China Telecom Corporation Limited

(A joint stock limited company incorporated in the People's Republic of China with limited liability)

Press Release

19 March 2019

For Immediate Release

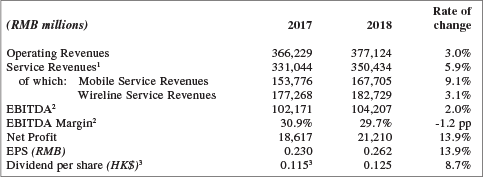

FINANCIAL HIGHLIGHTS

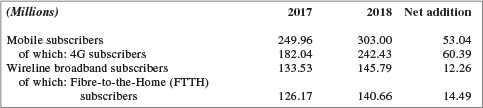

BUSINESS HIGHLIGHTS

China Telecom Corporation Limited (hereinafter "China Telecom" or the "Company") (Stock Code on the Hong Kong Stock Exchange: 728) (Stock Code on the New York Stock Exchange: CHA) announces its 2018 annual results today in Hong Kong.

In 2018, the Company firmly grasped the opportunities arising from the development of digital economy, and rode on the tide by leveraging the accurate insight into market trends and customer demands. The Company adhered to the new development principles and carried out supply-side structural reforms. The Company responded effectively to the complicated and challenging external environment, as well as increasingly fierce competition, achieving new breakthroughs in expanding its business scale while firmly elevating its corporate value, thereby reaching a new high in terms of overall competitiveness and market position. Over the past year, the Company deepened its implementation of step-up transformation while promoting reform and innovation on all fronts. The Company also proactively prospected the landscape for 5G development and built all-rounded competitive advantages. The Company accelerated the development of new impetus, deeply incentivised corporate vitality, strove to break new ground in terms of high-quality development, and remained committed to creating new value for shareholders.

In 2018, operating revenues of the Company amounted to RMB377.1 billion, of which, service revenues amounted to RMB350.4 billion, representing an increase of 5.9% compared to last year (if excluding the impact of the application of International Financial Reporting Standard 15 during the year under review, it represented an increase of 7.2% over last year), with revenue growth having surpassed the industry average for many consecutive years. Revenues from emerging businesses4 accounted for 51.9% of service revenues, representing an increase of nearly 6 percentage points compared to last year following a continual optimisation of the revenue structure. EBITDA reached RMB104.2 billion, representing an increase of 2.0% over the same period last year. Net profit amounted to RMB21.2 billion, representing an increase of 13.9% compared to last year, while basic earnings per share were RMB0.262, achieving rapid growth. Capital expenditure was RMB74.9 billion, representing a decrease of 15.5% compared to last year, the third consecutive annual decline. Free cash flow5 reached RMB22.5 billion, representing a remarkable increase compared to last year.

Taking shareholder returns into consideration, alongside the Company's profitability, cash flow level and capital requirement for future development, the Board of Directors has decided to recommend at the forthcoming shareholders' meeting that a final dividend equivalent to HK$0.125 per share for the year 2018 be declared, representing an 8.7% increase over the year 2017. Going forward, the Company will continue to create shareholder value, while fully balancing the cash flow required for the long-term development of the Company with returns to shareholders.

In 2018, the Company seized the precious opportunities arising from the benefits released from data traffic, while actively capitalising on increasing demand from corporates subscribing for cloud. The Company expedited products innovation, promoted overall upgrade of its services convergence, strengthened its network edges, and improved its operational capability. As a result, the Company rapidly improved its competitiveness, achieved a record high pace in market expansion, and rapidly magnified its growth momentum.

The Company's mobile service revenues amounted to RMB167.7 billion, representing an increase of 9.1% compared to last year. The total number of mobile subscribers reached 303 million, a net addition of 53.04 million subscribers, which hit a record high. The market share of mobile subscribers net addition reached 44%, while overall market share increased to 19.6%. Out of this, the number of 4G subscribers was 242 million, a net addition of 60.39 million, maintaining an all-time high pace of growth. 4G penetration rate reached 80%, making the Company an industry leader. Aggregate handset data traffic also grew strongly by nearly 3 times, with 4G DOU reaching 5.5GB. Handset Internet access revenue grew by 22.4% compared to last year. Wireline service revenues amounted to RMB182.7 billion, representing an increase of 3.1% compared to last year. The number of wireline broadband subscribers reached 146 million, a net addition of 12.26 million, achieving a 6-year high. Out of this, the proportion of wireline broadband subscribers of 100Mbps or above accounted for 66%.

The growth of revenues from the Company's Intelligent Applications ecospheres6 accelerated further and contributed over 50% to incremental service revenues. With "cloudification"7 on all fronts, the development of the Company's DICT and Internet of Things (IoT) businesses was accelerated by the uptake of cloud-network integration and IoT-cloud integration. Revenues from IDC and cloud services increased by 22.4% and 85.9% respectively compared to last year, contributing nearly 2 percentage points to service revenues growth. The Company made further breakthroughs in accelerating the growth of IoT services, with IoT revenue and the scale of connected devices doubled yet again. With the overall upgrade of services convergence, the Company rapidly expanded the market through the bundling of "large data traffic, 100Mbps broadband, and Smart Family" products. The number of e-Surfing HD (IPTV) subscribers reached a new high of above 100 million, enabling Smart Family application to achieve a meaningful scale. The Company also built an integrated platform for Internet Finance, resulting in synergies with the mobile business to promote mutual scale development. The number of average monthly active users of BestPay exceeded 43 million, and the aggregate gross merchandise value for the year exceeded RMB1.6 trillion.

In 2018, focusing on user experience, business scale expansion and value management, the Company pushed forward the construction and intelligent upgrade of its network to build up comprehensive network advantages. The Company accurately grasped changing market demand and expanded the market by leveraging its data traffic and cloud products, cultivating convergence operation, and effectively bundling its services. As a result, the overall competitiveness of the Company's bundled products was significantly strengthened, which facilitated rapid breakthroughs in expanding market scale, thereby creating new avenues for value growth. The synergies that resulted from the integration and mutual development of its five ecospheres enabled the Company to explore new paths towards future sustainable development. Following the consolidation of the Company's IT infrastructure and the greater adoption of new technologies such as big data and artificial intelligence (AI), the Company injected more intelligent elements into operation, leading to efficiency improvement and productivity enhancement. The Company sought to implement reform and foster innovation in all parts of its operation, constantly enhancing the vitality of corporate development and operational capability. The Company continued deepening the three-dimensional inter-driven reform and mixed ownership reform in the emerging areas, which deeply stimulated the vitality of corporate development.

President Ke pointed out that, at present, the national economy has entered a stage of high-quality development, which is accelerating the conversion of old impetus into new ones. New technologies represented by 5G and AI are integrating and evolving, enabling them to support supply-side structural reform, which will lead to a rapid expansion of potential value for digital economy. As the next generation infrastructure, 5G network will become ever more intertwined with applications and telecom operators will play an increasingly pivotal role in the information communications industry. The Company will actively explore commercial applications of various new technologies, accelerate the development of operation mechanisms that are adapted for 5G, and capitalise on its advantages to promote ecological services ahead of time. Recently, China Telecom was awarded the 3.5GHz band to conduct nationwide 5G network trials. Leveraging the advantages of the 5G mainstream frequency band and insisting on open cooperation, the Company will accelerate 5G deployment proactively and pragmatically. Persisting in a market-oriented and demand-driven approach, the Company will appropriately manage the momentum, propel the development of non-standalone (NSA) and standalone (SA) concurrently, and progressively expand the scale of network trials and the pilot project of 2B/2C applications.

Whilst the vigorous development of digital economy has presented historical opportunities, the Company is clearly aware that its future external environment is becoming complicated and challenging. While the macro economy is facing downward pressure, cross-industry and homogeneous competition is also becoming increasingly intense. As a result, transforming development model and pursuing high-quality development have now become the Company's top priorities. Persisting in the principle of new development and supply-side structural reforms, the Company will accelerate its advancement towards high-quality development, and proactively fulfill the requirements of "Speed Upgrade and Tariff Reduction". With scale development as the foundation and value management as the core, the Company will continuously push forward with "cloudification" and accelerate ecological endowment. The Company will build a "Trinity" value management system, featuring convergence, integration and intelligentisation, for high-quality development, while marching towards becoming a leading integrated intelligent information services provider and constantly creating new value for shareholders.

For further information, please browse the Company's website at: www.chinatelecom-h.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document may be viewed as "forward-looking statements" within the meaning of Section 27A of the U.S. Securities Act of 1933 (as amended) and Section 21E of the U.S. Securities Exchange Act of 1934 (as amended). Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. In addition, the Company does not intend to update these forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in the Company's most recent Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the "SEC") and in the Company's other filings with the SEC.

For press enquiries:

China Telecom Corporation Limited

Investor Relations Department

Ms. Lisa Lai/Mr. Nick Fung/Ms. Karen So

IR Enquiry: (852) 2582-0388

Email: ir@chinatelecom-h.com

Fax: (852) 2877-0988

| © Copyright 1996-2023 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |