Beijing Enterprises Holdings Limited

(Incorporated in Hong Kong with limited liability)

| PRESS RELEASE | 27 March 2024, Hong Kong |

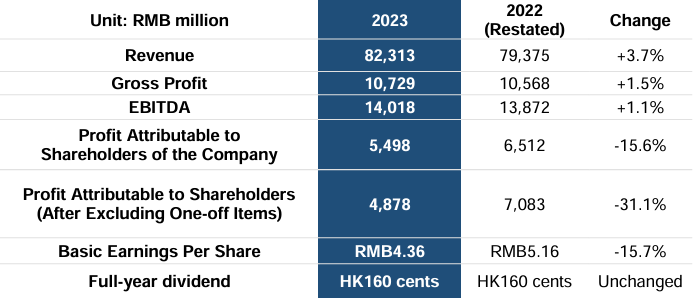

Results Highlights:

Financial Summary:

(27 March 2024, Hong Kong) The Board of Directors of Beijing Enterprises Holdings Limited ("BEHL" or the "Company", stock code: 0392.HK) announces the consolidated results of the Company and its subsidiaries (collectively, the "Group") for the year ended 31 December 2023 (the "Period"). In 2023, the global economic recovery faced certain headwinds as core inflation and public debt ratios of various countries remained high, and the risks of supply chain disruption and geopolitical conflicts remained. Benefiting from the continuous promotion of the stabilising growth policy, China's economy strode forward at a steady pace amid challenges such as insufficient effective domestic demand, weak external demand and adjustments in the real estate industry. During the Period, the Company actively shook off the impact of the complicated economic conditions at home and abroad, adhered to its strategic direction, harnessed internal potential and improved its operational efficiency to ensure the continued stability of the Company's operating fundamentals.

Gas operation comprehensively advanced, overall development steadily progressing

In 2023, Beijing Gas Group Company Limited ("Beijing Gas") recorded revenue of RMB61.47 billion, representing a year-on-year increase of 2.7%. Profit before tax from the principal businesses (including natural gas distribution business, natural gas transmission business and VCNG of Rosneft) was RMB4.79 billion. As at 31 December 2023, Beijing Gas had a total of approximately 7.62 million piped gas subscribers and approximately 32,900 kilometres of natural gas pipelines in operation in Beijing.

During the year, as the first phase of Beijing Gas' Tianjin Nangang project entered pilot production and operation after its successful commissioning, the capacity of peak adjustment and supply support for the Beijing-Tianjin-Hebei region was significantly improved. Through active expansion in the Beijing market, the gas volume continued to grow, and several incremental market projects were implemented in competitive areas. For LNG business, the Group actively expanded the trading scale, secured supply sources and completed the signing of a long-term resource agreement. Aiming for active and steady expansion in the integrated energy heating market, the Group promoted the integrated energy and new energy businesses in an orderly manner by defining the four development directions of new energy power generation, energy storage, integrated energy heating and hydrogen energy.

As an energy company covering the entire natural gas industry chain, Beijing Gas is also involved in upstream resource development and midstream long-distance pipeline operations. In terms of upstream resource development, Beijing Gas conducted its business through its 20% owned PJSC Verkhnechonskneftegaz ("VCNG") project of Rosneft Oil Company. Beijing Gas shared a net operating profit after taxation for the year of RMB1.04 billion. In terms of pipeline operation business, Beijing Gas conducts its business through PipeChina Group Beijing Pipeline Co., Ltd. ("PipeChina Beijing Pipeline Co.,"), a company in which Beijing Gas has a 40% equity interest. During the Period, Beijing Gas' share of net profit after tax amounted to RMB2.44 billion, representing a year-on-year increase of 36.7%.

The associated company, China Gas Holdings Limited ("China Gas", stock code: 384) proactively implemented the natural gas price pass-through policy while continuing to strengthen the fundamentals of the natural gas business, improving the comprehensive dollar margin compared with the same period of last year. To offset the impact of the prolonged weakness in the real estate industry, it promoted the "bottled-to-piped gas conversion" reform and user connection in old micro-districts, which opened a new chapter for operation. During the six months ended 30 September 2023, China Gas' total natural gas sales volume increased by 1.7% to 16.97 billion cubic metres, and its LPG sales volume reached 1.98 million tons, with total sales revenue of HK$8.42 billion. Approximately 1.05 million households were newly connected, bringing the cumulative number of households connected to approximately 46.45 million.

Water business continued to consolidate the fundamentals, stock asset efficiency improved

Beijing Enterprises Water Group Limited's ("BE Water", stock code: 371) focused on the primary business and continued to strengthen the operation fundamentals. It also enhanced cash collection, optimized the asset-liability structure, and insisted on improving the quality and efficiency of stock assets through measures such as managing inefficient assets and upgrading operational models. BE Water's revenue for the year increased by 14.1% year-on-year to RMB24.52 billion, with profit attributable to shareholders increased by 60% year-on-year to RMB1.896 billion. As at 31 December 2023, BE Water already participated in 1,455 water plants which are or will be in operation, including 1,215 sewage treatment plants, 170 water distribution plants, 69 reclaimed water treatment plants and one seawater desalination plants, with a total design capacity of 43.963 million tons/day.

Domestic and overseas environmental operation developed steadily, waste treatment volume gradually increased

During the Period, BEHL's domestic and overseas environmental business developed steadily. The key business indicators of the Group's offshore EEW Energy from Waste GmbH ("EEW GmbH") actively responded to the impact of the weakened economy in Germany and vigorously expanded its sources of waste imports within Europe, accomplishing a waste treatment volume of 4.876 million tons, a year-on-year increase of 5.8%; energy sales of 4.77 billion kWh, a year on-year decrease of 2.9%; and revenue of RMB5.77 billion, a year-on-year increase of 13.6%.

The Group's domestic environmental business segment include Beijing Enterprises Environment Group Limited ("BE Environment", stock code: 154) and Beijing Enterprises Holdings Environment Technology Co., Ltd ("BEHET") etc. During the Period, it improved its unit efficiency by strengthening its operation and management. The joint sludge treatment business was conducted in various project companies, the heat and gas supply business also made progress and was successfully carried out in projects in many places, thus effectively increasing the revenue from waste disposal and continuously expanding the Group's market share. The Group's domestic solid waste project recorded a waste treatment volume of 7.059 million tons, representing a year-on-year increase of 17.3%. It generated 2.22 billion KWH of grid electricity, representing a year-on-year increase of 21.8%. The total revenue reached RMB2.66 billion.

Yanjing Brewery brand promoted and upgraded through various initiatives, product and management continued to be optimised

During the Period, Beijing Yanjing Brewery Co., Ltd. ("Yanjing Brewery") intensively promoted its bulk single-product strategy in all directions, and comprehensively strengthened the control of market price and product flow of U8 to maintain market sales order, continued to accelerate the construction of high-end channels and completed the research and development as well as the transformation of a number of products; empowered enterprise development with digitalization, carried out digital upgrade to supply chain and management system, and built new production lines to gradually realize intensive production, quality and efficiency improvement; perfected the assessment and evaluation mechanism for enterprises classification and properly pushed forward the elimination of inefficient production capacity to revitalize the stock assets. During the Period, Yanjing Brewery achieved a beer sales volume of 3.94 million kilolitres, representing a year-on-year increase of 4.5%, of which, the sales volume of Yanjing U8 recorded 532,400 kilolitres, representing a year-on-year increase of 36.9%. The revenue of Beijing Yanjing Brewery Investments Co., Limited ("Yanjing Limited") was RMB12.33 billion for the Period, representing a year-on-year increase of 6.4%, and its profit before taxation was RMB955 million, representing a year-on-year increase of 60.1%.

ESG efforts yield results with better rating than industry peers

BEHL remains committed to integrating the concept of sustainable development into its daily operations and management, striving for harmonious progress between its own development and the environment, society, and corporate governance. In a recent announcement, MSCI published its ESG rating results for the year 2023, and the Company received a two-notch upgrade from "BB" to "A", placing it in a leading position within the industry. The Company's environmental performance has improved significantly, with the "Biodiversity & Land Use" indicator ranking first in the industry.

Mr Xiong Bin, Executive Director and CEO of BEHL, said, "While the global economy is changing at an accelerated pace, China is witnessing a steady recovery of its economy, although it is still in a critical stage of structural adjustment and transformation, which has posed challenges to Beijing enterprises in the development of the physical industry. In 2024, the Group will accelerate the optimisation of the asset structure for its core business and the restoration of growth momentum, enhance its refined operations and control capabilities in all aspects, and continuously increase its industrial strength and economic benefits, so as to realise quality and sustainable development."

About Beijing Enterprises Holdings Limited (0392.HK):

Beijing Enterprises Holdings Limited ("BEHL") is the largest flagship company for overseas investment and financing of the People's Government of Beijing Municipality. It is designated to attract capital, technology, and management knowledge from the international market to support the priority projects in Beijing. After reforms like reorganisation, transition, and resources integration, BEHL successfully transformed into an integrated public utility company with core businesses covering city gas, water treatment, environment, and beer.

As at 31 December 2023, its core assets included: 100% of the equity in Beijing Gas Group Company Limited, China's largest integrated city gas company; 23.57% of the equity in China Gas Holdings Limited (00384.HK); 57.40% of the equity in the A-Share listed company, Beijing Yanjing Brewery Co., Ltd. (000729.SZ), through 79.77% of the equity in Beijing Yanjing Beer Investment Co., Ltd.; 41.13% of the equity in Beijing Enterprises Water Group Limited (00371.HK) which is deemed as a major platform to invest in water projects in Mainland China; 50.40% of the equity in Beijing Enterprises Environment Group Limited (00154.HK) committed to becoming a flagship company in the solid waste treatment industry; and 100% of the equity in EEW Energy from Waste GmbH, a leading European waste recycling company headquartered in Germany.

For more information, please visit http://www.behl.com.hk.

Investor Relations Enquiries:

Beijing Enterprises Holdings Limited

Investor Relations Department

Tel: (852)2915 2898

Email: mailbox@behl.com.hk

Media Enquiries:

Strategic Financial Relations Limited

Vicky Lee / Yan Li / Shannon Lei

Tel: 2864 4834 / 2114 4320 / 2114 2881

E-mail: vicky.lee@sprg.com.hk / yan.li@sprg.com.hk / shannon.lei@sprg.com.hk

Website: www.sprg.com.hk

| © Copyright 1996-2025 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |