C C Land Holdings Limited

(Incorporated in Bermuda with limited liability)

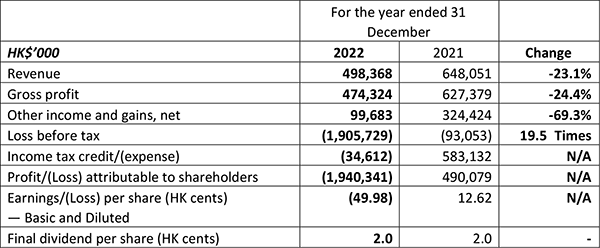

Financial Highlights

(27 March 2023 - Hong Kong) C C Land Holdings Limited ("C C Land" or the "Company", together with its subsidiaries collectively known as the "Group"; stock code: 1224) is pleased to announce its annual results for the year ended 31 December 2022 (the "Year").

The Group achieved a consolidated revenue of HK$498.4 million, representing a decrease of approximately 23.1% compared to HK$648.1 million in 2021. Taking into account the provision for expected credit losses on amounts due from the two PRC property projects and the fair value losses on investment properties which are non-cash and unrealized in nature, the Group recognized a loss after tax of HK$1,940.3 million for the year ended 31 December 2022 compared to a profit of HK$490.1 million for 2021. If these two significant non-cash and unrealized items were excluded, the Group would record a profit of HK$483.8 million for the year.

The loss attributable to shareholders was HK$1,940.3 million (2021: profit attributable to shareholders of HK$490.1 million). The basic loss per share for the year was HK49.98 cents (2021: the basic earnings per share was HK12.62 cents).

Performance for the year was impacted by the COVID-19 pandemic and a challenging economic environment. Rental income is down slightly by 3.4 % to HK$494.6 million due to the depreciation of approximately 10% of the average exchange rate of the GBP against the HKD during the year.

Divestment in the treasury investments reduced revenues by HK$132.2 million in the year, in line with an effort to reduce risks posed by economic instability. After the divestment, interest income from loans receivable and debt investments as well as dividend income were reduced during the year.

During the year, the Group generated a rental income of HK$494.6 million (2021: HK$512.0 million) from its investment properties in the UK. The Group's rent collection has performed exceptionally well and continues to experience minimal interruption, with 99% of the rent for the year collected (2021: 97%). Rent reviews were carried out for the Leadenhall Building involving 234,000 sqf at an average of an increase of 3.1% on an annual basis.

The global economic slowdown continued to interrupt business activities and supply chains, and produced significant volatility in the financial markets, resulting in a general decline in equity prices. This has an adverse impact on the treasury investment business. The treasury investment segment, comprising of listed equity securities and unlisted investment funds, recorded fair value losses of HK$140.5 million and realized losses of HK$3.6 million (2021: fair value losses and realized losses amounted to HK$179.8 million and HK$229.2 million respectively) during the year.

In the PRC, Covid's disruptions to business activity have dampened consumer sentiments. The adverse situation in China's residential property market worsened in the year as homebuyers remained cautious, and therefore reduced property purchases. A series of measures were implemented by the Government to support the property sector, including cutting benchmark lending rates in August 2022 to reduce cost for homebuyers. It appears that more policy measures are needed to stabilize the property sector. As there is an increasing possibility of a slowdown in China's economy and the credit crisis prevailing in the PRC property market, the Group has made a provision for expected credit losses on amounts due from the Jiangsu Yancheng Project and Guangdong Jiangmen Project which included in prepayments, deposits and other receivables, for a total HK$1.0 billion as at 31 December 2022. The provision for expected credit losses is performed by an independent professional valuer by applying the probability of default approach with reference to the risks of default of the counterparties after discussion with the management. Since the controlling shareholder of the associates has announced default on its corporate bonds, the probability of default applied is 100% (2021: ranged from 0.33% to 9.51%), and the loss given default is estimated to be approximately 83% (2021: 62%) by reference to the Annual Default Study published by Moody's Investors Service.

The value of the Group's investment properties in the UK had also been adversely impacted by the interest rate hikes which resulted in fair value losses of HK$1.4 billion. As this expense is non-cash in nature, and the Group is holding these investment properties for long term rental purposes, the Group does not expect its overall financial position to be affected substantially.

