelerated its development as a service-oriented, technology-oriented and secured enterprise. The Company maintained rapid growth in its operating results and continued to share its highquality development achievements with its shareholders, customers and the society.

In the first half of 2022, operating revenues of the Company amounted to RMB242.3 billion, representing an increase of 10.5% year-on-year. Of which, service revenues amounted to RMB221.4 billion, representing an increase of 8.8% year-on-year, remaining above the industry's average growth rate7. EBITDA amounted to RMB69.8 billion, representing an increase of 5.3% over the same period last year. The net profit was RMB18.3 billion, representing an increase of 3.1% over the same period last year. Excluding the one-off after-tax gain8 from the disposals of its subsidiaries last year, the year-on-year growth rate was 12.0%. The basic earnings per share were RMB0.20. Capital expenditure was RMB41.7 billion and free cash flow9 reached RMB14.5 billion.

The Company attaches great importance to shareholder returns and strives to enhance its profitability and cash flow generation capability while effectively controlling capital expenditure. The Board of Directors has resolved to declare an interim dividend for the first time in 2022, and the profit distributed in cash will be 60% of the profit attributable to equity holders of the Company in the first half of 2022, i.e., RMB0.120 per share. This successfully fulfilled the commitment to introduce interim dividends made by the Company during A-Share offering. The Board of Directors will take into full consideration the Company's profitability, alongside cash flow levels and capital needs for its future development, and will make recommendations at the shareholders' meeting after comprehensively reviewing the annual dividend distribution proposal for 2022, furthering its efforts to create more value for shareholders.

In the first half of 2022, adhering to the customer-oriented approach, the Company strengthened the supply of integrated intelligent information products and services, accelerated the innovative expansion of fundamental businesses and Industrial Digitalisation, built a better life and empowered the digital transformation of numerous walks of life. The service quality of the Company maintained at the industry-leading position.

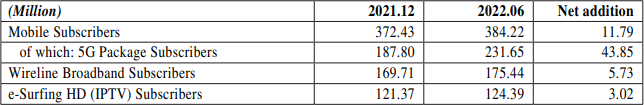

The Company further enhanced 5G network coverage, promoted network access and usage for 5G subscribers with precision and optimised the experience of applications such as cloud VR/AR, cloud games, ultra HD and etc. The Company created innovative applications such as 5G Messaging, 5G New Calls, Quantum-encrypted Calls and etc., with an aim to further expand products and services under 5G scenes and promote the upgrade of individual's digital consumption demands as well as drive the continuous enhancement of subscriber scale and value. In the first half of the year, the Company's mobile communications service revenues amounted to RMB99.0 billion, representing an increase of 6.0% over the same period last year, maintaining healthy growth. The total number of mobile subscribers reached 384 million, with a net addition of 11.79 million, achieving steady growth of subscriber market share. The number of 5G package subscribers reached 232 million with a penetration rate of 60.3%, remaining at an industry-leading level. Mobile ARPU10 amounted to RMB46.0, maintaining its growth momentum.

Focusing on customers' demands for digital life upgrades, the Company further promoted the speed upgrade of broadband subscribers and accelerated the expansion of Gigabit products at scale. The Company built a platform for digital life applications with wider connectivity, broader reach and higher level of intelligence, promoted the migration of applications from interconnection between single products to inter-convergency across ecosystems. Leveraging ultra HD, multi-camera, multi-angle and VR/AR to create new experience of contents, the Company further promoted the integration and mutual promotion as well as connected development among Smart Family, Smart Community and Digital Village, while continuously enriching the content of digital life and promoting steady growth in volume and revenue of family services. In the first half of the year, Wireline and Smart Family service revenues of the Company amounted to RMB59.9 billion, representing an increase of 4.4% year-on-year. Of which, broadband access revenue reached RMB40.8 billion, representing an increase of 7.1% year-on-year. The total number of wireline broadband subscribers reached 175 million, of which the number of Gigabit broadband subscribers reached 20.68 million, with its penetration rate increasing to 11.8%, achieving an industry-leading level. The value contribution from Smart Family services continued to increase. Broadband blended ARPU11 reached RMB47.2, maintaining healthy growth.

The Company proactively seized the current opportunities brought by the demands from various industries in the economy and society for network-based, digitalised, and smart integrated information services. Leveraging resources in whole process and whole network as well as the edges in clientele accumulation, service localisation and etc., while also leveraging its abundant use cases and massive data, the Company focused on the dual driving engines of its projects and products, created edges from differentiation and convergence and proactively empowered the transformation and upgrades of traditional industries to support the "the cloud migration, the use of data and intelligence injection" for numerous walks of life. In the first half of the year, revenue from Industrial Digitalisation reached RMB58.9 billion, representing a year-on-year growth of 19.0% on a comparable basis.

Adhering to the cooperation philosophy of "Broadest Scope, Best Service, Best Value, Farthest Growth", the Company conducted ecological cooperation to further promote the vigorous development of cloud technologies and industry. In the first half of the year, revenue from e-Surfing Cloud reached RMB28.1 billion with the year-on-year growth rate reaching 100.8%. In line with the demands from the "East-to-West Computing Resource Transfer" project, the Company accelerated the building of new hub capabilities. In the first half of the year, the development of IDC further enhanced with its revenue amounting to RMB17.9 billion, representing an increase of 11.1% year-on-year. As the fifth fundamental network of the Company, e-Surfing Internet of Video Things pushed forward the construction of digital cloudnetwork ecology of videos. The aggregate number of connected devices reached 30 million, with rapid launch of diversified use cases such as "Kitchen Monitoring" etc.

The development of the Company's 5G 2B services maintained good momentum. The three customised network modes, namely "Wide-area", "Adjacent", and "Wingspan", fully exerted the features of 5G including massive connectivity, high speed, low latency and data security. Focusing on the demands such as flexible production, HD video backhaul transmission and remote control of equipment, the Company created 5G industry use cases such as 5G+industrial vision, 5G+remote equipment control, and 5G+smart factory logistics to effectively empower the digital and intelligent transformation and upgrades of industries such as Industrial Internet, Internet of Vehicles (IoV), and smart healthcare. Fully leveraging the industryleading benchmarking effects, the Company accelerated the expansion and replication of its projects. In the first half of the year, the number of the newly contracted customised network projects exceeded 1,300, with revenue from the newly contracted projects increasing by more than 80% year-on-year. The cumulative number of 5G industry commercial projects reached approximately 9,000.

The Company currently owns more than 700 IDC sites and the number of IDC cabinets amounted to 487,000 with a utilisation rate of 72%. The Company has the greatest number and the most extensive distribution of IDC resources in China. In the first half of the year, the number of newly built e-Surfing Cloud servers reached 81,000, with the scale of computing power reaching 3.1EFLOPS while "One-City-One-Pool of Cloud Resources" cumulatively covered more than 160 cities.

The Company proactively pushed forward a new model for cloud-network construction and operation to reduce duplicated resources input, and achieved further cost reduction and efficiency enhancement, while at the same time striving to build a green cloud-network with high efficiency and lower energy consumption. The Company continued deepening the co-building and co-sharing of networks with China Unicom on all fronts. In the first half of the year, the number of co-built and co-shared 5G base stations increased by 180,000, with the number of 5G base stations in use reaching 870,000. The number of co-shared 4G base stations increased by 210,000, with accelerated promotion of "one single 4G network". The cumulative investment savings for both parties amounted to RMB240 billion.

The Company took the promotion of sci-tech innovation as the strategic guide for its high-quality development. The Company constantly scaled up sci-tech innovation, boosted its sci-tech capabilities, and made solid strides towards becoming a sci-tech company. The Company was awarded the title of "Enterprises with Outstanding Contribution to Sci-tech Innovation" by State-owned Assets Supervision and Administration Commission of the State Council (SASAC). In the first half of the year, the percentage of proprietary IT systems and service platforms increased by 8.9 percentage points over the same period last year. The number of new patents was 1,128, representing an increase of 145% year-on-year. Cooperation and innovation among industry, academia, research and development (R&D) institutes and customers entered a substantive stage with more than 40 cooperation projects being initiated in the fields of fundamental research and application research with leading universities and scientific research institutes.

In the first half of 2022, the Company coordinated Epidemic prevention and control with corporate operation and development while also undertook its responsibilities. The Company carried out various measures in areas such as precise speed upgrade, fee reduction or exemption, considerate service as well as digital and intelligent endowment, to effectively support the relief and problem-solving for small- and medium-sized enterprises (SMEs).

Chairman Ke pointed out that, looking ahead, the Company will continue to seize on new stages of its development and implement its new development principles completely, accurately and comprehensively, while proactively serving and integrating into the new development pattern. The Company will continue to promote its high-quality development and fully implement its "Cloudification and Digital Transformation" strategy. Through the integration of cloud, AI, security and greenness, the Company will speed up the digitalised, scene-based and convergent upgrade of products and accelerate the nurturing and development of strategic emerging services such as cloud, security, AI and Big Data. The Company will insist on leading its corporate development with sci-tech innovation, enhance its capabilities in corporate value creation and sustainable development and proactively implement social responsibilities. The Company will also fully motivate and stimulate the enthusiasm, initiative and creativity of all employees and expedite the building of a world-class enterprise.

For further information, please browse the Company's website at: www.chinatelecom-h.com or scan below QR code to follow China Telecom's IR public account on Wechat (content available in Chinese only).

FORWARD-LOOKING STATEMENTS

The development strategies, future business plans, prospects and other forward-looking statements do not constitute commitment by China Telecom Corporation Limited (the "Company") to investors. Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. In addition, we do not intend to update these forward-looking statements. Investors are advised to pay attention to investment risks.

For press enquiries:

China Telecom Corporation Limited

Investor Relations Department

Ms. Lisa Lai/Mr. Nick Fung

IR Enquiry: (852) 2582-0388

Email: ir@chinatelecom-h.com

Fax: (852) 2877-0988

| © Copyright 1996-2023 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |