Kingsgate Consolidated Limited

EXPERIENCED PACIFIC RIM GOLD PRODUCER, KINGSGATE CONSOLIDATED LIMITED (ASX:KCN) IS A HIGHLY SUCCESSFUL ASX LISTED GOLD COMPANY WITH SIGNIFICANT EXPERTISE IN GOLD EXPLORATION, DEVELOPMENT AND MINING, USING WORLD'S BEST PRACTICE FOR SAFE, ENVIRONMENTAL AND SOCIALLY RESPONSIBLE OPERATIONS.

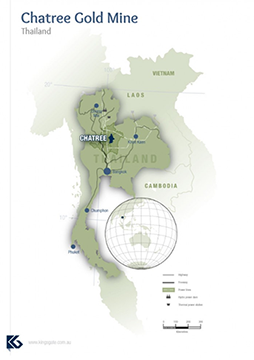

The Company was listed in 1988 and commenced gold production at its Chatree Gold Mine ("Chatree") in central Thailand in 2001. Kingsgate is the owner of Chatree through its Thai subsidiary, Akara Resources Public Company Limited.

Since operations commenced in 2001, Chatree has produced more than 1.8 million ounces of gold, and more than 10 million ounces of silver. In recent years, Chatree has operated at a rate of approximately 125,000 to 135,000 ounces per annum.

However in May 2016, the Thai Government announced that all gold mining in Thailand would cease by 31 December 2016.

As a result, Chatree was placed on Care and Maintenance on 1 January 2017.

Since the announcement in May 2016, Kingsgate has been focussed on ways to remedy the situation. More information on the status of the Chatree Gold Mine can be found HERE

In 2009, Kingsgate expanded into South America with the acquisition of the Arqueros Project in Chile, with further high sulphidation epithermal project acquisitions in 2011 before consolidating them into the Nueva Esperanza Project. The Nueva Esperanza Project, 100% owned by Kingsgate, is located in the highly endowed Maricunga Gold/Silver Belt of the Atacama Region of northern Chile.

In April 2016, Kingsgate released a Pre-Feasibility Study for the Nueva Esperanza Project which aims to deliver an average 91,000oz pa AuEq60* for 11.6 years at a life of mine average cash cost of US$642/oz AuEq60 and an average All-in cost of US$849/oz.

Mine plan optimisation delivers a 3 year payback period and strong first 5 years production with an average 135,000oz pa AuEQ60 at an average $US568/oz cash cost.

The Ore Reserve for Nueva Esperanza has increased and now stands at 1.1 million ounces AuEq60, at a grade of 2.0g/t AuEq60 of oxidised mineralisation contained in 3 open pits and the total Mineral Resource base stands at 1.9 million ounces AuEq60, at a grade of 1.5g/t AuEq60.

Kingsgate's team is highly experienced in the discovery, delineation, construction and operation of precious metals opportunities. Coupled with a strong balance sheet and sustainable cashflow generating capacity, Kingsgate is well placed to capitalise on exploration success as well as opportunistic M&A transactions.

|

|

Notes: *AuEq60 = gold equivalent based on a ratio of 60oz silver per 1oz gold

updated 10th January, 2017

| © Copyright 1996-2019 irasia.com Ltd. All rights reserved. |

|

DISCLAIMER: irasia.com Ltd makes no guarantee as to the accuracy or completeness of any

information provided on this website. Under no circumstances shall irasia.com Ltd be liable

for damages resulting from the use of the information provided on this website.

TRADEMARK & COPYRIGHT: All intellectual property rights subsisting in the contents of this website belong to irasia.com Ltd or have been lawfully licensed to irasia.com Ltd for use on this website. All rights under applicable laws are hereby reserved. Reproduction of this website in whole or in part without the express written permission of irasia.com Ltd is strictly prohibited. TERMS OF USE: Please read the Terms of Use governing the use of our website. |