The Leadenhall Building is one of the iconic buildings in Central London - a skyscraper with a height of 225 metres (738 feet) tall. The building's distinctive wedge-shaped architectural design has created a number of specific spaces to cater to the different needs of the tenants' businesses. The combination of modern offices and food experiences in the neighborhood enables tenants' businesses to attract and keep talented people. The property consists of 46 floors which are used mainly for office purposes and will be held by the Group as an investment property for long term capital growth. It comprises approximately 610,000 sqf of office and retail space, and was almost fully let as at 31 December 2022 with a weighted average unexpired lease term of approximately 9.0 years with 7.2 years on a term-certain basis. The building's tenant base includes a number of renowned international insurance companies alongside other financial institutions, technology, and professional service businesses. The current annual contract rent of The Leadenhall Building is in the region of GBP41.6 million (2021: GBP39.4 million). The rental yield is approximately 3.6% (2021: 3.4%) per annum.

One Kingdom Street is well connected to public transportation with nearby underground stations, providing easy access to Oxford Street or Heathrow Airport. One Kingdom Street is situated in Paddington Central, a location comprised of dining, office and residential blocks, hotel, retail and entertainment amenities. The building itself features elegant glazed exteriors and a superbly functional entrance hall, while above, 265,000 sqf of superior office space is spread over nine floors. There is a huge amount of natural light in every office to create a productive and enjoyable working environment. One Kingdom Street offers approximately 265,000 sqf of Grade A office accommodation and some parking spaces, with a current annual contract rent of approximately GBP15.4 million (2021: GBP15.4 million), equivalent to an annual yield of 5.3% (2021: 5.3%). The building is almost fully leased to reputable major tenants.

During the year, the Group's joint venture completed the disposal of 85 Spring Street in Melbourne at a consideration of AUD130 million with a pre-tax gain of approximately AUD9 million over the cost of the property. Looking ahead, the Group will continue to seek investment opportunities in the Australian market to further diversify the Group's businesses and provide the opportunity for additional growth going forward.

As at 31 December 2022, the Group has seven property projects operating through joint ventures, two projects with over 1.1 million sqf of attributable development space in London, three projects with approximately 0.5 million sqf in Hong Kong and two projects with approximately 7.0 million sqf in the PRC. The Group's total investments in joint venture projects increased to HK$10.3 billion as at 31 December 2022, up from HK$8.7 billion as at 31 December 2021. The increase was largely due to the acquisition of No.15 Shouson.

Along the south bank of River Thames, the 10-acre former New Covent Garden Market site is now being redeveloped as Thames City, a mixed-use development featuring 12 residential and commercial buildings, ranging in height from 4 to 53 storeys, and a park which forms part of a vibrant regeneration district that will run from the Vauxhall Bridge to the Battersea Power Station. When fully developed, Thames City comprises 1,500 luxury residential units with a total saleable area of approximately 1.7 million sqf, including three primary towers which rise up to 53 storeys above basement, providing breathtaking panoramic views over the whole of London. Other facilities include a grand clubhouse with a 30-metre indoor heated swimming pool, a state of the art gymnasium, cinema, karaoke lounge, library, conference and function rooms, landscaped gardens, restaurants, retail outlets and commercial spaces. Together with the high quality finish and built-in amenities, these facilities have attracted many buyers, both end-users and investors alike, to build up an believably exciting sales momentum.

The development schedule has not been affected by COVID-19 restrictions. Two major towers of the Phase I development were completed in the second half of the year. A total of 195 units representing 192,500 sqf were delivered as at 31 December 2022, yielding a sales revenue of GBP287 million. The last tower of Phase 1, N6, is expected to be delivered in June this year. Altogether upon full completion, Phase I development comprises 543 residential units. The Group's near to medium term pipeline now covers about 1 million sqf with the second phase of Thames City, comprising 9 buildings, providing a mix of residential, commercial, and retail spaces. Construction will start soon. The Group has a 50% interests in the Thames City project. In June 2022, the Group's Chairman personally became its 50% partner in this project by taking over the 50% interest originally owned by Guangzhou R&F Properties Co. Ltd.

In 2019, the Group committed to invest GBP182 million to restore the legendary Whiteley project which constitutes an important part of the ongoing regeneration of Queensway which will be transformed into a more pedestrian friendly zone. Located in Queenway, W2 London, the Whiteley redevelopment project is a mixed-use scheme which secured planning permission in 2016. When finished, the project with about 603,000 sqf, will deliver 139 unique luxury residential apartments, a 109-keys spa hotel operated by Six Senses, retail and restaurant spaces, offering an exceptional destination in prime Central London. Completion of the redevelopment is expected around the end of 2023, restoring Whiteley to its deserved glorious position in the heart of Bayswater. The Group has fully paid its committed investment of GBP182 million for the development.

The construction activity has made good progress and will contribute to the Group's growth when the project is completed. Located in one of Central London's most attractive neighborhoods, the redevelopment of Whiteley will add luxury residential spaces in a popular area with limited supply. The development includes a combination of 326,000 sqf of residential apartments, and 277,000 sqf of retail, hotel, commercial and parking spaces. As at 31 December 2022, 54 residential units have been presold for GBP 334 million. The Group has approximately 46% interest but 50% voting power in the project.

Located next to the Kai Tak Development District, Harbourside HQ is a 28-storeyed Grade A office building with a total marketable gross floor area of approximately 795,000 sqf, including retail spaces on the ground and first floor, and 285 parking spaces. Overlooking the Kai Tak and Kwun Tong Promenade, the property is situated close to the Ngau Tau Kok MTR stations, rendering it accessible and connected to different parts of Hong Kong. With its unique location and iconic 136.5 metres height, Harbourside HQ commands a panoramic harbour view from the Lei Yue Mun Straits to the Victoria Harbour. The nearby retail and commercial structures offer extensive amenities in shopping, dining and entertainment. The building is 58% leased out as at 31 December 2022. The cost of acquisition was HK$7.5 billion in which the Group has a 25% interest.

No. 15 Shouson is located at No.15 Shouson Hill Road West. It comprises 15 luxury villas with a total gross floor area of approximately 88,000 sqf. All the villas have built-in lifts, gardens, usable rooftops and parking spaces. Among them, 13 villas have also private swimming pools. Construction of the properties has been completed and marketing commenced during the year with a successful sale of two villas at prices of approximately HK$870 million and HK$435 million respectively, equivalent to HK$108,000 and HK$92,000 per sqf respectively. Through two separate acquisitions in January 2022 and October 2022, the Group has acquired an effective 42% interest in the project with an investment of about HK$1.2 billion as at 31 December 2022.

The Group has an effective 15% interest in a joint venture development project related to the Kowloon Bay International Trade & Exhibition Centre with an attributable investment of about HK$906 million. The property with a site area of about 240,000 sqf and a total gross floor area of about 1.8 million sqf is positioned for commercial developments. The investment is in line with the view that the new supply and local demand of commercial spaces over the next few years will be in Kowloon East as a build-up to be Hong Kong's second CBD hub.

Dr. Peter Lam, Deputy Chairman and Managing Director of C C Land, concluded "Looking forward to 2023, the Management anticipates volatility, uncertainty and a more challenging business environment. The Group will focus on ensuring the stability and durability of its existing property portfolio and balance sheet. However, with its strong balance sheet, and the quality property portfolio, the Group is well positioned to take advantage of opportunities and cherry pick acquisition targets along the way. The Group's healthy leverage and liquidity position have afforded it the financial capacity and flexibility to maintain growth objectives for years to come. For the two development projects in London, revenue will be continually booked throughout the year when completed units are delivered."

About C C Land

Headquartered in Hong Kong, the core business of C C Land is property development and investment as well as treasury investments. The Group started to build its global property portfolio since early 2017, and now has both investment and development projects in the United Kingdom, Hong Kong and mainland China. The Group's business strategy is to have a balanced property portfolio with both stable recurring rental income and property sales revenue in developed cities worldwide.

For enquiries, please contact:

C C Land Holdings Limited

Eva Chan

Tel: (852) 2820 7000

Email: evachan@ccland.com.hk

iPR Ogilvy Ltd

Tina Law / Emily Chiu

Tel: (852) 2136 6181 / 3920 7659

Fax: (852) 3170 6606

Email: ccland@iprogilvy.com

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |